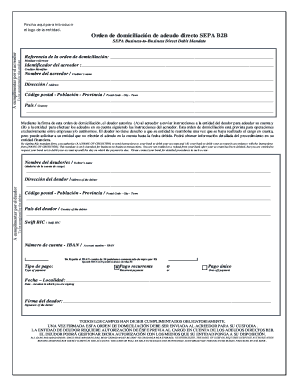

Sepa B2b Form

What is the Sepa B2B?

The Sepa B2B (Single Euro Payments Area Business to Business) is a payment scheme that facilitates the transfer of funds between businesses across the Eurozone. This standardized method allows for seamless cross-border transactions, enhancing efficiency and reducing costs. The Sepa B2B is designed specifically for business transactions, ensuring that companies can make and receive payments quickly and securely. It operates under strict regulations to ensure compliance with European banking standards, making it a reliable option for businesses engaging in international trade.

How to Use the Sepa B2B

Utilizing the Sepa B2B involves a few straightforward steps. First, businesses need to ensure they have a valid International Bank Account Number (IBAN) and a Bank Identifier Code (BIC) for their accounts. Next, the initiating business must provide the necessary payment details, including the amount and the recipient's banking information. Once the payment instruction is prepared, it can be submitted through the bank’s online platform or payment software that supports Sepa transactions. It's important to verify that all details are accurate to avoid delays or errors in processing.

Steps to Complete the Sepa B2B

Completing a Sepa B2B transaction involves several key steps:

- Gather the recipient's IBAN and BIC.

- Determine the payment amount and currency.

- Log into your bank's online platform or payment software.

- Input the payment details accurately, ensuring all information is correct.

- Review the transaction for any errors before submission.

- Submit the payment and keep a record of the transaction confirmation for your records.

Legal Use of the Sepa B2B

The legal framework governing the Sepa B2B ensures that transactions are conducted in compliance with European regulations. This includes adherence to anti-money laundering laws and data protection regulations. Businesses using the Sepa B2B must ensure that they have the necessary authorizations from their clients to process payments. Additionally, all transactions must be documented to provide a clear audit trail, which is crucial for legal and regulatory purposes.

Key Elements of the Sepa B2B

Several key elements define the Sepa B2B transaction process:

- IBAN and BIC: Essential for identifying accounts and banks involved in the transaction.

- Payment initiation: Must be authorized by the payer to ensure security.

- Transaction limits: Typically, there may be limits on the amount that can be transferred in a single transaction.

- Settlement times: Payments are usually settled within one business day, enhancing cash flow for businesses.

Examples of Using the Sepa B2B

Businesses can leverage the Sepa B2B for various transactions, such as:

- Paying suppliers for goods and services across Europe.

- Settling invoices with international partners efficiently.

- Making payroll payments to employees located in different countries within the Eurozone.

- Transferring funds for joint ventures or collaborative projects.

Quick guide on how to complete sepa b2b

Complete Sepa B2b effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sepa B2b on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Sepa B2b without hassle

- Locate Sepa B2b and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Sepa B2b and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sepa b2b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SEPA B2B and how does it work with airSlate SignNow?

SEPA B2B is a payment method that facilitates cross-border payments in euros, allowing businesses to streamline transactions. With airSlate SignNow, you can easily eSign documents related to SEPA B2B payments, ensuring that your agreements are legally binding and efficiently managed.

-

How can airSlate SignNow enhance my SEPA B2B transactions?

airSlate SignNow offers features tailored to streamline SEPA B2B transactions. By allowing you to electronically sign documents, you reduce processing times and eliminate paperwork, making your financial operations faster and more efficient.

-

What are the pricing options for airSlate SignNow related to SEPA B2B services?

airSlate SignNow offers various pricing tiers to accommodate different business sizes and needs, including options specifically for users managing SEPA B2B transactions. Our competitive pricing ensures that you get the best value while effectively managing your eSigning and document workflow.

-

Are there any integrations available for managing SEPA B2B with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and payment platforms that handle SEPA B2B transactions. These integrations help streamline both document management and payment processing, allowing you to focus on your core business activities.

-

Can airSlate SignNow help with compliance in SEPA B2B transactions?

Absolutely! airSlate SignNow provides compliant eSigning solutions that adhere to the regulations surrounding SEPA B2B payments. This ensures that all your documents are legally binding, minimizing the risk of non-compliance.

-

What benefits does airSlate SignNow provide for businesses handling SEPA B2B transactions?

Using airSlate SignNow, businesses can experience increased efficiency, reduced turnaround times, and enhanced security in their SEPA B2B transactions. By digitizing the signing process, you empower your team to act quickly while maintaining high standards of document integrity.

-

How user-friendly is airSlate SignNow for SEPA B2B transactions?

airSlate SignNow is designed with user experience in mind, making it easy for anyone to eSign documents related to SEPA B2B transactions. Our intuitive interface allows users to navigate the platform effortlessly, regardless of their technical skills.

Get more for Sepa B2b

Find out other Sepa B2b

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word