Motion Access Condor Form

What is the Motion Access Condor

The Motion Access Condor is a specialized equipment manual designed for operators of the Condor MA50200 model. This manual provides essential guidelines and safety instructions for the proper use and maintenance of the equipment. It is crucial for ensuring that operators understand the functionalities and limitations of the Condor, promoting safe and effective operation in various settings.

How to use the Motion Access Condor

Using the Motion Access Condor involves several steps to ensure safety and efficiency. First, operators should familiarize themselves with the manual, which outlines key features and operational procedures. Before starting, it is important to conduct a pre-operation inspection to check for any mechanical issues. Once the equipment is deemed safe, operators can follow the step-by-step instructions provided in the manual to operate the Condor effectively, ensuring compliance with safety regulations.

Steps to complete the Motion Access Condor

Completing the Motion Access Condor involves a systematic approach. Operators should:

- Review the manual thoroughly to understand all operational guidelines.

- Conduct a safety inspection of the equipment before use.

- Follow the operational procedures as outlined in the manual.

- Document any maintenance or issues encountered during operation.

- Ensure that all safety protocols are adhered to throughout the process.

Legal use of the Motion Access Condor

The legal use of the Motion Access Condor is governed by various safety regulations and standards. Operators must comply with Occupational Safety and Health Administration (OSHA) guidelines to ensure that the equipment is used safely and responsibly. Additionally, understanding local and state regulations regarding equipment operation is essential for compliance and to avoid potential legal issues.

Key elements of the Motion Access Condor

Key elements of the Motion Access Condor include its operational features, safety mechanisms, and maintenance requirements. The manual details the specifications of the equipment, including load capacities and operational limits. It also emphasizes the importance of regular maintenance checks to ensure optimal performance and safety. Understanding these elements is vital for effective operation and compliance with legal standards.

Examples of using the Motion Access Condor

Examples of using the Motion Access Condor can be found in various industries, including construction, warehousing, and event management. For instance, in construction, the Condor can be utilized for lifting materials to elevated work sites. In warehousing, it may assist in moving heavy items efficiently. Each application demonstrates the versatility and importance of following the operational guidelines outlined in the manual to ensure safety and efficiency.

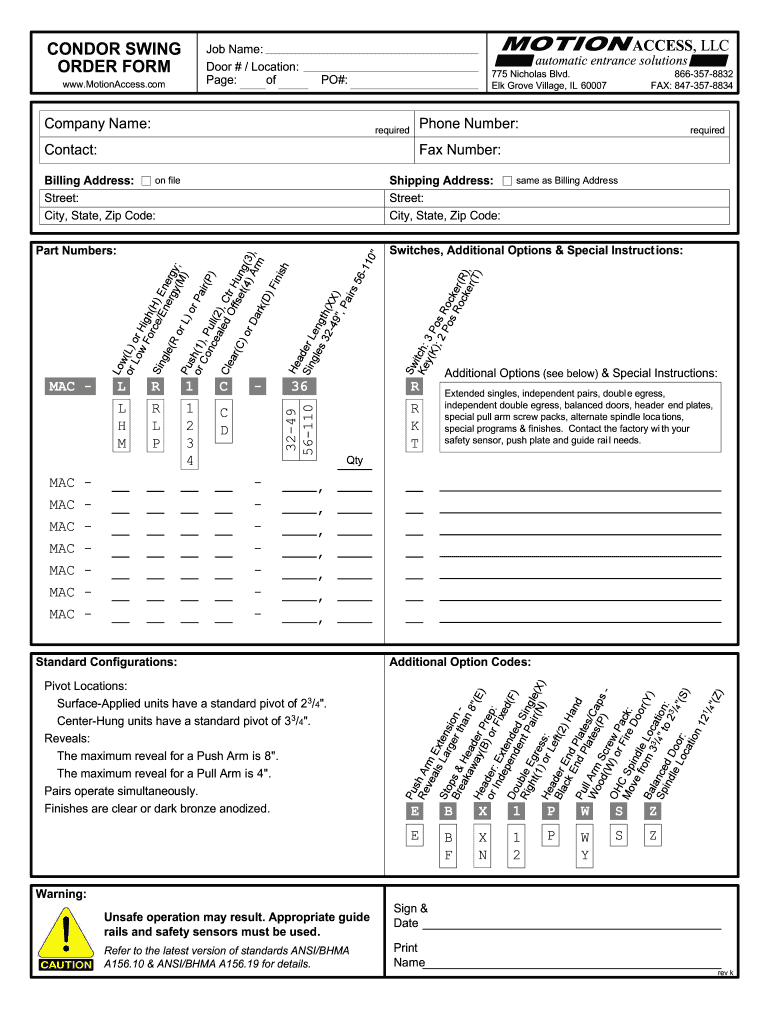

Quick guide on how to complete condor swing motion access llc order form motionaccess

Learn how to effortlessly navigate the Motion Access Condor execution with this straightforward guide

Completing and submitting documents online is becoming increasingly favored and is the preferred choice for numerous users. It offers numerous advantages over outdated printed forms, such as convenience, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can locate, modify, verify, and send your Motion Access Condor without the hassle of constant printing and scanning. Follow this concise guide to initiate and finish your document.

Utilize these steps to obtain and complete Motion Access Condor

- Begin by clicking the Get Form button to access your document in our editor.

- Follow the green marker on the left that indicates required fields to ensure you don't miss them.

- Employ our advanced features to annotate, modify, sign, secure, and enhance your document.

- Secure your file or convert it into a fillable form using the appropriate tab tools.

- Review the document and check for any mistakes or inconsistencies.

- Click DONE to complete your edits.

- Rename your document or leave it as is.

- Choose the storage option you want for your document, send it via USPS, or click the Download Now button to save your document.

If Motion Access Condor isn't what you were looking for, you can explore our extensive collection of pre-designed templates that you can fill out with ease. Discover our solution now!

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What do you need from your partners in order to fill out a k1-form? We all used LLC's to split our partnership up, so do I just need thier EINs or do I need their personal SSN as well?

Assuming each LLC is a single member disregarded entity, then you need the individual's SSN not the EIN of the LLC. You also put the individual's name on the K1 not the name of the LLC. If the LLC's are any other type of entity, then use the EIN and name of the LLC.You also need each partner's address and capital, loss and profit percentage.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How do I create a authentication code system with WordPress (no coding)? Clients can enter the code and then be shown a form to fill out. Also have a client side setup to create access codes.

Yes, what I understand is that you need a plugin order to create an authentication code system various free plugins are available on WordPress plugin directory list but here are some of best authentication code plugin that I would recommend:Authentication Code By MitchTwo Factor AuthenticationGoogle Authenticator By Henrik SchackRublon Two-Factor AuthenticationTry It and Tell me how these plugins work for you… All The Best

Create this form in 5 minutes!

How to create an eSignature for the condor swing motion access llc order form motionaccess

How to generate an eSignature for your Condor Swing Motion Access Llc Order Form Motionaccess in the online mode

How to make an eSignature for your Condor Swing Motion Access Llc Order Form Motionaccess in Chrome

How to create an electronic signature for signing the Condor Swing Motion Access Llc Order Form Motionaccess in Gmail

How to generate an eSignature for the Condor Swing Motion Access Llc Order Form Motionaccess from your mobile device

How to generate an electronic signature for the Condor Swing Motion Access Llc Order Form Motionaccess on iOS

How to generate an electronic signature for the Condor Swing Motion Access Llc Order Form Motionaccess on Android

People also ask

-

What is the motion access condor swing operator?

The motion access condor swing operator is a powerful tool designed for efficient control and operation of swing gates. It provides seamless access management for various types of entry points, ensuring safety and convenience for users. With its advanced features, the operator helps streamline access for residential and commercial applications.

-

How does the motion access condor swing operator enhance security?

The motion access condor swing operator enhances security by providing a reliable mechanism to control access points. Its integrated safety features include obstruction detection and automatic closure to prevent unauthorized entry. By utilizing the motion access condor swing operator, businesses and homeowners can bolster their property security.

-

What features does the motion access condor swing operator offer?

The motion access condor swing operator comes equipped with several key features such as remote control operation, programmable settings, and safety sensors. Additionally, it’s designed for quick installation and can easily integrate with existing systems. These features make it an ideal choice for efficient access management.

-

Is the motion access condor swing operator compatible with smart home systems?

Yes, the motion access condor swing operator is designed to be compatible with most smart home systems. This integration allows for intuitive control and monitoring of your swing gates through mobile devices and smart assistants. By connecting to a smart home system, users can enhance their operational efficiency and convenience.

-

What is the pricing structure for the motion access condor swing operator?

The pricing for the motion access condor swing operator varies based on the specifications and installation options chosen. Typically, it is offered as a cost-effective solution that provides signNow long-term savings due to its durable design and low maintenance requirements. For a precise quote, it is best to consult with a certified distributor.

-

How can businesses benefit from using the motion access condor swing operator?

Businesses can benefit from the motion access condor swing operator by improving their access control systems while ensuring customer and employee safety. Its easy installation and user-friendly operation allow businesses to streamline their entrance management, leading to enhanced operational efficiency. Additionally, this operator minimizes wait times and enhances the customer experience.

-

What types of gates are compatible with the motion access condor swing operator?

The motion access condor swing operator is compatible with a range of gate types, including residential, commercial, and industrial swing gates. Its versatile design ensures optimal operation regardless of gate size or material. This compatibility makes it a suitable choice for various installation scenarios.

Get more for Motion Access Condor

Find out other Motion Access Condor

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement