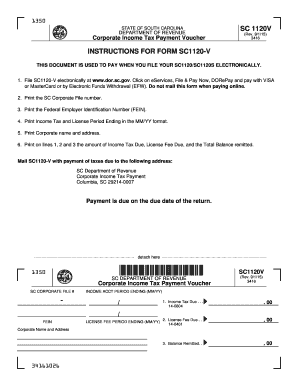

Sc1120 V Form

What is the SC1120 V?

The SC1120 V is a specific tax form used by certain business entities in the United States to report income and calculate tax obligations. This form is essential for corporations and partnerships, allowing them to provide the Internal Revenue Service (IRS) with detailed financial information. Understanding the SC1120 V is crucial for compliance with federal tax regulations.

Steps to Complete the SC1120 V

Completing the SC1120 V requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section, providing the entity's name, address, and Employer Identification Number (EIN).

- Report total income, deductions, and credits in the appropriate sections.

- Calculate the tax liability based on the provided information.

- Review the form for accuracy before submission.

Legal Use of the SC1120 V

The SC1120 V must be completed and submitted in accordance with IRS guidelines to ensure its legal validity. This includes adhering to deadlines and accurately reporting all required information. Failure to comply with these regulations can result in penalties or audits.

Filing Deadlines / Important Dates

Timely submission of the SC1120 V is essential. The typical deadline for filing this form is the 15th day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the SC1120 V, various documents are necessary. These may include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets and liabilities.

- Previous year’s tax return for reference.

- Any relevant schedules or attachments required by the IRS.

Form Submission Methods

The SC1120 V can be submitted through various methods, including:

- Online submission via the IRS e-file system.

- Mailing a paper copy to the appropriate IRS address.

- In-person delivery at designated IRS offices, if necessary.

Who Issues the Form

The SC1120 V is issued by the Internal Revenue Service (IRS), which provides the necessary guidelines and requirements for its completion. It is essential for businesses to utilize the most current version of the form to ensure compliance with tax laws.

Quick guide on how to complete sc1120 v

Effortlessly Complete Sc1120 V on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Sc1120 V on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Easily Modify and eSign Sc1120 V

- Find Sc1120 V and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Mark key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that require new printed copies. airSlate SignNow meets your document management needs with just a few clicks from your selected device. Modify and eSign Sc1120 V to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1120 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sc1120s form, and how does it relate to airSlate SignNow?

The sc1120s form is a tax document required for S corporation tax filings. airSlate SignNow allows businesses to easily send, receive, and eSign this form digitally, ensuring compliance and efficiency in your tax processing.

-

How much does it cost to use airSlate SignNow for sc1120s eSigning?

Pricing for airSlate SignNow varies based on the plan selected, but it offers competitive rates designed for businesses of all sizes. The service includes features tailored for managing documents like sc1120s, providing great value for cost-effective document management.

-

What features does airSlate SignNow offer for handling sc1120s documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage, making it easier to manage your sc1120s documents. You can also track signatures in real-time and integrate with other applications for streamlined operations.

-

Can I integrate airSlate SignNow with my existing systems for managing sc1120s?

Yes, airSlate SignNow offers robust integrations with various software systems including CRMs and accounting tools. This means you can seamlessly incorporate sc1120s management into your existing workflows without disruption.

-

Why should I choose airSlate SignNow for signing sc1120s over traditional methods?

Choosing airSlate SignNow for your sc1120s offers signNow advantages including reduced paperwork, faster turnaround times, and enhanced security. Digital eSigning saves time and helps you stay organized while ensuring that your documents are legally binding.

-

Is airSlate SignNow compliant with legal standards for sc1120s?

Absolutely, airSlate SignNow adheres to legal standards for electronic signatures, ensuring that your sc1120s and other documents are processed securely and in compliance with regulations. This helps protect your business and maintain the validity of your signed documents.

-

What support resources does airSlate SignNow provide for sc1120s users?

airSlate SignNow provides extensive support resources, including tutorials, FAQs, and customer service to assist with sc1120s eSigning. Their knowledgeable team is available to help you navigate any challenges you may encounter while using the platform.

Get more for Sc1120 V

Find out other Sc1120 V

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed