CP 575 B Notice Hunterdon K 9 Center LLC Form

What is the CP 575 B Notice?

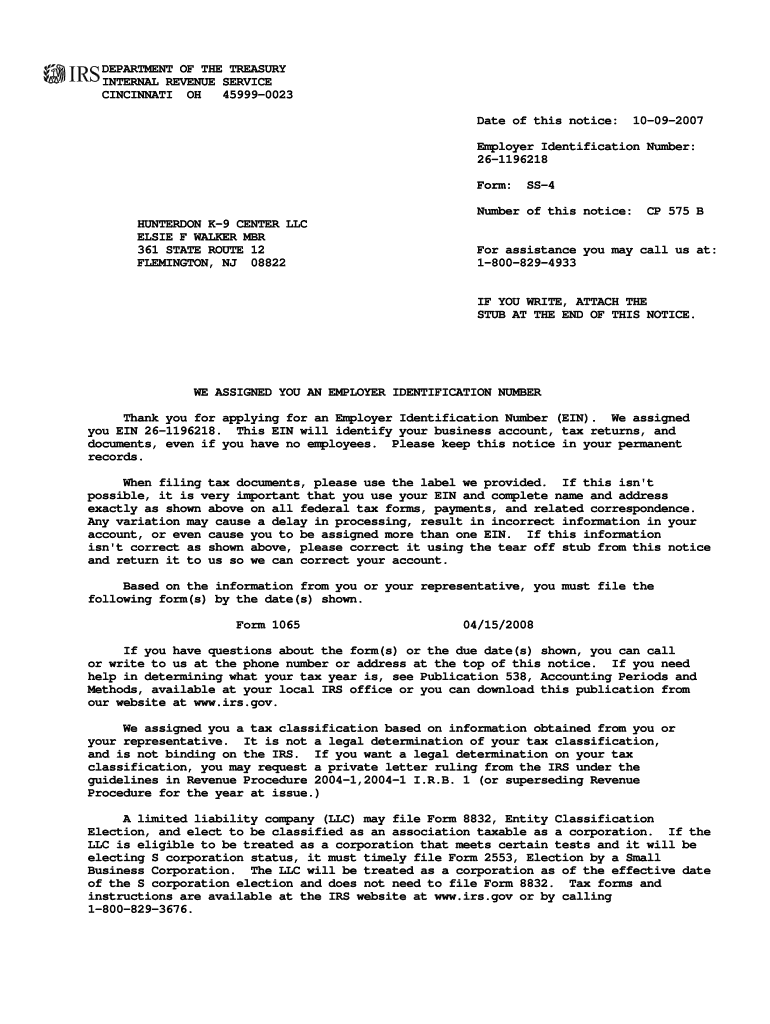

The CP 575 B Notice is an important document issued by the IRS, primarily used to inform taxpayers about their Employer Identification Number (EIN). This notice is typically sent to businesses and organizations after they have successfully applied for an EIN. It serves as official confirmation that the IRS has processed the application and assigned the EIN. Understanding the significance of this notice is crucial for compliance with federal tax regulations and for maintaining accurate records.

How to Obtain the CP 575 B Notice

To obtain the CP 575 B Notice, businesses must first apply for an Employer Identification Number through the IRS. This can be done online, by mail, or by fax. Once the application is processed, the IRS will send the CP 575 B Notice to the address provided in the application. If the notice is not received within a few weeks, it is advisable to contact the IRS directly to ensure that the application was processed correctly and to request a duplicate notice if necessary.

Steps to Complete the CP 575 B Notice

Completing the CP 575 B Notice involves several key steps. First, ensure that all information on the notice is accurate, including the EIN and the business name. If there are any discrepancies, it is important to contact the IRS to correct them. Second, keep the notice in a secure location, as it may be required for future tax filings or business transactions. Lastly, if the notice is needed for verification purposes, make copies to provide to banks or other entities that may require proof of the EIN.

Legal Use of the CP 575 B Notice

The CP 575 B Notice is legally significant as it serves as proof of the EIN, which is essential for various business activities, including opening bank accounts, filing tax returns, and applying for business licenses. It is important to understand that this notice is not just a formality; it carries legal weight in confirming the establishment of a business entity with the IRS. Businesses should ensure they retain this document for their records to comply with tax obligations and legal requirements.

Key Elements of the CP 575 B Notice

The CP 575 B Notice contains several key elements that are important for taxpayers to understand. These include the assigned Employer Identification Number, the name of the business or organization, and the date the EIN was issued. Additionally, the notice may include instructions for using the EIN and information on how to contact the IRS for further assistance. Familiarity with these elements can help ensure proper handling of the notice and compliance with IRS regulations.

IRS Guidelines for the CP 575 B Notice

The IRS provides specific guidelines regarding the use and retention of the CP 575 B Notice. Taxpayers are advised to keep this notice in a safe place, as it may be required for various tax-related activities. The IRS also recommends reviewing the notice for accuracy and reporting any errors promptly. Understanding these guidelines helps ensure that businesses remain compliant with federal tax laws and maintain accurate records.

Quick guide on how to complete cp 575 b notice hunterdon k 9 center llc

Complete CP 575 B Notice Hunterdon K 9 Center LLC seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely preserve it online. airSlate SignNow equips you with every tool needed to create, modify, and electronically sign your documents swiftly without any holdups. Handle CP 575 B Notice Hunterdon K 9 Center LLC on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign CP 575 B Notice Hunterdon K 9 Center LLC with ease

- Locate CP 575 B Notice Hunterdon K 9 Center LLC and click on Get Form to begin.

- Utilize the resources we provide to finalize your document.

- Emphasize signNow sections of your documents or conceal private details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate reprinting document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your desired device. Modify and electronically sign CP 575 B Notice Hunterdon K 9 Center LLC to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp 575 b notice hunterdon k 9 center llc

How to create an eSignature for the Cp 575 B Notice Hunterdon K 9 Center Llc online

How to generate an eSignature for the Cp 575 B Notice Hunterdon K 9 Center Llc in Chrome

How to generate an eSignature for signing the Cp 575 B Notice Hunterdon K 9 Center Llc in Gmail

How to make an eSignature for the Cp 575 B Notice Hunterdon K 9 Center Llc from your mobile device

How to create an electronic signature for the Cp 575 B Notice Hunterdon K 9 Center Llc on iOS

How to create an electronic signature for the Cp 575 B Notice Hunterdon K 9 Center Llc on Android OS

People also ask

-

What is the cp575 form and why is it important?

The cp575 form is a confirmation notice issued by the IRS that designates your entity's Employer Identification Number (EIN). It is essential for businesses to ensure they are operating under the correct EIN. Proper handling of the cp575 can help prevent tax-related issues and streamline your business operations.

-

How does airSlate SignNow simplify the eSigning of cp575 forms?

airSlate SignNow provides a straightforward platform for businesses to electronically sign cp575 forms securely and efficiently. With its intuitive interface, users can fill out and send documents for eSignature in moments, expediting the entire process compared to traditional methods.

-

Are there any costs associated with using airSlate SignNow for cp575 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The plans are designed to be cost-effective, ensuring that businesses can manage their cp575 documents without incurring excessive costs while benefiting from all the features provided.

-

What features does airSlate SignNow offer for managing cp575 forms?

airSlate SignNow provides features such as document templates, automated workflows, and unlimited eSigning for cp575 forms. These tools help streamline document management and improve organization, allowing businesses to focus on their core activities rather than paperwork.

-

Can I integrate airSlate SignNow with other software for managing cp575 forms?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications like Google Drive, Dropbox, and Microsoft Office. These integrations allow for a more cohesive workflow, making it easier to manage cp575 forms alongside other business documents.

-

Is airSlate SignNow compliant with legal requirements for cp575 signatures?

Yes, airSlate SignNow is compliant with major eSignature regulations, including ESIGN and UETA. This compliance ensures that your signed cp575 forms are legally binding, giving you peace of mind that your electronic documents hold up to legal scrutiny.

-

How can airSlate SignNow benefit my business in handling cp575 forms?

airSlate SignNow enhances efficiency and reduces the time spent on document management tasks such as cp575 forms. By utilizing our user-friendly platform, your team can quickly send, sign, and store documents, ultimately increasing productivity and supporting better business decisions.

Get more for CP 575 B Notice Hunterdon K 9 Center LLC

- Beauty salon budget spreadsheet form

- Ps form 2608

- Qualified written request sample form

- Shire cares form

- Air masses and fronts worksheet pdf form

- Surgery scheduling form template

- Uct 7937 election to exclude principal officers this form is used by employers to elect out of paying state unemployment tax on

- Uct 7937 form

Find out other CP 575 B Notice Hunterdon K 9 Center LLC

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free