Visio Modified Business Tax FI13 Vsd TAX F003 MBT Return General Businesses 10 1 22 PDF 2022-2026

Understanding the Nevada Modified Business Tax

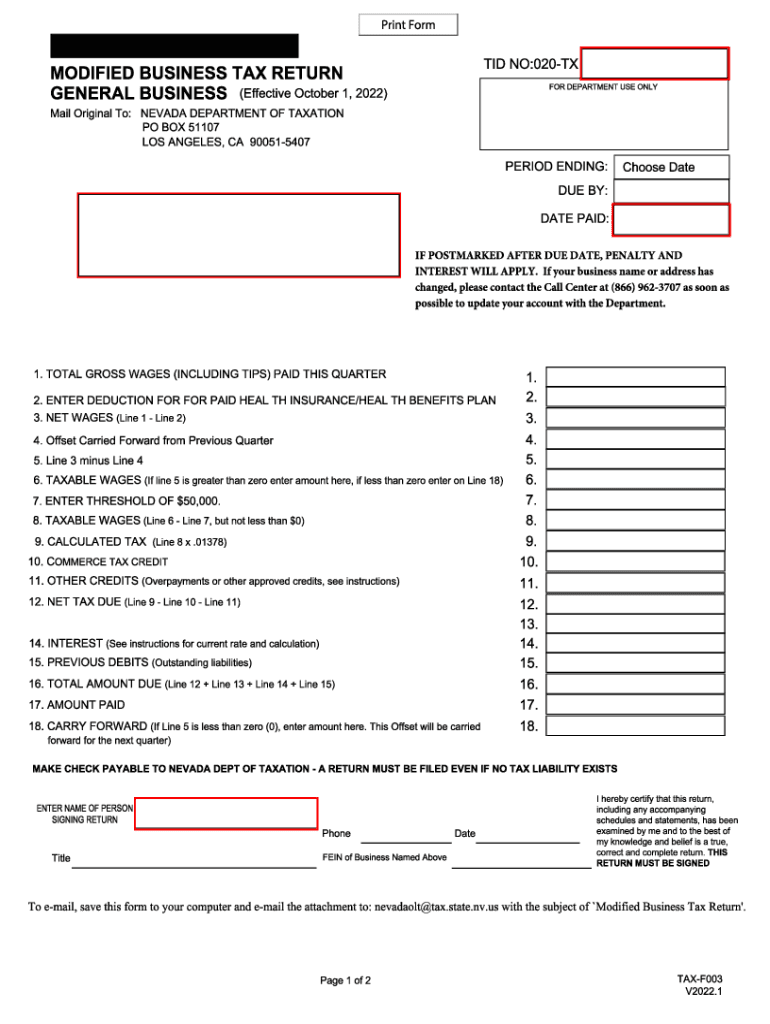

The Nevada Modified Business Tax (MBT) is a tax imposed on businesses operating within the state. It is calculated based on the gross wages paid to employees, minus certain deductions. This tax is particularly relevant for employers, as it helps fund various state services, including education and public safety. Understanding the specifics of this tax can ensure compliance and help businesses manage their financial obligations effectively.

Steps to Complete the Nevada Modified Business Tax Form

Filling out the Nevada Modified Business Tax form requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including payroll records and any applicable deductions.

- Access the Nevada Modified Business Tax form for the relevant tax year, such as the 2025 version.

- Fill in your business information, including the legal name, address, and employer identification number.

- Report total gross wages and calculate the tax based on the applicable rate.

- Apply any eligible deductions, such as health insurance contributions.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Nevada Modified Business Tax

Timely filing of the Nevada Modified Business Tax is crucial to avoid penalties. The tax is typically due quarterly, with specific deadlines for each quarter. Businesses should mark their calendars for these key dates to ensure compliance:

- First quarter: Due by the last day of April

- Second quarter: Due by the last day of July

- Third quarter: Due by the last day of October

- Fourth quarter: Due by the last day of January

Required Documents for Filing

When preparing to file the Nevada Modified Business Tax, certain documents are essential. These include:

- Payroll records for the reporting period

- Records of employee health insurance contributions

- Any previous tax returns related to the Modified Business Tax

- Employer identification number (EIN) documentation

Penalties for Non-Compliance

Failure to comply with the Nevada Modified Business Tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time

- Interest on unpaid taxes

- Potential audits by state tax authorities

Digital vs. Paper Version of the Nevada Modified Business Tax Form

Businesses have the option to file the Nevada Modified Business Tax form either digitally or via paper submission. The digital version offers several advantages:

- Faster processing times

- Reduced risk of errors

- Immediate confirmation of submission

Choosing the digital route can streamline the filing process and enhance overall efficiency.

Quick guide on how to complete visio modified business tax fi13 vsd tax f003 mbt return general businesses 10 1 22 pdf

Complete Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf with ease

- Find Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct visio modified business tax fi13 vsd tax f003 mbt return general businesses 10 1 22 pdf

Create this form in 5 minutes!

How to create an eSignature for the visio modified business tax fi13 vsd tax f003 mbt return general businesses 10 1 22 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is modified business tax in relation to airSlate SignNow?

Modified business tax is a tax that businesses may need to consider while managing their finances. With airSlate SignNow, you can effectively create, send, and sign documents, which includes managing your modified business tax obligations seamlessly. This ensures you are compliant while optimizing your operational efficiency.

-

How does airSlate SignNow help with modified business tax documentation?

airSlate SignNow simplifies the process of preparing your modified business tax documents. Our platform enables you to easily customize templates and gather electronic signatures, making document management straightforward. This can save you time and reduce errors associated with tax documentation.

-

What are the pricing options for airSlate SignNow if I need features related to modified business tax?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including features essential for handling modified business tax. You can choose from our basic to premium plans based on your organization's requirements. Each plan provides access to tools that streamline document creation and signature collection.

-

Can I integrate airSlate SignNow with accounting software for modified business tax purposes?

Yes, airSlate SignNow integrates seamlessly with popular accounting software. This integration ensures that you can align your document processes with your modified business tax calculations easily. Keeping your records accurate becomes more manageable with our combined functionalities.

-

What are the benefits of using airSlate SignNow for managing modified business tax documents?

Using airSlate SignNow for modified business tax documents enhances efficiency and accuracy in your tax management processes. The platform allows for quick document turnaround, reducing the time spent on paperwork. It also helps maintain compliance and improves workflow in your business operations.

-

Is airSlate SignNow suitable for businesses of all sizes when handling modified business tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small business or a large corporation, our solution provides the necessary tools to manage modified business tax documents effectively while keeping costs down.

-

How can airSlate SignNow improve my team's workflow related to modified business tax?

airSlate SignNow streamlines team collaboration when dealing with modified business tax documents. By allowing multiple users to access, review, and sign documents online, your team can work more efficiently together. This leads to faster processing times and improved accuracy.

Get more for Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf

- Cybershift nyc doe form

- Mardi gras float rider release of liability form

- Pet addendum to residentiallease pal form

- Editable passport pages form

- Power equipment delivery check list pre delivery inspection and final powerequipment honda form

- In response to your request enclosed is an application form hsmv 82040 for a florida certificate of title along with a

- New asia college resident registration form

- Resident registration form xlsx

Find out other Visio Modified Business Tax FI13 vsd TAX F003 MBT Return General Businesses 10 1 22 pdf

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document