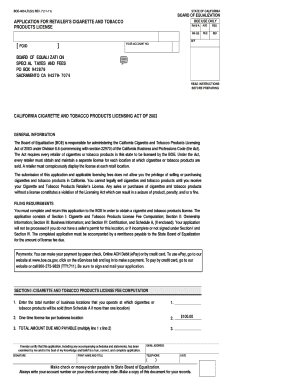

Form Boe 400 Lr

What is the Form Boe 400 Lr

The Form Boe 400 Lr is a document used primarily for reporting property tax information in the United States. This form is essential for businesses and individuals who own property and need to comply with local tax regulations. It serves as a means to report the value of property, ensuring that the correct amount of taxes is assessed and collected by the appropriate authorities.

How to use the Form Boe 400 Lr

Using the Form Boe 400 Lr involves several steps to ensure accurate reporting of property values. First, gather all necessary information regarding the property, including its location, type, and assessed value. Next, fill out the form with the required details, ensuring that all information is accurate and complete. Once completed, the form can be submitted to the relevant tax authority, either electronically or via traditional mail, depending on local regulations.

Steps to complete the Form Boe 400 Lr

Completing the Form Boe 400 Lr requires careful attention to detail. Follow these steps for successful completion:

- Gather property information, including legal descriptions and assessed values.

- Fill in the form with accurate data, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to your local tax authority by the specified deadline.

Legal use of the Form Boe 400 Lr

The legal use of the Form Boe 400 Lr is crucial for compliance with property tax laws. This form must be filled out accurately to avoid penalties or disputes with tax authorities. Electronic signatures are accepted, provided they meet the legal standards set forth by regulations such as the ESIGN Act and UETA. Ensuring that the form is completed and submitted on time is vital to maintaining compliance and avoiding legal issues.

Key elements of the Form Boe 400 Lr

Several key elements are essential when completing the Form Boe 400 Lr. These include:

- Property identification details, including the address and parcel number.

- Owner information, such as name and contact details.

- Valuation information, including the assessed value and any exemptions claimed.

- Signature of the property owner or authorized representative.

Form Submission Methods

The Form Boe 400 Lr can be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission via the local tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at the local tax office.

Quick guide on how to complete form boe 400 lr

Prepare Form Boe 400 Lr effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form Boe 400 Lr on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The simplest way to modify and eSign Form Boe 400 Lr with ease

- Locate Form Boe 400 Lr and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form Boe 400 Lr and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form boe 400 lr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Boe 400 Lr?

Form Boe 400 Lr is an essential document for tax purposes, specifically related to California's tax regulations. It allows businesses to report their use tax liabilities accurately. By utilizing airSlate SignNow, you can easily eSign and submit Form Boe 400 Lr digitally, saving time and ensuring compliance.

-

How does airSlate SignNow help with Form Boe 400 Lr?

airSlate SignNow streamlines the entire process of filling out and submitting Form Boe 400 Lr. Our platform provides user-friendly tools that allow users to easily edit, sign, and store the document securely. This eliminates the need for printing and mailing, making it an efficient solution for businesses.

-

Is there a cost associated with using airSlate SignNow for Form Boe 400 Lr?

Yes, airSlate SignNow offers various pricing plans that suit different business needs, including those that frequently handle Form Boe 400 Lr. Our pricing is competitive, and the investment is often justified by the time and resources saved in document management. You can choose a plan that fits your frequency of use and team size.

-

What features does airSlate SignNow provide for Form Boe 400 Lr?

With airSlate SignNow, you get features like document templates, customizable fields, and electronic signatures tailored for Form Boe 400 Lr. Additionally, automated reminders and notifications help ensure timely submission. These features make managing your forms more organized and efficient.

-

Can I integrate airSlate SignNow with other software for managing Form Boe 400 Lr?

Absolutely! airSlate SignNow offers integrations with various popular software tools, allowing seamless access to Form Boe 400 Lr alongside your existing platforms. This means you can manage your documents directly within your favorite CRM, accounting, or workflow tools, maximizing productivity.

-

What benefits does eSigning Form Boe 400 Lr provide?

eSigning Form Boe 400 Lr through airSlate SignNow ensures enhanced security and compliance. Digital signatures are legally binding and help reduce the risk of errors associated with paper forms. Furthermore, it accelerates the submission process, enabling faster processing of your tax liabilities.

-

Is airSlate SignNow legally compliant for Form Boe 400 Lr submissions?

Yes, airSlate SignNow complies with all legal regulations for electronic signatures and document submissions, including for Form Boe 400 Lr. We ensure that our platform meets all necessary standards, making it safe and reliable for your essential tax documentation.

Get more for Form Boe 400 Lr

- I 129f cover letter 101448197 form

- Ingrezza enrollment form

- Mpc 162 blogspot form

- Form ct 1 employers annual railroad retirement tax

- Form 2220 underpayment of estimated tax by corporations 771766905

- About form 8827 credit for prior year minimum tax

- Generic agreement template form

- Generic confidentiality agreement template form

Find out other Form Boe 400 Lr

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation