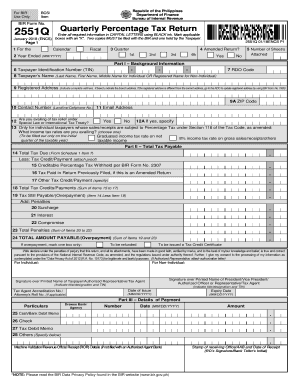

Quarterly Percentage Tax Return Form

What is the Quarterly Percentage Tax Return

The Quarterly Percentage Tax Return is a tax form used by businesses and self-employed individuals in the United States to report and pay their quarterly estimated taxes. This form allows taxpayers to calculate their tax liability based on their income, deductions, and credits for the quarter. It is essential for maintaining compliance with federal and state tax regulations, ensuring that taxpayers meet their obligations in a timely manner.

Steps to complete the Quarterly Percentage Tax Return

Completing the Quarterly Percentage Tax Return involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements, expense records, and any relevant tax forms.

- Calculate your estimated income for the quarter, taking into account any deductions or credits you may qualify for.

- Use the appropriate tax rate to determine your estimated tax liability based on your income.

- Fill out the Quarterly Percentage Tax Return form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Quarterly Percentage Tax Return

The Quarterly Percentage Tax Return is legally binding when completed and submitted according to IRS guidelines. To ensure its validity, taxpayers must adhere to specific regulations concerning eSignature and document submission. Using a reliable eSignature solution can enhance the legal standing of the form, as it provides a secure method for signing and storing the document, ensuring compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

Timely filing of the Quarterly Percentage Tax Return is crucial to avoid penalties. Generally, the deadlines for submission are:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Taxpayers should be aware of these dates and plan accordingly to ensure they meet their obligations without incurring late fees or interest charges.

Required Documents

To accurately complete the Quarterly Percentage Tax Return, taxpayers should have the following documents on hand:

- Income statements, such as W-2s or 1099s

- Expense records, including receipts and invoices

- Previous tax returns for reference

- Any relevant schedules or forms that support deductions and credits

Having these documents readily available will streamline the process and help ensure that all calculations are accurate.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Quarterly Percentage Tax Return:

- Online: Many taxpayers prefer to file electronically using tax software or e-filing services, which can simplify the process and provide instant confirmation of submission.

- Mail: The form can be printed and mailed to the appropriate IRS address, depending on the taxpayer's location.

- In-Person: Some taxpayers may choose to submit their forms in person at local IRS offices, although this option may vary by location.

Choosing the right submission method can enhance convenience and ensure compliance with filing requirements.

Quick guide on how to complete quarterly percentage tax return

Complete Quarterly Percentage Tax Return effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without obstacles. Manage Quarterly Percentage Tax Return on any gadget using airSlate SignNow's Android or iOS applications, and streamline your document-related tasks today.

The easiest method to alter and electronically sign Quarterly Percentage Tax Return without hassle

- Obtain Quarterly Percentage Tax Return and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow designed for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and bears the same legal validity as a traditional handwritten signature.

- Review the details carefully and then click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Quarterly Percentage Tax Return and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quarterly percentage tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Quarterly Percentage Tax Return and why is it important?

A Quarterly Percentage Tax Return is a tax form that businesses need to file quarterly to report their percentage taxes. It's important as it helps ensure compliance with tax regulations and avoids potential penalties, allowing businesses to manage their cash flow effectively.

-

How can airSlate SignNow assist with managing Quarterly Percentage Tax Returns?

airSlate SignNow offers a seamless platform to eSign and send documents related to your Quarterly Percentage Tax Return. With this easy-to-use solution, you can enhance the efficiency of your tax filing process and ensure that your documents are secure and accessible.

-

What are the pricing options for using airSlate SignNow with Quarterly Percentage Tax Returns?

airSlate SignNow provides flexible pricing plans that cater to diverse business needs. These plans are designed to be cost-effective, enabling you to manage your Quarterly Percentage Tax Return process without overspending.

-

Can I integrate airSlate SignNow with my accounting software for Quarterly Percentage Tax Returns?

Yes, airSlate SignNow can be integrated with various accounting software platforms to streamline your Quarterly Percentage Tax Return workflow. This integration allows for easier document management and ensures accurate tax reporting.

-

What features does airSlate SignNow offer for eSigning Quarterly Percentage Tax Returns?

airSlate SignNow provides features such as customizable templates, secure eSigning, and tracking capabilities for your Quarterly Percentage Tax Return documents. These tools enhance security and improve turnaround times for your tax filings.

-

What are the benefits of using airSlate SignNow for my Quarterly Percentage Tax Returns?

Using airSlate SignNow for your Quarterly Percentage Tax Return provides benefits such as reduced paperwork, faster processing times, and enhanced compliance. The platform simplifies the overall process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling sensitive Quarterly Percentage Tax Return documents?

Absolutely! airSlate SignNow employs top-notch security measures to protect your sensitive Quarterly Percentage Tax Return documents. This includes encryption and secure cloud storage, ensuring your data remains confidential and safe.

Get more for Quarterly Percentage Tax Return

- Statement of diligent effort form

- Form 70 001 17 1 1 000 rev 05 17

- Landscape design contract form

- Cvse0014 form

- Hoja de ayuda para pago en ventanilla bancaria form

- First american title forms california

- Horse training contract template fill online printable form

- Horse training contract template 442540741 form

Find out other Quarterly Percentage Tax Return

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document