N 15 Rev NonResident and Part Year Resident Income Tax Return Forms Fillable 2024-2026

What is the Hawaii N-15 Nonresident and Part-Year Resident Income Tax Return?

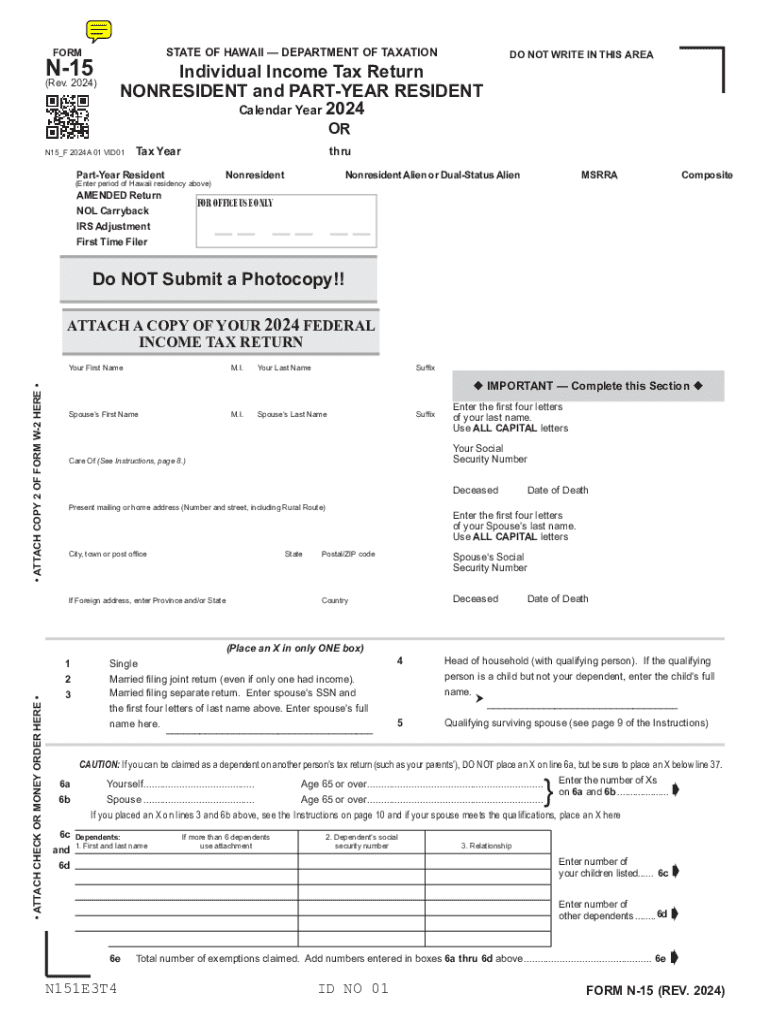

The Hawaii N-15 form is designed for nonresidents and part-year residents to report their income and calculate their state tax obligations. This form is essential for individuals who earn income in Hawaii but do not meet the residency requirements for full-time residents. The N-15 allows taxpayers to report income earned while residing in Hawaii and ensures compliance with state tax laws.

How to Use the Hawaii N-15 Form

To effectively use the Hawaii N-15 form, taxpayers should first gather all relevant financial documents, including W-2s and 1099s. The form can be filled out electronically or printed for manual completion. After entering personal information and income details, taxpayers must calculate their tax liability based on the instructions provided with the form. It is important to review the completed form for accuracy before submission.

Steps to Complete the Hawaii N-15 Form

Completing the Hawaii N-15 form involves several key steps:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill in personal information, including name, address, and Social Security number.

- Report all income earned in Hawaii, including wages, interest, and dividends.

- Calculate any deductions or credits applicable to your situation.

- Determine your total tax liability using the provided tax tables.

- Sign and date the form before submitting it to the appropriate state agency.

Required Documents for the Hawaii N-15 Form

When preparing to file the Hawaii N-15 form, taxpayers should have the following documents on hand:

- W-2 forms from employers showing income earned in Hawaii.

- 1099 forms for any additional income sources, such as freelance work.

- Records of any deductions or credits claimed, such as mortgage interest or education expenses.

- Any previous tax returns that may provide context for current filings.

Filing Deadlines for the Hawaii N-15 Form

Taxpayers must adhere to specific deadlines when filing the Hawaii N-15 form. The standard deadline for filing is typically April 20 for the previous tax year. If additional time is needed, taxpayers can request an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance with the Hawaii N-15 Form

Failure to file the Hawaii N-15 form or inaccuracies in reporting can result in penalties. The state may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. It is crucial for taxpayers to file accurately and on time to avoid these consequences.

Handy tips for filling out N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable online

Quick steps to complete and e-sign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant service for optimum simpleness. Use signNow to electronically sign and share N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct n 15 rev nonresident and part year resident income tax return forms fillable

Create this form in 5 minutes!

How to create an eSignature for the n 15 rev nonresident and part year resident income tax return forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii state tax form N 15?

The Hawaii state tax form N 15 is a tax return form used by part-year residents and non-residents to report their income earned in Hawaii. This form allows taxpayers to calculate their tax liability based on the income sourced from Hawaii. Understanding how to fill out the Hawaii state tax form N 15 is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with the Hawaii state tax form N 15?

airSlate SignNow provides a seamless platform for electronically signing and sending the Hawaii state tax form N 15. With its user-friendly interface, you can easily upload your completed form, gather signatures, and ensure timely submission. This simplifies the process and helps you stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for the Hawaii state tax form N 15?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides access to features that streamline the signing process for documents like the Hawaii state tax form N 15. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for managing the Hawaii state tax form N 15?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, which are beneficial for managing the Hawaii state tax form N 15. These features enhance efficiency and ensure that your documents are handled securely and professionally. Additionally, you can automate reminders for signatures to avoid delays.

-

Can I integrate airSlate SignNow with other applications for the Hawaii state tax form N 15?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the Hawaii state tax form N 15 alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, these integrations help streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Hawaii state tax form N 15?

Using airSlate SignNow for the Hawaii state tax form N 15 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and sign documents electronically, saving time and minimizing the risk of errors. This is especially useful during tax season when timely submissions are critical.

-

Is airSlate SignNow secure for handling the Hawaii state tax form N 15?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Hawaii state tax form N 15 and other sensitive documents are protected. The platform uses advanced encryption and secure storage solutions to safeguard your data. You can trust that your information is handled with the utmost care and confidentiality.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Form 42 access agreement consent to disclose bc ctc

- Advanced pain management patient registration form

- Home health skilled nursing visit note examples form

- Anexo 1 rellenable form

- Pet parade contest form

- Solicitud baja contrato form

- How to get labour contractor licence in tamilnadu form

- Dg plate supply team tn gov form

Find out other N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney