TAX TABLES the Two Tax Tables Used for Indivi 2024-2026

Understanding Arkansas State Income Tax Tables

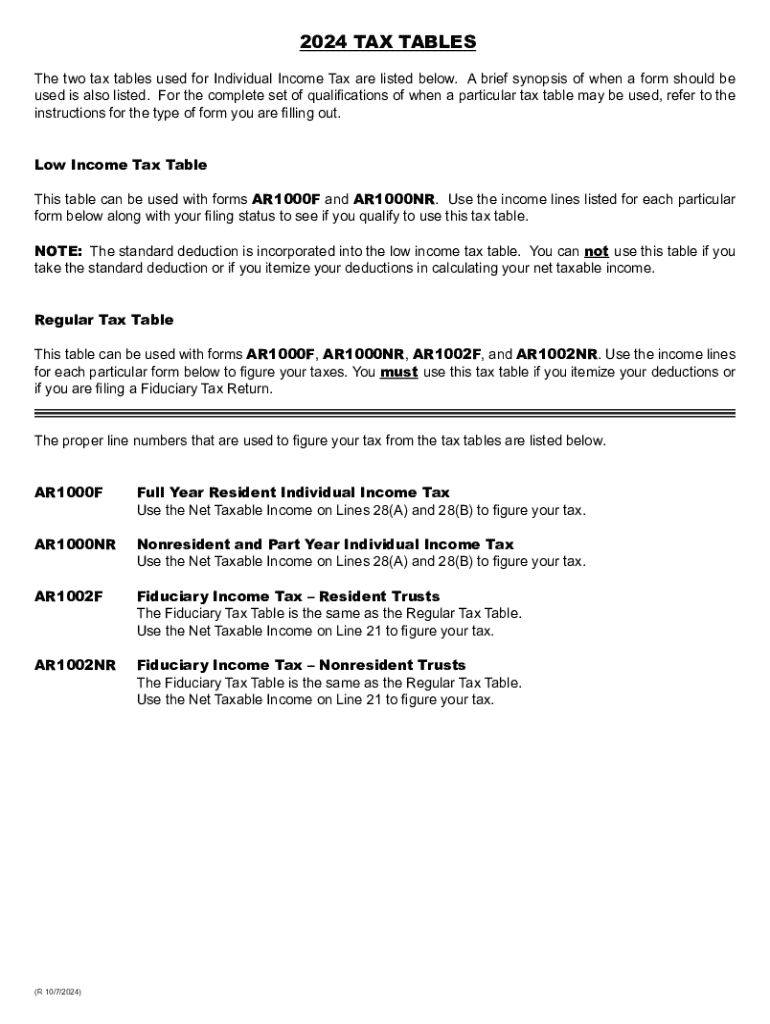

The Arkansas state income tax tables are essential resources for taxpayers in Arkansas, providing a structured way to determine the amount of tax owed based on income levels. For the tax year 2024, the state employs two primary tax tables: one for single filers and another for married couples filing jointly. Each table outlines specific income brackets alongside corresponding tax rates, allowing individuals to calculate their tax liability accurately.

How to Use the Arkansas State Income Tax Tables

To effectively use the Arkansas state income tax tables, taxpayers should first identify their filing status, as this will determine which table to consult. Once the appropriate table is selected, locate the income range that corresponds to the taxpayer's total taxable income. The tax owed is calculated by applying the specified rate to the income within the relevant bracket. It is important to note that taxpayers may also need to consider deductions and credits that could affect their final tax liability.

Key Elements of the Arkansas State Income Tax Tables

Key elements of the Arkansas state income tax tables include the income brackets, tax rates, and any applicable deductions or credits. Each income bracket is associated with a specific tax rate, which progressively increases as income rises. Understanding these elements is crucial for taxpayers to ensure compliance and optimize their tax filings. Additionally, the tables may include information on standard deductions, which can further reduce taxable income.

Examples of Using the Arkansas State Income Tax Tables

Examples can clarify how to utilize the Arkansas state income tax tables. For instance, if a single filer has a taxable income of $50,000, they would locate this amount in the single filer tax table. If the corresponding tax rate for that income bracket is ten percent, the taxpayer would calculate their tax liability as $5,000. This straightforward example illustrates the process of determining tax obligations using the tables.

Filing Deadlines and Important Dates

Filing deadlines for Arkansas state income taxes typically align with federal deadlines, with individual returns due on April 15. However, extensions may be available under specific circumstances. Taxpayers should remain aware of these dates to avoid penalties and ensure timely submissions. Staying informed about any changes in deadlines for the 2024 tax year is also advisable, as state regulations may evolve.

Required Documents for Arkansas State Income Tax Filing

When preparing to file Arkansas state income taxes, taxpayers should gather essential documents, including W-2 forms, 1099 forms, and any records of deductible expenses. These documents provide the necessary information to accurately report income and claim deductions. Additionally, having identification numbers, such as Social Security numbers, readily available is crucial for completing the tax forms correctly.

Penalties for Non-Compliance with Arkansas State Tax Regulations

Taxpayers who fail to comply with Arkansas state tax regulations may face penalties, including fines and interest on unpaid taxes. The severity of penalties can vary depending on the nature of the non-compliance, such as late filing or underreporting income. Understanding these penalties is vital for taxpayers to avoid unnecessary financial burdens and to encourage timely and accurate tax filings.

Create this form in 5 minutes or less

Find and fill out the correct tax tables the two tax tables used for indivi

Create this form in 5 minutes!

How to create an eSignature for the tax tables the two tax tables used for indivi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Arkansas state income tax tables for 2023?

The Arkansas state income tax tables for 2023 outline the tax rates and brackets applicable to individual taxpayers. These tables are essential for calculating your tax liability accurately. Understanding these tables can help you plan your finances better and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Arkansas state income tax documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to Arkansas state income tax. With our platform, you can easily manage tax forms and ensure they are signed and submitted on time. This efficiency can save you time and reduce the stress associated with tax season.

-

Are there any costs associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features that simplify the management of Arkansas state income tax tables and related documents. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning capabilities.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for handling Arkansas state income tax tables. These features ensure that your tax documents are processed efficiently and securely. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers integrations with various accounting software solutions, making it easier to manage your Arkansas state income tax tables and related documents. This integration allows for seamless data transfer and ensures that your tax calculations are accurate. You can connect with popular platforms to enhance your workflow.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including those related to Arkansas state income tax tables. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with Arkansas state income tax?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses managing Arkansas state income tax tables. Whether you are filing personal taxes or handling corporate tax documents, our platform provides the tools you need for efficient document management and eSigning.

Get more for TAX TABLES The Two Tax Tables Used For Indivi

Find out other TAX TABLES The Two Tax Tables Used For Indivi

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template