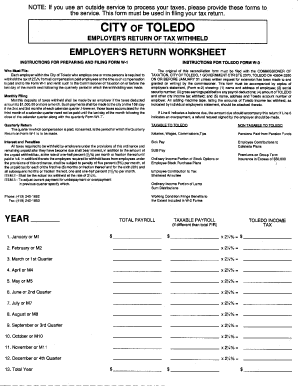

City of Toledo Income Tax Form

What is the City of Toledo Income Tax Form

The City of Toledo Income Tax Form is a document required for individuals who earn income within the city limits of Toledo, Ohio. This form is essential for reporting income and calculating the local income tax owed to the city. It is designed to ensure compliance with local tax laws and to facilitate the proper collection of taxes from residents and non-residents who work in Toledo. The form includes sections for personal information, income details, and applicable deductions or credits.

How to use the City of Toledo Income Tax Form

Using the City of Toledo Income Tax Form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with accurate personal and financial information. It is important to follow the instructions carefully to ensure all required fields are completed. After filling out the form, review it for accuracy, and then submit it according to the specified methods. Proper use of the form helps avoid penalties and ensures timely processing of your tax return.

Steps to complete the City of Toledo Income Tax Form

Completing the City of Toledo Income Tax Form involves a systematic approach:

- Gather necessary documents, including income statements and previous tax returns.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and any other earnings.

- Apply any eligible deductions or credits that may reduce your taxable income.

- Calculate the total tax owed based on the income reported.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the City of Toledo Income Tax Form

The City of Toledo Income Tax Form is legally binding when completed and submitted correctly. It adheres to local tax regulations and is recognized by the City of Toledo Department of Taxation. To ensure its legal standing, the form must be signed by the taxpayer, and all information must be truthful and accurate. Failure to comply with the requirements can result in penalties or legal consequences. Using a reliable platform for electronic submission can enhance the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the City of Toledo Income Tax Form are crucial for compliance. Typically, individual tax returns must be filed by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines, as local regulations may affect filing dates. Additionally, taxpayers should be aware of any estimated payment deadlines if applicable.

Required Documents

To complete the City of Toledo Income Tax Form, several documents are necessary:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or interest.

- Documentation of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Quick guide on how to complete city of toledo income tax form

Effortlessly Prepare City Of Toledo Income Tax Form on Any Device

Digital document management has become favored by enterprises and individuals alike. It offers a superior eco-friendly option to traditional printed and signed documents, as you can obtain the required form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any holdups. Handle City Of Toledo Income Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign City Of Toledo Income Tax Form with Ease

- Find City Of Toledo Income Tax Form and then click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or mistakes that require new printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and electronically sign City Of Toledo Income Tax Form to ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of toledo income tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Toledo income tax form 2020 and who needs to file it?

The city of Toledo income tax form 2020 is a tax document required by residents of Toledo to report their income for the year 2020. Anyone who earned income, whether as an employee or from self-employment, is required to file this form. It's essential to ensure compliance with local tax regulations to avoid penalties.

-

Where can I find the city of Toledo income tax form 2020?

You can find the city of Toledo income tax form 2020 on the official Toledo city government website or through reputable tax filing services. These platforms often provide easy access to the necessary forms, helping you stay organized during the tax filing season.

-

What features does airSlate SignNow offer for signing the city of Toledo income tax form 2020?

airSlate SignNow provides a user-friendly platform to electronically sign and manage the city of Toledo income tax form 2020. Its features include customizable templates, secure cloud storage, and integration with various productivity tools, making the process efficient and hassle-free for users.

-

How does airSlate SignNow ensure the security of my city of Toledo income tax form 2020?

AirSlate SignNow prioritizes data security with bank-grade encryption and secure access protocols. All documents, including your city of Toledo income tax form 2020, are stored securely, ensuring that your sensitive information is protected from unauthorized access.

-

What are the costs associated with using airSlate SignNow for my city of Toledo income tax form 2020?

AirSlate SignNow offers cost-effective pricing plans, which can vary based on the number of users and features needed. Many users find that the value provided by airSlate SignNow for managing documents like the city of Toledo income tax form 2020 far exceeds the costs, especially when considering the time saved.

-

Can I integrate airSlate SignNow with other software for my city of Toledo income tax form 2020?

Yes, airSlate SignNow seamlessly integrates with various software platforms such as Google Workspace, Microsoft Office, and CRM systems. This allows you to streamline your workflow when handling the city of Toledo income tax form 2020, making it easier to manage all your documentation in one place.

-

What benefits do I get by using airSlate SignNow for the city of Toledo income tax form 2020?

Using airSlate SignNow for the city of Toledo income tax form 2020 offers several benefits, including rapid document turnaround times and increased accuracy in signing and filling out forms. Additionally, you gain access to mobile capabilities, allowing you to manage your tax documents on the go.

Get more for City Of Toledo Income Tax Form

Find out other City Of Toledo Income Tax Form

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract