Fiduciary Irs Form

What is the Fiduciary IRS Form

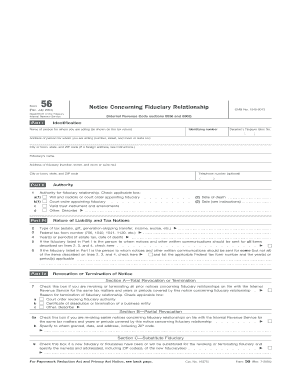

The Fiduciary IRS Form is a tax document used by fiduciaries to report income, deductions, and credits for estates and trusts. This form is essential for managing the financial responsibilities of a deceased person's estate or a trust established for beneficiaries. Fiduciaries, such as executors or trustees, are responsible for ensuring that the estate or trust complies with tax regulations and fulfills its obligations to the IRS.

How to use the Fiduciary IRS Form

To effectively use the Fiduciary IRS Form, fiduciaries must first gather all necessary financial information related to the estate or trust. This includes income generated from assets, expenses incurred, and any distributions made to beneficiaries. Once the information is compiled, the fiduciary can accurately fill out the form, ensuring that all sections are completed correctly. It is important to review the completed form for accuracy before submission to avoid potential penalties.

Steps to complete the Fiduciary IRS Form

Completing the Fiduciary IRS Form involves several key steps:

- Gather all financial documents related to the estate or trust.

- Fill out the identifying information, including the name and taxpayer identification number of the fiduciary and the estate or trust.

- Report all income received during the tax year, including interest, dividends, and rental income.

- List all deductions, such as administrative expenses, legal fees, and taxes paid.

- Calculate the taxable income and any credits applicable to the estate or trust.

- Sign and date the form, certifying that the information provided is accurate and complete.

Legal use of the Fiduciary IRS Form

The legal use of the Fiduciary IRS Form requires compliance with IRS regulations. The form must be filed for any estate or trust that has generated income during the tax year. Failure to file can result in penalties and interest on unpaid taxes. Additionally, fiduciaries must ensure that the form is submitted by the appropriate deadlines to avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Fiduciary IRS Form vary depending on the type of entity. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. It is crucial for fiduciaries to be aware of these deadlines to ensure timely compliance and avoid penalties.

Required Documents

When completing the Fiduciary IRS Form, several documents are necessary to provide accurate information. These documents include:

- Financial statements detailing income and expenses.

- Records of distributions made to beneficiaries.

- Documentation of any deductions claimed.

- Previous tax returns for the estate or trust, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Fiduciary IRS Form can be submitted through various methods. Fiduciaries have the option to file online using IRS e-file services, which can expedite processing times. Alternatively, the form can be mailed to the appropriate IRS address based on the estate or trust's location. In-person submissions are generally not available for tax forms, but fiduciaries can seek assistance at local IRS offices if needed.

Quick guide on how to complete fiduciary irs form

Complete Fiduciary Irs Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without any delays. Manage Fiduciary Irs Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to modify and electronically sign Fiduciary Irs Form with ease

- Obtain Fiduciary Irs Form and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Fiduciary Irs Form to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fiduciary irs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fiduciary IRS Form?

A Fiduciary IRS Form is an essential document required for entities managing the assets of others, often for estates or trusts. This form helps in reporting income, deductions, and distributions from the fiduciary entity to the IRS. Understanding its implications can help you comply with tax obligations effectively.

-

How can airSlate SignNow assist me with my Fiduciary IRS Form?

airSlate SignNow offers a streamlined process to create, send, and eSign your Fiduciary IRS Form effortlessly. Our platform is designed to simplify document management, ensuring that you can generate and organize the necessary forms quickly and securely. This helps you focus more on compliance rather than paperwork.

-

Is airSlate SignNow cost-effective for handling Fiduciary IRS Forms?

Yes, airSlate SignNow provides a cost-effective solution for managing Fiduciary IRS Forms. By offering competitive pricing plans, you can effectively reduce administrative costs associated with document creation and signature collection. This ensures that you can efficiently manage your fiduciary actions without breaking the bank.

-

What features does airSlate SignNow offer for processing Fiduciary IRS Forms?

airSlate SignNow includes numerous features tailored for processing Fiduciary IRS Forms, such as customizable templates, automatic reminders, and secure e-signature capabilities. These features enhance the ease of completing and managing your forms efficiently. Additionally, the user-friendly interface simplifies the document workflow.

-

Can I integrate airSlate SignNow with other software to manage my Fiduciary IRS Forms?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions, enhancing your ability to manage Fiduciary IRS Forms. You can easily connect it to your existing systems for a more efficient workflow. This integration capability allows you to streamline operations and maintain consistency across platforms.

-

What are the benefits of using airSlate SignNow for Fiduciary IRS Forms?

Using airSlate SignNow for your Fiduciary IRS Forms brings several benefits, including improved efficiency, accurate document management, and robust security features. You can quickly send documents for signatures, track their status in real-time, and ensure compliance with all IRS regulations. This not only saves time but also minimizes errors traditionally associated with paperwork.

-

How secure is the information I submit with my Fiduciary IRS Form using airSlate SignNow?

The security of your information is our top priority at airSlate SignNow. We implement advanced encryption protocols and adhere to industry standards to protect all data associated with your Fiduciary IRS Form. You can trust that your sensitive information remains safe and confidential throughout the process.

Get more for Fiduciary Irs Form

- Pradhan mantri jeevan jyoti bima yojana claim form to be completed by the claimant ampamp

- Health status in application form 29308517

- Acft score card form

- Ds 2029 example form

- Section 14 3 seafloor sediments pdf answer key form

- Background disclosure form minnesota

- Mndot mto request to sublet form 9 16 docx

- State of minnesota district court financial affidavit for form

Find out other Fiduciary Irs Form

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself