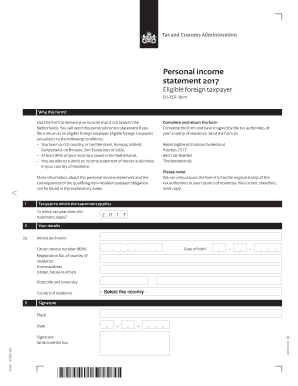

Personal Income Statement Form

What is the Personal Income Statement?

The personal income statement is a financial document that summarizes an individual's income and expenses over a specific period, typically a year. This form is essential for understanding one's financial position, especially when applying for loans or mortgages. It provides a clear picture of earnings from various sources, including wages, investments, and any other income streams, while also detailing expenditures such as living costs, debts, and discretionary spending.

How to Use the Personal Income Statement

Using the personal income statement involves several steps. First, gather all relevant financial documents, including pay stubs, bank statements, and receipts for expenses. Next, input your total income figures, categorizing them into sections like salary, bonuses, and investment income. After documenting income, outline your expenses, separating them into fixed costs, such as rent or mortgage payments, and variable costs, such as groceries and entertainment. This comprehensive overview helps in budgeting and financial planning.

Steps to Complete the Personal Income Statement

Completing the personal income statement requires careful attention to detail. Start by listing all sources of income for the year, ensuring you include all relevant amounts. Follow this by calculating total expenses, categorizing them appropriately. It is crucial to ensure that all figures are accurate and reflect your financial situation. Finally, review the completed statement for any discrepancies before finalizing it for submission or personal records.

Legal Use of the Personal Income Statement

The personal income statement can serve various legal purposes, such as verifying income for loan applications or financial aid. It is essential that the information presented is accurate and truthful, as discrepancies can lead to legal consequences. When used in legal contexts, ensure that the document complies with relevant regulations and guidelines, as these can vary by state and purpose.

IRS Guidelines

When preparing a personal income statement, it is important to adhere to IRS guidelines. This includes accurately reporting all income and expenses, as the IRS may require documentation for verification. Understanding the tax implications of your income and expenses can also aid in effective tax planning. Familiarize yourself with the IRS requirements to ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for personal income statements can vary based on specific circumstances, such as whether you are self-employed or filing jointly with a spouse. Generally, personal income tax returns are due by April fifteenth of each year. It is advisable to keep track of these dates to ensure timely submission and avoid late fees or penalties. Mark your calendar with important dates related to tax filings and any associated documentation.

Quick guide on how to complete personal income statement

Effortlessly Prepare Personal Income Statement on Any Device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Handle Personal Income Statement on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Edit and Electronically Sign Personal Income Statement with Ease

- Obtain Personal Income Statement and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or mask sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Personal Income Statement and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal income statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal income statement 2017 and why is it important?

A personal income statement 2017 summarizes an individual's income and expenses for that year, providing a clear view of financial health. It is important for budgeting, tax filing, and applying for loans. Accurately preparing this document can lead to better financial decision-making.

-

How can airSlate SignNow help me create a personal income statement 2017?

With airSlate SignNow, you can easily create and eSign your personal income statement 2017 using our intuitive templates and tools. Our platform allows you to customize the document to fit your specific financial situation. This saves you time and ensures your statements are professionally prepared.

-

Are there any costs associated with using airSlate SignNow for my personal income statement 2017?

airSlate SignNow offers flexible pricing options to suit diverse budgets. You can access essential features for free, while premium plans provide advanced functionalities for creating and managing your personal income statement 2017. Review our pricing page for detailed information.

-

What features does airSlate SignNow offer for drafting a personal income statement 2017?

airSlate SignNow features customizable templates, intuitive editing tools, and secure eSigning capabilities for your personal income statement 2017. Additionally, our cloud storage allows you to access your documents anytime. These features ensure you have everything needed for efficient document management.

-

How does airSlate SignNow ensure the security of my personal income statement 2017?

At airSlate SignNow, we prioritize your data security with advanced encryption and compliance with industry regulations. Your personal income statement 2017 is stored in a secure environment, ensuring that only authorized individuals can access it. Your privacy and data protection are our top priorities.

-

Can I integrate airSlate SignNow with other financial software for my personal income statement 2017?

Yes, airSlate SignNow offers integrations with various financial software applications, enhancing your ability to manage your personal income statement 2017 seamlessly. This connectivity allows you to import data directly from your financial records and ensures accuracy. Check our integration page for a full list of compatible software.

-

What are the benefits of using airSlate SignNow for my personal income statement 2017?

Using airSlate SignNow for your personal income statement 2017 streamlines the document creation process, saving you valuable time. Additionally, our platform ensures compliance and accuracy, helping you avoid potential tax issues. The ease of eSigning further simplifies the workflow, making it accessible from anywhere.

Get more for Personal Income Statement

- Domestic electrical installation condition report form

- Tarrant county guardianship forms

- Enrollment forms 248713210

- Tsp 17 pdf form

- Genuine redundancy account claim form incolink

- Hhs hrsa photoimage release form nhsc nhsc hrsa

- Small claim cases and general information in arizona

- Ffmcareerex applicant acknowledgement permission form

Find out other Personal Income Statement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast