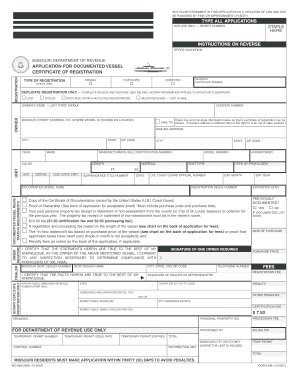

Dor 4398 Form

What is the Form 4398?

The Form 4398 is a specific document used primarily for tax purposes in the United States. It is essential for individuals and businesses to accurately report certain types of income or deductions. Understanding the purpose of this form is crucial for compliance with IRS regulations. The form requires detailed information about the taxpayer's financial situation, including income sources and applicable deductions. Properly completing the Form 4398 ensures that taxpayers can take advantage of potential tax benefits while remaining compliant with federal tax laws.

How to use the Form 4398

Using the Form 4398 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form with precise information, ensuring that all sections are completed according to IRS guidelines. It is important to double-check entries for accuracy to prevent delays in processing. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and IRS instructions. Utilizing digital tools, such as signNow, can simplify the signing and submission process.

Steps to complete the Form 4398

Completing the Form 4398 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income and expense records.

- Download the Form 4398 from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail your income sources and any applicable deductions in the designated sections.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form according to IRS guidelines, either online or by mail.

Legal use of the Form 4398

The Form 4398 is legally binding when completed and submitted according to IRS regulations. To ensure its validity, the form must be filled out accurately and signed by the appropriate parties. Electronic signatures are acceptable under U.S. law, provided they comply with the ESIGN and UETA acts. This means that using a reliable eSignature platform, like signNow, can help maintain compliance while ensuring the document is legally recognized. It is essential to keep a copy of the submitted form for your records, as this may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4398 can vary based on individual circumstances and the type of income being reported. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15 of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to stay informed about any changes in deadlines or requirements by checking the IRS website or consulting a tax professional. Missing the deadline can result in penalties or delayed processing of your tax return.

Form Submission Methods (Online / Mail / In-Person)

The Form 4398 can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to file electronically, which can expedite processing times. Many tax software programs offer direct submission options. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person submission is generally not available, as the IRS encourages electronic filing for efficiency. Whichever method you choose, ensure that you keep a copy of the submitted form for your records.

Quick guide on how to complete dor 4398 form

Prepare Dor 4398 Form effortlessly on any device

Online document management has gained signNow traction with organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without any holdups. Handle Dor 4398 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign Dor 4398 Form without hassle

- Obtain Dor 4398 Form and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that function.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Dor 4398 Form and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dor 4398 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4398, and why is it important?

Form 4398 is a tax form used by corporations and partnerships to calculate taxes on certain types of income. Understanding how to fill out form 4398 correctly is crucial for businesses to ensure compliance with federal tax regulations and avoid penalties.

-

How can airSlate SignNow help with form 4398?

airSlate SignNow enables you to easily eSign and send form 4398 securely. With its user-friendly interface, you can streamline the process of managing your tax documents and ensure that all signatures are collected efficiently.

-

What features does airSlate SignNow offer for form 4398 processing?

airSlate SignNow includes features such as templates, automated workflows, and real-time tracking, which enhance the efficiency of processing form 4398. These tools ensure that you can complete the form accurately and quickly, reducing the chances of errors.

-

Is there a cost associated with using airSlate SignNow for form 4398?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. Whether you're a small business or a larger enterprise, there's a plan that allows you to manage form 4398 at an affordable rate, maximizing your investment.

-

Can I integrate airSlate SignNow with other applications for form 4398?

Absolutely! airSlate SignNow supports integrations with numerous applications, enhancing your workflow when dealing with form 4398. You can connect it with CRM systems, file storage services, and others to streamline document management.

-

What are the benefits of eSigning form 4398 with airSlate SignNow?

ESigning form 4398 with airSlate SignNow provides numerous benefits including faster turnaround times and improved security. Digital signatures are legally binding, making your eSigned documents just as valid as traditional signatures.

-

Is my data safe when I use airSlate SignNow for form 4398?

Yes, airSlate SignNow prioritizes data security and complies with industry standards to protect your information when handling form 4398. With features like encryption and secure cloud storage, your documents are safe from unauthorized access.

Get more for Dor 4398 Form

- Pediatric review of systems form

- Renunciation of executor form florida

- Deposit and withdrawal worksheets form

- Parent request for revocation of consent for special education services and programsdoc form

- Iso 17020 checklist form

- Grady employee parking form

- Wage tax refund petition 6165232 form

- Request for contingent annuitant allowance persi idaho gov form

Find out other Dor 4398 Form

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer