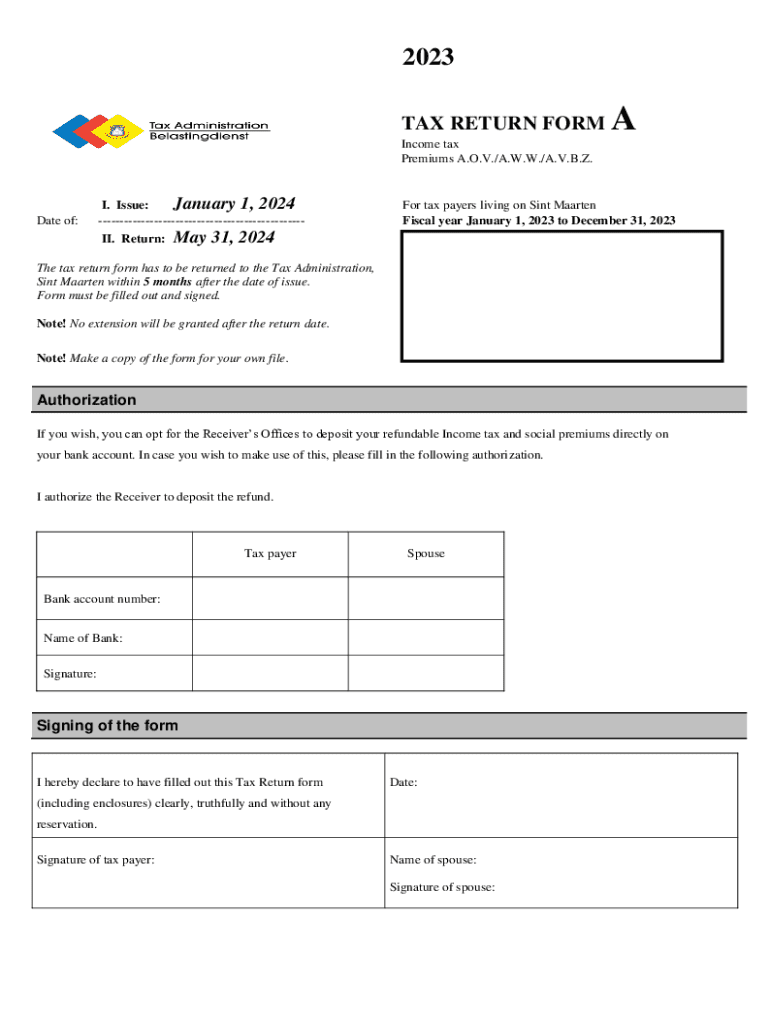

TAX RETURN FORMAIncome Tax Premiums a O V a 2023-2026

What is the TAX RETURN FORMAIncome Tax Premiums A O V A

The TAX RETURN FORMAIncome Tax Premiums A O V A is a specific form used for reporting income tax premiums in the United States. This form is essential for individuals and businesses to accurately declare their tax obligations and ensure compliance with federal tax regulations. It captures various types of income, deductions, and credits that may affect the overall tax liability. Understanding this form is crucial for anyone looking to navigate the complexities of income taxation effectively.

How to use the TAX RETURN FORMAIncome Tax Premiums A O V A

Using the TAX RETURN FORMAIncome Tax Premiums A O V A involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, fill out the form accurately, ensuring that all income sources are reported and deductions are applied where applicable. It is important to review the completed form for any errors before submission. Finally, submit the form according to the guidelines provided by the IRS, either electronically or by mail.

Steps to complete the TAX RETURN FORMAIncome Tax Premiums A O V A

Completing the TAX RETURN FORMAIncome Tax Premiums A O V A requires a systematic approach:

- Collect all relevant financial documents, including income statements and expense records.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in amounts listed.

- Apply any eligible deductions or credits to reduce taxable income.

- Double-check all entries for accuracy and completeness.

- Submit the form through the preferred method, ensuring it is sent before the deadline.

Required Documents

To complete the TAX RETURN FORMAIncome Tax Premiums A O V A, several documents are necessary:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investment earnings.

- Documentation for any deductions claimed, such as receipts for medical expenses or mortgage interest.

- Previous year’s tax return for reference and consistency.

Filing Deadlines / Important Dates

Filing deadlines for the TAX RETURN FORMAIncome Tax Premiums A O V A are critical to avoid penalties. Generally, the deadline for individual tax returns is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, which typically provides an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failing to file the TAX RETURN FORMAIncome Tax Premiums A O V A on time can result in significant penalties. The IRS imposes a failure-to-file penalty, which is typically five percent of the unpaid tax amount for each month the return is late, up to a maximum of 25 percent. Additionally, there may be a failure-to-pay penalty if taxes owed are not paid by the due date. These penalties can accumulate quickly, making timely filing crucial for compliance.

Create this form in 5 minutes or less

Find and fill out the correct tax return formaincome tax premiums a o v a

Create this form in 5 minutes!

How to create an eSignature for the tax return formaincome tax premiums a o v a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAX RETURN FORMAIncome Tax Premiums A O V A?

The TAX RETURN FORMAIncome Tax Premiums A O V A is a specialized form designed to help individuals and businesses accurately report their income tax premiums. It simplifies the tax filing process, ensuring compliance with tax regulations while maximizing potential deductions. Using airSlate SignNow, you can easily eSign and submit this form online.

-

How does airSlate SignNow help with the TAX RETURN FORMAIncome Tax Premiums A O V A?

airSlate SignNow streamlines the process of completing and submitting the TAX RETURN FORMAIncome Tax Premiums A O V A. Our platform allows users to fill out the form digitally, eSign it, and send it securely, reducing the time and effort involved in tax preparation. This ensures that your tax returns are filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and enterprises. Each plan includes features that support the completion of forms like the TAX RETURN FORMAIncome Tax Premiums A O V A. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow. You can connect it with accounting software, CRM systems, and other tools to simplify the management of your TAX RETURN FORMAIncome Tax Premiums A O V A. This integration helps streamline data transfer and improves overall efficiency.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features tailored for tax document management, including customizable templates, secure eSigning, and document tracking. These features ensure that your TAX RETURN FORMAIncome Tax Premiums A O V A is handled efficiently and securely. You can also collaborate with team members in real-time to ensure accuracy.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your sensitive information, including the TAX RETURN FORMAIncome Tax Premiums A O V A. Our platform is compliant with industry standards, ensuring that your documents are safe from unauthorized access.

-

Can I access my TAX RETURN FORMAIncome Tax Premiums A O V A from any device?

Absolutely! airSlate SignNow is designed to be accessible from any device with internet connectivity. Whether you're using a desktop, tablet, or smartphone, you can easily manage and eSign your TAX RETURN FORMAIncome Tax Premiums A O V A on the go, making tax preparation more convenient.

Get more for TAX RETURN FORMAIncome Tax Premiums A O V A

- 941 pr fillable form

- Asi flex form

- Multicharts crack form

- Pusd tax credit form prescott unified school district

- Formulario 003 msp ecuador pdf

- Form jv 446 download fillable pdf or fill online findings

- Student absence form pdf university of missouri st louis umsl

- International questionnaire university of california riverside form

Find out other TAX RETURN FORMAIncome Tax Premiums A O V A

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now