Brevard County Tourist Tax 2015

What is the Brevard County Tourist Tax

The Brevard County Tourist Tax, also known as the bed tax, is a tax levied on short-term rentals in Brevard County, Florida. This tax applies to accommodations rented for six months or less, including hotels, motels, vacation rentals, and other lodging facilities. The revenue generated from this tax is used to promote tourism and support local infrastructure, benefiting the community and enhancing visitor experiences.

How to use the Brevard County Tourist Tax

Using the Brevard County Tourist Tax involves understanding the applicable rates and ensuring compliance with local regulations. Property owners and managers must collect the tax from guests and remit it to the county. The current tax rate is typically a percentage of the rental fee, and it is essential to keep accurate records of all transactions. This ensures proper reporting and remittance to the county authorities.

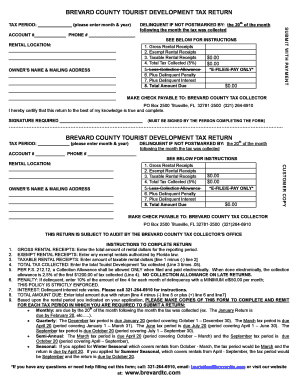

Steps to complete the Brevard County Tourist Tax

Completing the Brevard County Tourist Tax involves several key steps:

- Determine the applicable tax rate based on the rental amount.

- Collect the tax from guests at the time of booking or check-in.

- Maintain accurate records of all collected taxes and rental transactions.

- Prepare and submit the necessary forms to the Brevard County Tax Collector's Office.

- Remit the collected taxes by the established deadlines to avoid penalties.

Legal use of the Brevard County Tourist Tax

The legal use of the Brevard County Tourist Tax requires adherence to local laws and regulations governing short-term rentals. Property owners must register their rental properties with the county and obtain the necessary permits. Compliance with these legal requirements ensures that the tax is collected and remitted appropriately, thereby supporting the local tourism industry while avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Brevard County Tourist Tax are crucial for property owners and managers to avoid penalties. Typically, taxes must be reported and paid monthly, with specific due dates set by the county. It is important to stay informed about these deadlines to ensure timely compliance. Missing a deadline can result in fines and interest on the unpaid tax amount.

Required Documents

To properly file the Brevard County Tourist Tax, certain documents are required. These include:

- Completed Brevard County Tourist Tax Return form.

- Records of rental transactions, including invoices and receipts.

- Proof of tax collection from guests.

- Any additional documentation requested by the county for verification purposes.

Penalties for Non-Compliance

Failure to comply with the Brevard County Tourist Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for property owners and managers to understand their responsibilities and ensure timely filing and payment to avoid these consequences.

Quick guide on how to complete brevard county tourist tax

Effortlessly Prepare Brevard County Tourist Tax on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without complications. Handle Brevard County Tourist Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Brevard County Tourist Tax with Ease

- Obtain Brevard County Tourist Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and electronically sign Brevard County Tourist Tax to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct brevard county tourist tax

Create this form in 5 minutes!

How to create an eSignature for the brevard county tourist tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brevard County tourist tax?

The Brevard County tourist tax is a tax levied on short-term rentals and accommodations for visitors in Brevard County, Florida. This tax helps fund local tourism initiatives and services designed to enhance the visitor experience. Understanding this tax is essential for property owners and managers operating in the area.

-

How does airSlate SignNow help with managing the Brevard County tourist tax?

airSlate SignNow provides an efficient eSigning solution to streamline the process of sending and signing documents related to the Brevard County tourist tax. With features like templates and automated workflows, businesses can easily manage tax documentation and ensure compliance. This saves time and reduces the risk of errors in tax filings.

-

Is there a cost associated with airSlate SignNow when handling Brevard County tourist tax documents?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. These plans provide access to essential features for managing Brevard County tourist tax documents, including unlimited eSignatures and document storage. Investing in this solution can lead to time savings and increased productivity for your business.

-

What features does airSlate SignNow offer for Brevard County tourist tax compliance?

airSlate SignNow includes features such as customizable templates, in-app collaboration, and status tracking to support Brevard County tourist tax compliance. These tools help users easily create, send, and manage documents, ensuring all necessary information is accurately captured. This enhances the efficiency of tax-related processes for businesses.

-

Can airSlate SignNow integrate with other tools to manage Brevard County tourist tax documentation?

Absolutely! airSlate SignNow seamlessly integrates with various business applications such as CRM systems and financial software, making it easier to manage Brevard County tourist tax documentation. These integrations facilitate data transfer and automate workflows, allowing for a more cohesive approach to tax management.

-

Who can benefit from using airSlate SignNow for Brevard County tourist tax management?

Various stakeholders can benefit from airSlate SignNow, including property managers, real estate agents, and vacation rental owners involved in Brevard County tourist tax management. By utilizing this solution, they can streamline their documentation process and ensure compliance. Additionally, any business that deals with short-term rentals will find signNow value in this tool.

-

How secure is airSlate SignNow for handling sensitive Brevard County tourist tax documents?

Security is a top priority for airSlate SignNow when handling Brevard County tourist tax documents. The platform employs advanced encryption and security protocols to protect sensitive information. This ensures that your documents remain confidential and compliant with all applicable regulations.

Get more for Brevard County Tourist Tax

- Post continuous member transmittal form

- Hbd 12 10911218 form

- Risk tolerance questionnaire 234045032 form

- The missouri project record extension missouri form

- Departure answer key form

- Blank size chart template form

- Alternative sentencing san luis obispo county sheriff form

- City of oxnard water conservation master plan form

Find out other Brevard County Tourist Tax

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template