Nevada Disclosure of Earned Fees by Mortgage Broker NRS 645 Form

What is the Nevada Disclosure of Earned Fees by Mortgage Broker NRS 645

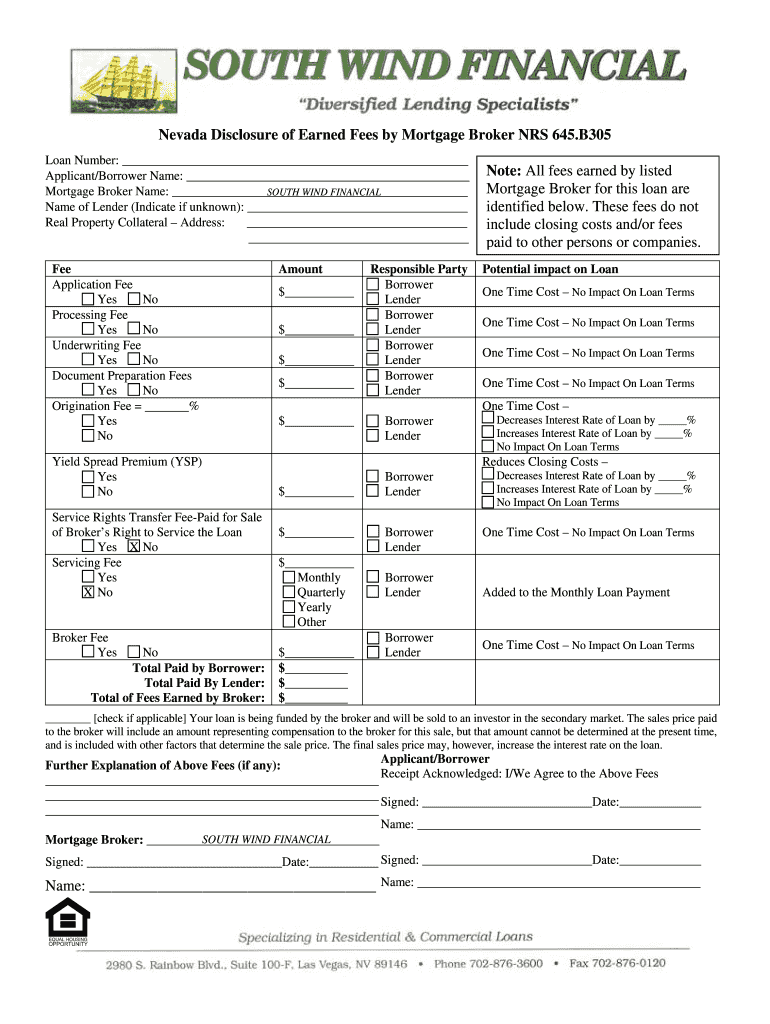

The Nevada Disclosure of Earned Fees by Mortgage Broker is a legal requirement established under NRS 645. This regulation mandates that mortgage brokers disclose the fees they earn from transactions to ensure transparency in financial dealings. The purpose of this disclosure is to inform clients about the costs associated with mortgage services, thereby promoting informed decision-making. This document is crucial for maintaining trust and compliance within the mortgage industry in Nevada.

Key Elements of the Nevada Disclosure of Earned Fees by Mortgage Broker NRS 645

Several key elements must be included in the Nevada Disclosure of Earned Fees by Mortgage Broker. These elements typically encompass:

- Broker's Name and Contact Information: Clear identification of the broker providing the services.

- Fee Structure: A detailed breakdown of all fees earned, including origination fees, processing fees, and any other charges.

- Service Description: An outline of the services provided in exchange for the fees.

- Client Acknowledgment: A section for clients to sign, indicating they have received and understood the disclosure.

Including these elements ensures compliance with the legal standards set forth in NRS 645 and fosters transparency in the mortgage process.

Steps to Complete the Nevada Disclosure of Earned Fees by Mortgage Broker NRS 645

Completing the Nevada Disclosure of Earned Fees by Mortgage Broker involves several straightforward steps:

- Gather Information: Collect all relevant details regarding the fees and services provided.

- Fill Out the Disclosure: Accurately complete the disclosure form, ensuring all required elements are included.

- Review for Accuracy: Double-check the information for any errors or omissions.

- Obtain Client Signature: Present the disclosure to the client for their review and signature.

- Retain Copies: Keep a copy of the signed disclosure for your records and provide a copy to the client.

Following these steps helps ensure that the disclosure is completed accurately and in compliance with Nevada law.

Legal Use of the Nevada Disclosure of Earned Fees by Mortgage Broker NRS 645

The legal use of the Nevada Disclosure of Earned Fees by Mortgage Broker is essential for compliance with state regulations. This document serves as a formal record of the fees charged by brokers, and it must be presented to clients before any mortgage transaction is finalized. By adhering to the legal requirements, brokers protect themselves from potential disputes and ensure that clients are fully aware of the financial implications of their mortgage agreements.

How to Obtain the Nevada Disclosure of Earned Fees by Mortgage Broker NRS 645

Obtaining the Nevada Disclosure of Earned Fees by Mortgage Broker can be accomplished through several means:

- Broker's Office: Request the disclosure directly from the mortgage broker's office during your initial consultation.

- Online Resources: Some brokers may provide downloadable versions of the disclosure on their websites.

- State Regulatory Agency: Contact the Nevada Division of Mortgage Lending for official templates or additional guidance.

Ensuring you have this document is vital for understanding the fees associated with your mortgage broker.

Disclosure Requirements

The disclosure requirements under NRS 645 are designed to ensure that clients receive comprehensive information regarding the fees charged by mortgage brokers. Brokers must provide a clear and detailed breakdown of all fees, including any potential additional costs that may arise during the mortgage process. This transparency is crucial for building trust and ensuring that clients make informed choices regarding their mortgage options.

Quick guide on how to complete nevada disclosure of earned fees by mortgage broker nrs 645

Effortlessly Prepare Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645 on Any Device

Digital document management has become favored among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly and without hassle. Manage Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645 Without Any Hassle

- Locate Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then hit the Done button to save your modifications.

- Select how you wish to share your form, whether via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645 and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada disclosure of earned fees by mortgage broker nrs 645

How to create an electronic signature for the Nevada Disclosure Of Earned Fees By Mortgage Broker Nrs 645 online

How to create an eSignature for your Nevada Disclosure Of Earned Fees By Mortgage Broker Nrs 645 in Google Chrome

How to make an eSignature for signing the Nevada Disclosure Of Earned Fees By Mortgage Broker Nrs 645 in Gmail

How to make an electronic signature for the Nevada Disclosure Of Earned Fees By Mortgage Broker Nrs 645 from your smart phone

How to generate an electronic signature for the Nevada Disclosure Of Earned Fees By Mortgage Broker Nrs 645 on iOS

How to create an eSignature for the Nevada Disclosure Of Earned Fees By Mortgage Broker Nrs 645 on Android OS

People also ask

-

What is the importance of the disclosure of fees earned by broker in eSigning?

The disclosure of fees earned by broker is crucial as it ensures transparency in the costs associated with digital signing services. Understanding these fees helps businesses make informed decisions about which eSigning solution to choose, like airSlate SignNow, that provides a clear breakdown of any applicable costs.

-

How does airSlate SignNow handle the disclosure of fees earned by broker?

airSlate SignNow takes pride in its honest pricing policies, offering a clear disclosure of fees earned by broker. This means businesses can easily see all costs involved up front, eliminating any surprises and allowing for better budget management.

-

Can I get a detailed pricing structure from airSlate SignNow?

Yes, airSlate SignNow provides a comprehensive pricing structure that includes the disclosure of fees earned by broker. This information allows potential customers to evaluate the effectiveness of their investment against the features and benefits offered.

-

What features can impact the disclosure of fees earned by broker?

The disclosure of fees earned by broker can be influenced by various features such as advanced document management, integrations, and customer support. By understanding these factors, businesses can choose the right plan on airSlate SignNow that aligns with their needs.

-

How does the disclosure of fees earned by broker benefit businesses?

The disclosure of fees earned by broker provides businesses with insights into the financial aspects of eSigning solutions. With airSlate SignNow's transparent pricing, companies can optimize their budget while accessing powerful features that enhance their document workflow.

-

Are there any hidden fees related to the disclosure of fees earned by broker?

AirSlate SignNow commits to transparency, ensuring that there are no hidden fees that could complicate the disclosure of fees earned by broker. Users can trust that all costs, including optional features, are communicated upfront to avoid unexpected expenses.

-

What integrations are available that affect the disclosure of fees earned by broker?

AirSlate SignNow offers various integrations with popular business tools while providing a clear disclosure of fees earned by broker for those services. This integration ensures that businesses can leverage their existing systems without incurring unnecessary costs.

Get more for Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645

Find out other Nevada Disclosure Of Earned Fees By Mortgage Broker NRS 645

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form