Bank Levy 2003-2026

What is the Bank Levy

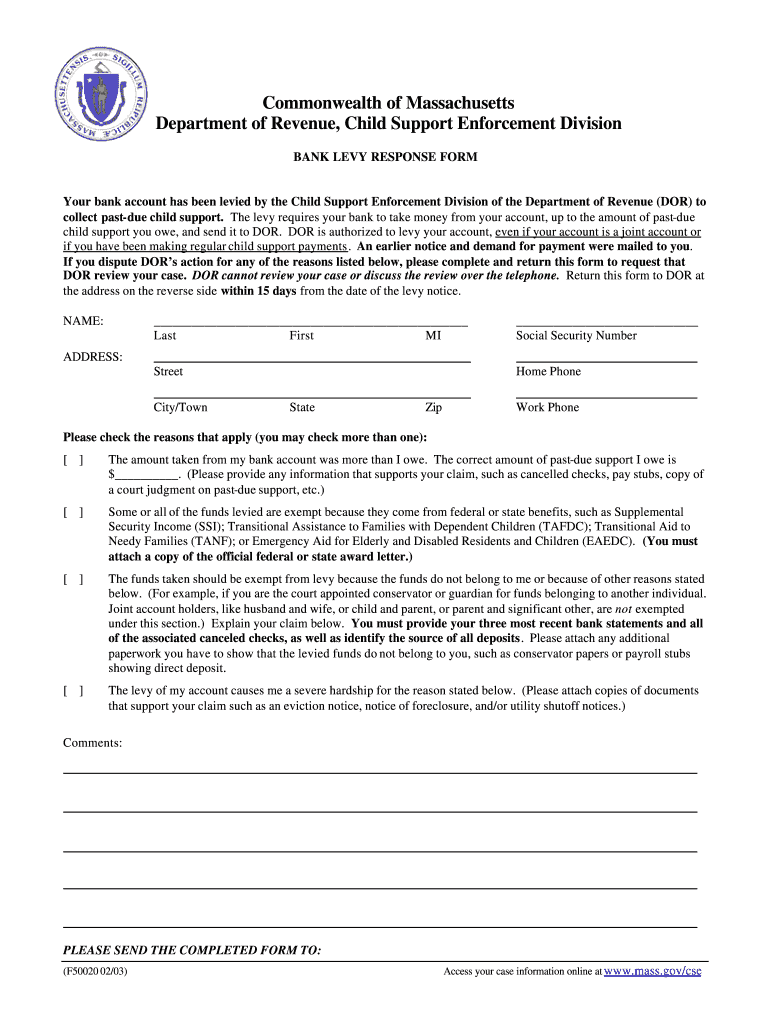

The Massachusetts bank levy is a legal mechanism that allows creditors to collect debts by freezing funds in a debtor's bank account. This process typically occurs after a court judgment has been obtained against the debtor. The bank levy serves as a means for creditors to secure payment by accessing the funds directly from the debtor's bank account, ensuring that the owed amount is paid. Understanding the implications of a bank levy is crucial for both creditors and debtors, as it affects financial stability and access to funds.

Steps to Complete the Bank Levy

Completing the Massachusetts bank levy involves several important steps to ensure compliance with legal requirements. The process generally includes:

- Obtaining a court judgment against the debtor.

- Filling out the Massachusetts levy form accurately, including all necessary details such as the debtor's information and the amount owed.

- Submitting the completed form to the bank where the debtor holds an account.

- Ensuring that all documentation is properly signed and dated to validate the levy.

- Monitoring the bank's response to confirm that the funds have been frozen as intended.

Key Elements of the Bank Levy

Understanding the key elements of the Massachusetts bank levy is essential for effective use. Important components include:

- Creditor Information: Details about the creditor seeking the levy, including contact information.

- Debtor Information: Accurate identification of the debtor, including their name and address.

- Judgment Details: Reference to the court judgment that authorizes the levy.

- Amount Owed: The specific amount that the creditor is attempting to collect through the levy.

- Bank Information: The name and address of the bank where the debtor's account is held.

Legal Use of the Bank Levy

The legal use of the Massachusetts bank levy is governed by state laws and regulations. Creditors must adhere to specific guidelines to ensure that the levy is enforceable. This includes obtaining a valid court judgment and providing proper notification to the debtor. Failure to comply with these legal requirements can result in the levy being deemed invalid, which may lead to legal repercussions for the creditor. It is advisable for creditors to consult legal professionals to navigate the complexities of the bank levy process.

Form Submission Methods

Submitting the Massachusetts bank levy form can be done through various methods, including:

- Online Submission: Some banks may allow for electronic submission of the levy form, streamlining the process.

- Mail: Sending the completed form via postal service to the bank's designated address is a common method.

- In-Person: Delivering the form directly to the bank branch can ensure immediate processing and confirmation.

Filing Deadlines / Important Dates

Awareness of filing deadlines and important dates related to the Massachusetts bank levy is vital for both creditors and debtors. Typically, the timing of the levy must align with court schedules and any applicable statutes of limitations. Creditors should ensure that the levy is filed promptly after obtaining a judgment to avoid any delays in collection. Additionally, debtors should be informed of their rights and any relevant timelines for responding to a bank levy.

Quick guide on how to complete bank levy response form final draftdoc vlpnet

Your assistance manual on how to prepare your Bank Levy

If you're interested in learning how to complete and submit your Bank Levy, here are a few concise pointers to facilitate tax processing.

To begin, simply sign up for your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents with ease. With its editor, you can navigate between text, checkboxes, and eSignatures, and return to adjust details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the subsequent steps to complete your Bank Levy in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Bank Levy in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can increase errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I get Google to remove an ad for a "restricted" product? I flag it in Google Chrome, fill out the form for a Google violation and no response.

You can fill out this form Feedback on AdWords AdsAs you can see Fireworks isn't an option on the list of violations. My best guess is this just isn't a top priority for Google since there are much more important issues they need to weed out like illegal drugs. Though it is clearly listed as disallowed in the Fireworks - Advertising Policies Help section enforcement varies between different policies.Often it's a waste of time and energy to try and get your competitor's ads blocked so I wouldn't bother.

Create this form in 5 minutes!

How to create an eSignature for the bank levy response form final draftdoc vlpnet

How to create an electronic signature for your Bank Levy Response Form Final Draftdoc Vlpnet in the online mode

How to create an eSignature for the Bank Levy Response Form Final Draftdoc Vlpnet in Google Chrome

How to make an electronic signature for signing the Bank Levy Response Form Final Draftdoc Vlpnet in Gmail

How to create an electronic signature for the Bank Levy Response Form Final Draftdoc Vlpnet straight from your mobile device

How to generate an eSignature for the Bank Levy Response Form Final Draftdoc Vlpnet on iOS

How to make an eSignature for the Bank Levy Response Form Final Draftdoc Vlpnet on Android

People also ask

-

What is a Bank Levy and how does it work?

A Bank Levy is a legal action that allows a creditor to seize funds directly from a bank account to satisfy a debt. This process typically involves a court order, and once initiated, the bank is required to freeze the account and release the specified funds to the creditor. Understanding how a Bank Levy works is crucial for businesses to safeguard their financial assets.

-

How can airSlate SignNow help in managing documents related to Bank Levy notices?

airSlate SignNow simplifies the management of important documents, including Bank Levy notices, by providing an easy-to-use eSigning solution. With our platform, users can quickly send, sign, and store documents securely, ensuring that all legal paperwork regarding a Bank Levy is handled efficiently and complies with regulations.

-

What are the pricing options for airSlate SignNow when dealing with Bank Levy documents?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including those needing to manage Bank Levy documents. Our pricing is designed to be cost-effective, ensuring that businesses can easily access the tools they need without overspending. Visit our pricing page to find a plan that fits your specific requirements.

-

What features does airSlate SignNow offer to support Bank Levy processes?

airSlate SignNow offers robust features that support Bank Levy processes, including customizable templates, secure document storage, and real-time tracking of document status. These features help streamline the workflow associated with Bank Levy documentation, making it easier for businesses to stay organized and compliant.

-

Can airSlate SignNow integrate with other software for handling Bank Levy cases?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage Bank Levy cases more effectively. Whether you're using accounting software, CRM systems, or other business tools, our integrations ensure that all your documents and data are synchronized, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Bank Levy documentation?

Using airSlate SignNow for Bank Levy documentation offers numerous benefits, including increased efficiency, enhanced security, and cost savings. Our eSigning platform reduces the time spent on paperwork and minimizes the risk of errors, allowing businesses to focus on their core operations while ensuring compliance with legal requirements.

-

Is airSlate SignNow secure for handling sensitive Bank Levy information?

Absolutely, airSlate SignNow prioritizes the security of your sensitive Bank Levy information. Our platform employs advanced encryption protocols and complies with industry standards to protect your data, giving you peace of mind while managing critical documents.

Get more for Bank Levy

Find out other Bank Levy

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors