Nevada Modified Business Tax Form PDF 2009

What is the Nevada Modified Business Tax Form PDF

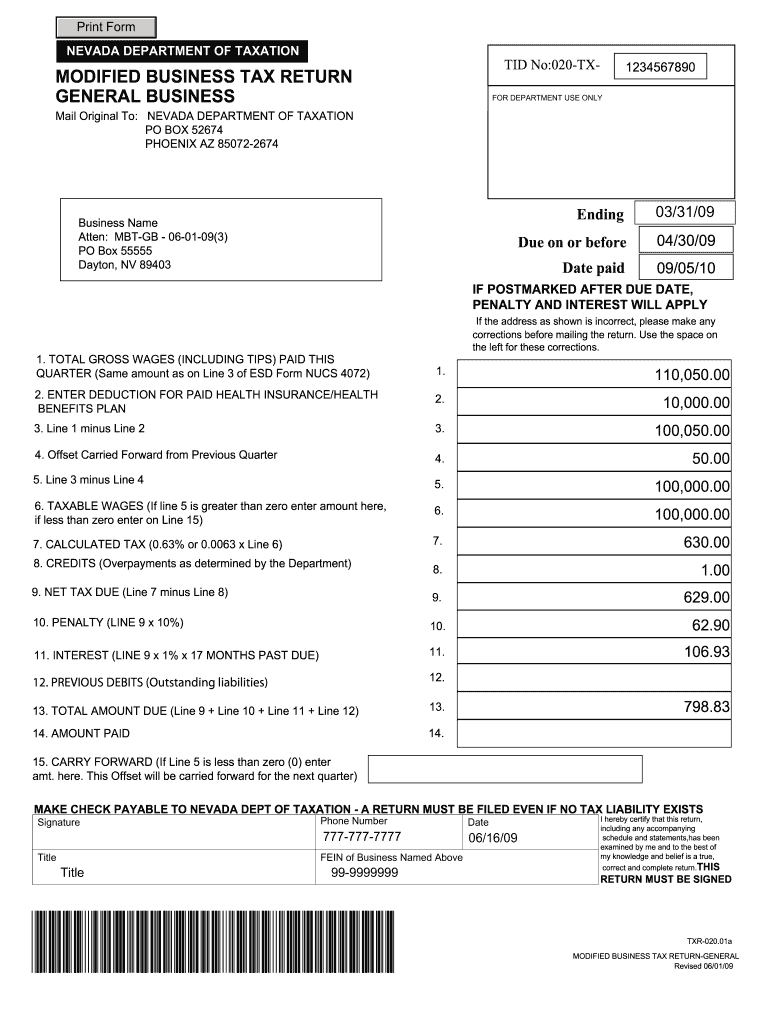

The Nevada Modified Business Tax (MBT) is a tax imposed on businesses operating within the state of Nevada. This tax is primarily based on the gross wages paid to employees, with certain deductions allowed. The Nevada Modified Business Tax Form PDF serves as the official document that businesses must complete and submit to report their tax obligations. It is essential for compliance with state tax laws and helps ensure that businesses fulfill their financial responsibilities accurately.

Steps to Complete the Nevada Modified Business Tax Form PDF

Completing the Nevada Modified Business Tax Form PDF involves several key steps:

- Gather necessary information, including total gross wages, deductions, and any applicable tax credits.

- Access the official Nevada MBT Form PDF from a reliable source.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy to avoid potential penalties.

- Submit the completed form by the designated deadline, either electronically or by mail.

Legal Use of the Nevada Modified Business Tax Form PDF

Using the Nevada Modified Business Tax Form PDF is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, businesses must adhere to the guidelines set forth by the Nevada Department of Taxation. This includes providing accurate information, meeting filing deadlines, and maintaining compliance with all applicable tax laws. Failure to comply can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Nevada Modified Business Tax is crucial for businesses to avoid penalties. The due date for filing the MBT typically falls on the last day of the month following the end of each quarter. For example, the first quarter's return is due on April 30, while the second quarter's return must be submitted by July 31. It is important to keep track of these dates to ensure timely submission.

Required Documents

When completing the Nevada Modified Business Tax Form PDF, certain documents may be required to support the information provided. These may include:

- Payroll records detailing gross wages paid to employees.

- Documentation of any deductions claimed, such as health insurance or retirement contributions.

- Previous tax returns for reference and accuracy.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Nevada Modified Business Tax Form PDF. The form can be submitted electronically through the Nevada Department of Taxation's online portal, which offers a convenient and efficient way to file. Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the state. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete nevada modified business tax return form

Effortlessly prepare Nevada Modified Business Tax Form Pdf on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nevada Modified Business Tax Form Pdf on any device with the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

How to edit and eSign Nevada Modified Business Tax Form Pdf with ease

- Obtain Nevada Modified Business Tax Form Pdf and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form: by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors requiring you to print new copies. airSlate SignNow manages all your document needs in just a few clicks from any device you prefer. Edit and eSign Nevada Modified Business Tax Form Pdf to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada modified business tax return form

FAQs

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How do I fill an income tax return with the 16A form in India?

The applicable Form for filing of your income tax return shall need to examine nature of your income.If you are receiving Form 16A only, then it means you are earning income other than salaries, and therefore possibly you shall need to file Income Tax Return in Form ITR 3 or ITR 4 (depends over the nature of income as already said in above para).You shall need to register your PAN on the website of income tax efiling, thereafter you shall need to link your PAN if you are a resident of India.After successful registration, you may file your income tax return through applicable form. Show your income as being appearing in Form 16A, your bank interest and any other income if you do have.For any assistance/queries related to taxation, you may contact me on pkush39@gmail.com

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the nevada modified business tax return form

How to make an electronic signature for your Nevada Modified Business Tax Return Form online

How to make an electronic signature for your Nevada Modified Business Tax Return Form in Google Chrome

How to create an eSignature for signing the Nevada Modified Business Tax Return Form in Gmail

How to generate an eSignature for the Nevada Modified Business Tax Return Form from your smartphone

How to create an electronic signature for the Nevada Modified Business Tax Return Form on iOS devices

How to make an eSignature for the Nevada Modified Business Tax Return Form on Android OS

People also ask

-

What is the Nevada Modified Business Tax Form Pdf and why is it important?

The Nevada Modified Business Tax Form Pdf is a crucial document for businesses operating in Nevada as it helps report and calculate business taxes owed to the state. It's essential for compliance with state tax regulations and avoiding penalties. Utilizing this form correctly can streamline your tax processes and ensure accuracy in your reporting.

-

How can I easily fill out the Nevada Modified Business Tax Form Pdf?

Filling out the Nevada Modified Business Tax Form Pdf is made simple with airSlate SignNow's user-friendly interface. You can easily upload the PDF, fill in the required fields, and save your progress. Our platform also allows you to eSign and share the completed form securely, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the Nevada Modified Business Tax Form Pdf?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, including options for individuals and larger teams. You can start with a free trial to explore our features, including the ability to manage the Nevada Modified Business Tax Form Pdf efficiently. Competitive pricing ensures that you receive great value for your investment.

-

What features does airSlate SignNow offer for managing the Nevada Modified Business Tax Form Pdf?

airSlate SignNow provides a range of features to enhance your experience with the Nevada Modified Business Tax Form Pdf, including document editing, eSigning capabilities, and cloud storage. Additionally, our platform allows for easy collaboration, enabling multiple users to work on the form simultaneously, which can save time and improve accuracy.

-

Can I integrate airSlate SignNow with my existing business software for the Nevada Modified Business Tax Form Pdf?

Yes, airSlate SignNow seamlessly integrates with various business applications, allowing you to manage the Nevada Modified Business Tax Form Pdf alongside your existing workflows. Popular integrations include popular accounting and CRM software, ensuring that you can streamline your processes without any disruptions. This interoperability enhances efficiency and data management.

-

What are the benefits of using airSlate SignNow for the Nevada Modified Business Tax Form Pdf?

Using airSlate SignNow for the Nevada Modified Business Tax Form Pdf offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. Our platform ensures that your tax forms are completed quickly and accurately, minimizing the risk of errors. Additionally, the eSigning feature allows for quick approvals, speeding up the entire process.

-

Is my data secure when using airSlate SignNow for the Nevada Modified Business Tax Form Pdf?

Absolutely! airSlate SignNow prioritizes the security of your data, especially when handling sensitive documents like the Nevada Modified Business Tax Form Pdf. We implement advanced encryption protocols and comply with industry standards to protect your information. You can trust that your data is safe while using our platform.

Get more for Nevada Modified Business Tax Form Pdf

- Request for medical center authorization form nyu langone

- Model 750rozd 4 aaron equipment company form

- Teacher of the week nomination form wltxcom

- Registration form for labels of imported products of bb nafiqad nafiqad gov

- Motion for continuance pike county courts form

- Harford county notices addendum betsher amp associates form

- Aoa diabetic form

- Government code 910 claim form schools insurance group

Find out other Nevada Modified Business Tax Form Pdf

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template