Tourist Tax Return Form Brevard Tax Collector 2016-2026

What is the Tourist Tax Return Form Brevard Tax Collector

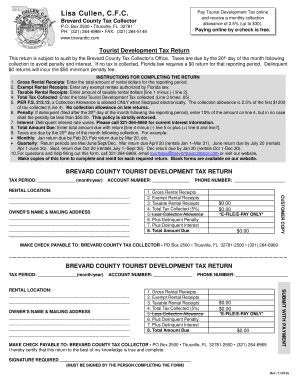

The Tourist Tax Return Form Brevard Tax Collector is a document required for businesses that rent or lease accommodations to tourists in Brevard County, Florida. This form is essential for reporting the collection of the local tourist development tax, which is levied on short-term rentals. The revenue generated from this tax supports various tourism-related initiatives and infrastructure within the county.

How to use the Tourist Tax Return Form Brevard Tax Collector

Using the Tourist Tax Return Form involves several steps. First, businesses must accurately report the total amount of rent collected from guests during the reporting period. This includes all fees and charges associated with the rental. After filling out the form, it must be submitted to the Brevard County Tax Collector's office, along with any taxes owed. It is important to retain a copy of the submitted form for your records.

Steps to complete the Tourist Tax Return Form Brevard Tax Collector

Completing the Tourist Tax Return Form requires attention to detail. Here are the steps to follow:

- Gather all necessary financial records, including rental agreements and payment receipts.

- Calculate the total rental income for the reporting period.

- Fill in the form with accurate figures, ensuring all required sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the Brevard County Tax Collector, either online or via mail.

Legal use of the Tourist Tax Return Form Brevard Tax Collector

The legal use of the Tourist Tax Return Form is governed by state and local laws. Businesses must ensure compliance with the regulations set forth by the Brevard County Tax Collector. This includes timely submission of the form and accurate reporting of collected taxes. Failure to comply with these legal requirements can result in penalties and fines.

Filing Deadlines / Important Dates

Filing deadlines for the Tourist Tax Return Form are typically set on a monthly basis. Businesses are required to submit their forms by the 20th of the month following the reporting period. It is crucial to be aware of these deadlines to avoid late fees and maintain compliance with local tax regulations.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Tourist Tax Return Form can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to adhere to all guidelines to avoid these consequences and ensure the smooth operation of their rental activities.

Quick guide on how to complete tourist tax return form brevard tax collector

Manage Tourist Tax Return Form Brevard Tax Collector effortlessly on any device

Digital document oversight has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Access Tourist Tax Return Form Brevard Tax Collector on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Tourist Tax Return Form Brevard Tax Collector with ease

- Locate Tourist Tax Return Form Brevard Tax Collector and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tourist Tax Return Form Brevard Tax Collector to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tourist tax return form brevard tax collector

Create this form in 5 minutes!

How to create an eSignature for the tourist tax return form brevard tax collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brevard County tourist tax?

The Brevard County tourist tax, also known as the bed tax, is a tax imposed on short-term rentals and hotels to fund tourism-related efforts in the area. This tax helps enhance local attractions and improve the overall visitor experience. Understanding this tax is essential for property owners and operators in Brevard County.

-

How can airSlate SignNow help me manage Brevard County tourist tax documentation?

airSlate SignNow streamlines the process of managing all your Brevard County tourist tax documentation by allowing you to easily eSign necessary forms and agreements. This not only saves time but also ensures that you maintain compliance with local tax regulations. The platform's user-friendly interface makes it simple for anyone to navigate.

-

What are the costs associated with using airSlate SignNow for handling tourist tax documents?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, making it a cost-effective solution for managing Brevard County tourist tax documents. With these plans, you gain access to features that help streamline the signing process and improve operational efficiency. Check their website for the latest pricing information.

-

Can I integrate airSlate SignNow with other tools to handle the Brevard County tourist tax?

Yes, airSlate SignNow offers integrations with various platforms and tools to help manage Brevard County tourist tax processes more effectively. Whether you use accounting software or property management systems, integrating these tools can enhance your workflow and documentation handling. This helps ensure that all necessary documentation for tourist tax compliance is readily accessible.

-

What features does airSlate SignNow offer to assist with Brevard County tourist tax compliance?

airSlate SignNow provides features like customizable templates and automatic reminders to help you stay compliant with Brevard County tourist tax regulations. You can create templates for frequently used documents, reducing manual error and saving time. These features ensure that you are always prepared during tax season.

-

How does eSigning with airSlate SignNow benefit my Brevard County tourist tax submissions?

Using airSlate SignNow for eSigning signNowly simplifies the process of submitting your Brevard County tourist tax-related documents. The platform allows for real-time tracking and notifications, ensuring timely submissions. This not only enhances your compliance but also provides peace of mind that documents are handled securely.

-

Is airSlate SignNow secure for managing sensitive tourist tax documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including those related to the Brevard County tourist tax. All data is encrypted and stored securely to protect sensitive information. Their compliance with industry standards ensures that your documents retain their integrity throughout the signing process.

Get more for Tourist Tax Return Form Brevard Tax Collector

- Bacs form template

- Sbl from fill form

- Ez custom measurement form for flat knit stockings

- Michigan opioid safety score form

- Wisconsin well construction reports form

- Maine certificate of discharge of estate tax lien form

- Joint product development agreement template form

- Joint purchase agreement template form

Find out other Tourist Tax Return Form Brevard Tax Collector

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free