F4868 Form

What is the F4868

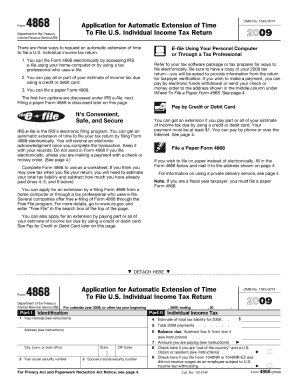

The F4868 form is an application for an automatic extension of time to file an individual income tax return in the United States. This form is typically used by taxpayers who need additional time to prepare their tax returns. By filing the F4868, individuals can extend their filing deadline by six months, allowing them to gather necessary documents and ensure accurate reporting of their income and deductions.

How to use the F4868

To use the F4868 form, taxpayers must complete it accurately and submit it to the Internal Revenue Service (IRS) by the original due date of their tax return. The form requires basic information such as the taxpayer's name, address, and Social Security number. Additionally, taxpayers must estimate their total tax liability and pay any amount due to avoid penalties and interest.

Steps to complete the F4868

Completing the F4868 form involves several straightforward steps:

- Obtain the F4868 form from the IRS website or a tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Estimate your total tax liability for the year.

- Indicate any payments made, if applicable.

- Sign and date the form.

- Submit the completed form electronically or by mail to the IRS.

Filing Deadlines / Important Dates

The deadline for submitting the F4868 form is typically the same as the due date for the individual income tax return, which is usually April 15. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to file the F4868 by this date to avoid late penalties.

Legal use of the F4868

The F4868 form is legally recognized as a valid request for an extension to file an individual income tax return. By submitting this form, taxpayers are granted an automatic extension, provided they meet the filing requirements. However, it is important to note that this extension does not apply to any tax payments due. Taxpayers are still responsible for paying any owed taxes by the original due date to avoid penalties.

Key elements of the F4868

Key elements of the F4868 form include:

- Taxpayer identification information: Name, address, and Social Security number.

- Estimated tax liability: A good faith estimate of the total tax owed for the year.

- Payment information: Any payments made towards the estimated tax liability.

- Signature: The taxpayer must sign and date the form to validate it.

Quick guide on how to complete f4868

Prepare F4868 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow supplies you with all the tools needed to create, alter, and eSign your documents swiftly without delays. Manage F4868 on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to edit and eSign F4868 without hassle

- Obtain F4868 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes no time and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign F4868 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f4868

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is f4868 and how does it relate to airSlate SignNow?

f4868 is a form used by individuals and businesses to apply for an extension on their tax returns. By integrating airSlate SignNow, you can easily eSign and send your f4868 form electronically, streamlining your tax extension process.

-

What features does airSlate SignNow offer for managing f4868 forms?

airSlate SignNow provides a user-friendly platform for sending and eSigning f4868 forms. Key features include easy document sharing, customizable templates, and secure cloud storage, ensuring your forms are managed efficiently.

-

How much does it cost to use airSlate SignNow for signing f4868 forms?

Pricing for airSlate SignNow varies depending on your plan, starting with a free trial that allows you to explore its features for signing f4868 forms. Paid plans offer additional features, making it a cost-effective solution for business document management.

-

Can I integrate airSlate SignNow with other software for f4868 form management?

Absolutely! airSlate SignNow integrates seamlessly with various productivity tools, enhancing your ability to manage f4868 forms alongside other documents. Popular integrations include Google Drive, Salesforce, and Zapier.

-

What are the benefits of using airSlate SignNow to eSign f4868 forms?

Using airSlate SignNow to eSign f4868 forms offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for your sensitive information. This efficient solution empowers users to complete tax tasks with ease.

-

How does airSlate SignNow ensure the security of my f4868 documents?

airSlate SignNow employs robust security measures, such as encryption and secure cloud storage, to protect your f4868 documents. Your data remains confidential while you sign and manage forms, ensuring peace of mind.

-

Is airSlate SignNow suitable for both individuals and businesses that need to handle f4868 forms?

Yes, airSlate SignNow is designed to cater to both individuals and businesses needing to handle f4868 forms effectively. Its flexible features adapt to various requirements, making it ideal for anyone needing to eSign documentation.

Get more for F4868

Find out other F4868

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract