Purple Heart Tax Receipt Form

What is the Purple Heart Tax Receipt

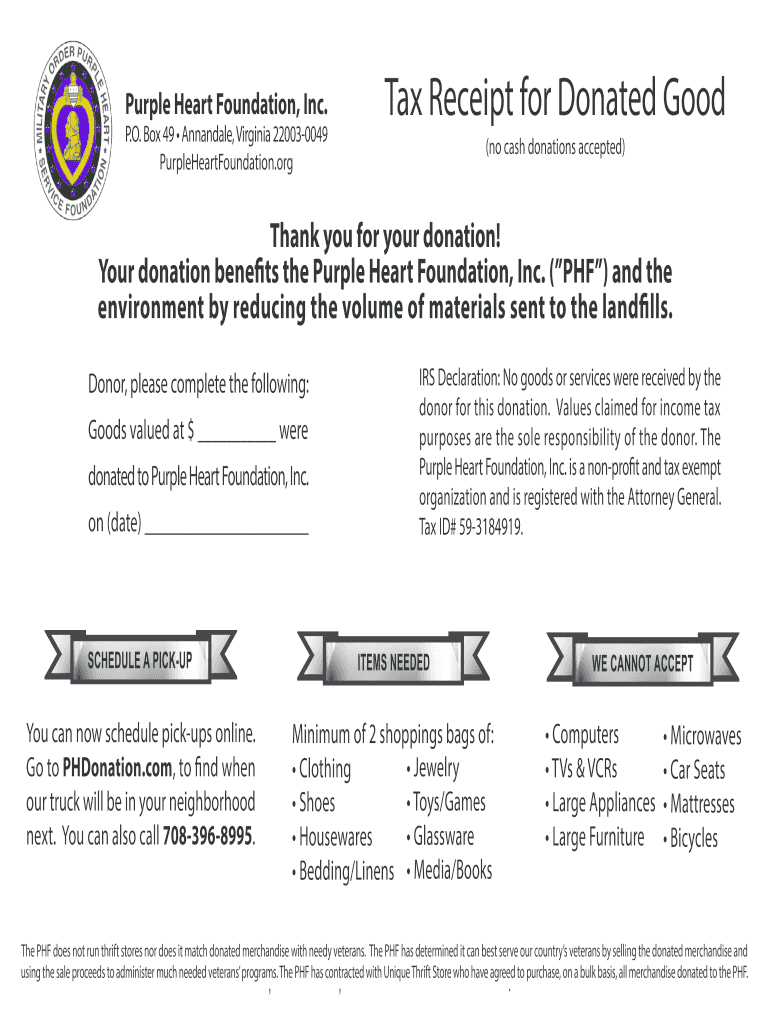

The Purple Heart Tax Receipt serves as documentation for donations made to the Purple Heart organization, which supports veterans and their families. This receipt is essential for individuals who wish to claim a tax deduction for their charitable contributions. It typically includes details such as the donor's name, the date of the donation, and a description of the items donated. Understanding the purpose and requirements of this receipt is crucial for ensuring compliance with IRS regulations.

How to use the Purple Heart Tax Receipt

Using the Purple Heart Tax Receipt effectively involves several steps. First, ensure that you have accurately documented your donation, including the items and their estimated value. When filing your taxes, include this receipt with your tax return to substantiate your charitable contributions. It is advisable to keep a copy of the receipt for your records, as the IRS may request proof of your donation during an audit. Proper use of this receipt can help maximize your tax benefits while supporting a worthy cause.

Steps to complete the Purple Heart Tax Receipt

Completing the Purple Heart Tax Receipt involves a straightforward process. Begin by gathering all necessary information about your donation, such as the type and condition of items donated. Next, fill out the receipt with accurate details, including the date of donation and your contact information. Ensure that you sign the receipt to validate it. After completing the form, retain a copy for your records and submit the original to the Purple Heart organization if required. Following these steps will help ensure that your receipt is valid and compliant.

IRS Guidelines

The IRS has specific guidelines regarding the use of tax receipts for charitable donations. According to IRS regulations, donations must be itemized to qualify for deductions. The Purple Heart Tax Receipt should clearly state the fair market value of the donated items. Additionally, donors must ensure that their contributions are made to qualified organizations, such as the Purple Heart. Familiarizing yourself with these guidelines can help ensure that you meet all necessary requirements and maximize your tax deductions.

Legal use of the Purple Heart Tax Receipt

The legal use of the Purple Heart Tax Receipt is governed by IRS rules and regulations. This receipt serves as proof of your charitable donation, which is necessary for claiming tax deductions. To be legally valid, the receipt must contain specific information, including the date of the donation and a detailed description of the items. It is essential to ensure that the receipt is filled out accurately to avoid issues with the IRS. Compliance with these legal requirements will help protect your tax benefits.

Required Documents

When preparing to use the Purple Heart Tax Receipt for tax purposes, certain documents are required. You will need the completed Purple Heart Tax Receipt itself, which includes details about your donation. Additionally, it is beneficial to have any supporting documents, such as photographs of the donated items or previous receipts, to substantiate the value of your contributions. Keeping these documents organized will facilitate a smoother filing process and help ensure compliance with IRS regulations.

Quick guide on how to complete purple heart tax receipt form

Uncover how to effortlessly navigate the Purple Heart Tax Receipt completion with this simple tutorial

Electronic filing and certification of forms is becoming increasingly favored and is the preferred choice for a diverse range of users. It offers numerous advantages over traditional printed documents, including convenience, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can find, modify, sign, and send your Purple Heart Tax Receipt without the hassle of constant printing and scanning. Follow this brief tutorial to begin and manage your document.

Follow these steps to obtain and complete Purple Heart Tax Receipt

- Start by clicking the Get Form button to access your document in our editor.

- Observe the green marker on the left that highlights mandatory fields so you won't miss them.

- Utilize our sophisticated tools to annotate, modify, sign, secure, and enhance your document.

- Secure your file or convert it into a fillable form using the appropriate tab features.

- Review the document and verify it for any mistakes or discrepancies.

- Select DONE to complete your edits.

- Rename your document or keep the original name.

- Choose your desired storage service to save your document, send it via USPS, or click the Download Now button to acquire your file.

If Purple Heart Tax Receipt is not what you were looking for, you can explore our extensive collection of pre-uploaded forms that you can complete with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the purple heart tax receipt form

How to create an eSignature for the Purple Heart Tax Receipt Form online

How to generate an eSignature for the Purple Heart Tax Receipt Form in Chrome

How to generate an eSignature for signing the Purple Heart Tax Receipt Form in Gmail

How to make an electronic signature for the Purple Heart Tax Receipt Form right from your smartphone

How to create an electronic signature for the Purple Heart Tax Receipt Form on iOS devices

How to generate an eSignature for the Purple Heart Tax Receipt Form on Android OS

People also ask

-

What are the purple heart unacceptable items when sending documents?

When using airSlate SignNow, it's essential to avoid certain purple heart unacceptable items, such as locked documents or those requiring special permissions. These items can hinder the signing process and lead to delays. Always ensure your documents are ready for eSigning to enhance efficiency.

-

How does airSlate SignNow handle purple heart unacceptable items?

AirSlate SignNow has built-in features that automatically identify purple heart unacceptable items, guiding users on how to correct them. This ensures a smooth signing experience and reduces errors during document handling. Our platform aims to simplify the eSigning process for all users.

-

Are there any costs associated with dealing with purple heart unacceptable items?

There are no additional costs specifically tied to purple heart unacceptable items; however, addressing these issues promptly is crucial to avoid delays. airSlate SignNow offers a cost-effective solution that includes comprehensive support for managing all types of items within documents. Investing time in understanding these items can save you money in the long run.

-

Can I integrate airSlate SignNow with other tools to manage purple heart unacceptable items?

Yes, airSlate SignNow integrates seamlessly with various productivity tools, allowing you to manage purple heart unacceptable items effectively. These integrations enhance workflow and ensure that all documents are compliant with eSigning requirements. By utilizing our app stack, you’ll have a streamlined process for addressing any unacceptable items.

-

What benefits does airSlate SignNow provide for dealing with purple heart unacceptable items?

One of the key benefits of using airSlate SignNow is its intelligent document management system that minimizes the occurrence of purple heart unacceptable items. By guiding users through the document preparation and signing process, we ensure that you can eSign documents efficiently. This service enhances overall productivity and reduces the risk of errors.

-

Is customer support available for issues related to purple heart unacceptable items?

Absolutely! airSlate SignNow provides comprehensive customer support to help users navigate any issues related to purple heart unacceptable items. Our dedicated team is available to answer questions and assist you in resolving any challenges you face with document processing. We’re committed to ensuring a smooth user experience.

-

How can I prepare my documents to avoid purple heart unacceptable items?

To avoid purple heart unacceptable items, ensure that your documents are properly formatted and all permissions are appropriately set before sending for signatures. airSlate SignNow offers templates and checklists to guide you through this preparation process. Proper preparation can signNowly streamline your eSigning experience.

Get more for Purple Heart Tax Receipt

- Dhs 0777 fillable form

- Evolution worksheet high school pdf form

- Job sheet template word form

- Cleaning validation protocol template form

- 11 year old well child check template form

- Road closing permit form town of clarkstown

- Independent reading checkpoint 1 form

- Membership form irish cultural center hudson valley icchv

Find out other Purple Heart Tax Receipt

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure