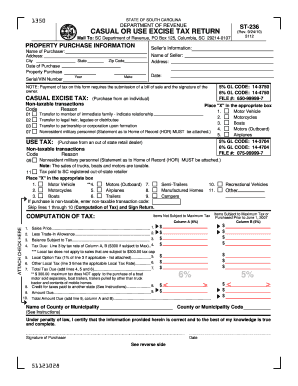

St 236 Form

What is the St 236 Form

The St 236 form is a specific document used in various legal and administrative contexts within the United States. It serves as a declaration or request that may be required for different purposes, such as tax exemptions or compliance with state regulations. Understanding the purpose and requirements of the St 236 form is essential for individuals and businesses to ensure proper filing and adherence to legal standards.

How to use the St 236 Form

Using the St 236 form involves several key steps to ensure accurate completion and submission. First, identify the specific purpose of the form, as this will dictate the information required. Next, gather all necessary supporting documents that may be needed to accompany the form. After filling out the form with the required information, review it carefully for accuracy. Finally, submit the form through the appropriate channels, which may include online submission, mailing it to the relevant authority, or delivering it in person.

Steps to complete the St 236 Form

Completing the St 236 form requires attention to detail. Follow these steps for successful completion:

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, address, and any other required details.

- Provide any necessary information related to the purpose of the form, ensuring accuracy.

- Attach any required supporting documents, such as identification or proof of eligibility.

- Sign and date the form to validate your submission.

Legal use of the St 236 Form

The St 236 form is legally binding when completed in accordance with applicable laws and regulations. It is crucial to ensure that all information provided is truthful and accurate, as misrepresentation can lead to legal consequences. Additionally, using a secure and compliant platform for electronic submissions can enhance the form's legal standing, ensuring that it meets the requirements set forth by relevant legal frameworks.

Key elements of the St 236 Form

Several key elements are essential for the St 236 form to be considered complete and valid. These include:

- Identification Information: Personal details such as name, address, and contact information.

- Purpose Statement: A clear declaration of the reason for submitting the form.

- Supporting Documentation: Any required attachments that substantiate the claims made in the form.

- Signature: The signer's affirmation of the accuracy of the information provided.

Form Submission Methods

The St 236 form can be submitted through various methods depending on the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many authorities allow for electronic filing through secure portals.

- Mail: The form can be printed and sent via postal service to the designated office.

- In-Person: Some individuals may prefer to deliver the form directly to the relevant office for immediate processing.

Quick guide on how to complete st 236 form

Complete St 236 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the essential tools to create, edit, and eSign your documents swiftly without delays. Handle St 236 Form on any device with the airSlate SignNow apps for Android or iOS and streamline any document-focused process today.

How to edit and eSign St 236 Form with ease

- Find St 236 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign St 236 Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 236 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 236 form and why is it important?

The ST 236 form is a key document used for sales tax exemption in various states. Businesses often need this form to exempt certain purchases from sales tax, ensuring compliance and saving costs during transactions.

-

How can airSlate SignNow help with the ST 236 form?

airSlate SignNow streamlines the process of filling out and electronically signing the ST 236 form. Our platform enables users to complete this crucial document with ease, ensuring accuracy and timely submissions.

-

Are there any costs associated with using the ST 236 form through airSlate SignNow?

Using the ST 236 form through airSlate SignNow comes with a range of subscription plans, catering to different business needs. Pricing is competitive, providing a cost-effective solution for managing various documents, including the ST 236 form.

-

What features does airSlate SignNow offer for the ST 236 form?

airSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking for the ST 236 form. These tools simplify the workflow and enhance document management capabilities.

-

Can I integrate airSlate SignNow with other tools for handling the ST 236 form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing easy management of the ST 236 form alongside other business tools. This integration enhances efficiency and keeps your documents organized.

-

What are the benefits of eSigning the ST 236 form with airSlate SignNow?

eSigning the ST 236 form with airSlate SignNow offers numerous benefits, including faster processing times and enhanced security. You can reduce paper waste and streamline approval workflows signNowly.

-

Is it safe to use airSlate SignNow for the ST 236 form?

Absolutely! airSlate SignNow prioritizes security, ensuring that your ST 236 form and all documents are protected with advanced encryption. This guarantees that your sensitive information remains confidential and secure.

Get more for St 236 Form

Find out other St 236 Form

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement