Bank Credit Reference Letter Form

What is the Bank Credit Reference Letter

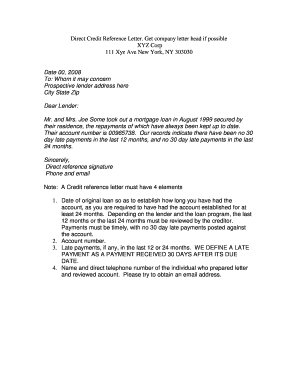

A bank credit reference letter is a formal document that provides information about an individual's or business's creditworthiness. It is typically issued by a bank or financial institution and serves as a verification of the client's financial history and reliability. This letter may include details such as account types, payment history, and current balances. It is often required by lenders, landlords, or other entities to assess the risk associated with extending credit or entering into a financial agreement.

How to Obtain the Bank Credit Reference Letter

To obtain a bank credit reference letter, individuals or businesses should contact their bank or financial institution directly. This process usually involves the following steps:

- Identify the specific requirements of the entity requesting the letter.

- Gather necessary personal or business information, such as account numbers and identification.

- Request the letter through the bank's customer service, either in person, by phone, or via the bank's online platform.

- Allow time for processing, as the bank may need to verify information before issuing the letter.

Key Elements of the Bank Credit Reference Letter

A comprehensive bank credit reference letter should include several key elements to ensure its effectiveness:

- Bank Letterhead: The letter should be printed on official bank stationery, including the bank's name, logo, and contact information.

- Client Information: This includes the name, address, and account number of the individual or business for whom the letter is issued.

- Credit History: A summary of the client's credit history, including account types, payment patterns, and any outstanding debts.

- Bank Representative Signature: The letter should be signed by an authorized bank representative to validate its authenticity.

Steps to Complete the Bank Credit Reference Letter

Completing a bank credit reference letter involves several important steps to ensure accuracy and compliance:

- Gather all necessary information about the client’s financial history and account details.

- Draft the letter, ensuring it includes all key elements mentioned above.

- Review the letter for accuracy, checking that all information is current and correctly stated.

- Obtain the signature of an authorized bank representative.

- Provide the completed letter to the requesting party in the required format, whether digital or paper.

Legal Use of the Bank Credit Reference Letter

The bank credit reference letter is a legally recognized document that can be used in various financial transactions. It is important to ensure that the letter complies with applicable laws and regulations, such as the Fair Credit Reporting Act (FCRA) in the United States. This compliance helps protect both the issuer and the recipient from potential legal issues. When used appropriately, the letter serves as a reliable source of information for assessing creditworthiness.

Examples of Using the Bank Credit Reference Letter

Bank credit reference letters are commonly used in various scenarios, including:

- Loan Applications: Lenders often require this letter to evaluate the borrower's credit risk.

- Rental Agreements: Landlords may request a credit reference to assess the reliability of potential tenants.

- Business Partnerships: Companies may seek credit references when considering new partnerships or contracts.

Quick guide on how to complete bank credit reference letter

Complete Bank Credit Reference Letter effortlessly on any gadget

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Bank Credit Reference Letter on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign Bank Credit Reference Letter with ease

- Locate Bank Credit Reference Letter and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click Done to save your modifications.

- Select how you prefer to deliver your form: by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Bank Credit Reference Letter and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank credit reference letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank credit reference form and why is it important?

A bank credit reference form is a document that provides a reference from a bank regarding a borrower’s creditworthiness. It is important for businesses to assess the financial reliability of their clients or partners, ensuring informed lending and investment decisions.

-

How can airSlate SignNow help in managing bank credit reference forms?

airSlate SignNow offers an efficient way to manage bank credit reference forms by allowing users to create, send, and eSign documents securely. This streamlines the process, reduces paperwork, and increases the speed at which you can obtain important financial references.

-

Is airSlate SignNow user-friendly for creating bank credit reference forms?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users to easily create customizable bank credit reference forms, ensuring that even those with minimal tech experience can navigate the platform effectively.

-

What are the pricing options for using airSlate SignNow for bank credit reference forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from different subscription levels, with features tailored for efficiently managing bank credit reference forms, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other software for bank credit reference forms?

Absolutely! airSlate SignNow supports integration with various third-party applications, allowing you to connect your existing systems. This makes it easy to incorporate bank credit reference forms into your overall workflow, enhancing productivity.

-

How secure is the information in bank credit reference forms on airSlate SignNow?

Security is a top priority at airSlate SignNow. All documents, including bank credit reference forms, are encrypted and follow strict compliance standards, ensuring that your sensitive financial information is protected against unauthorized access.

-

What are the benefits of using airSlate SignNow for bank credit reference forms?

Using airSlate SignNow for bank credit reference forms offers numerous benefits, including faster processing times, reduced paperwork, and improved collaboration between parties. This allows businesses to enhance their decision-making processes based on reliable financial information.

Get more for Bank Credit Reference Letter

Find out other Bank Credit Reference Letter

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later