California Tax Table Form

What is the California Tax Table

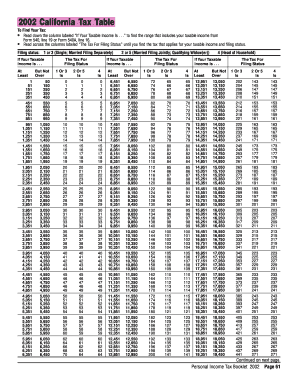

The California Tax Table is a crucial resource used by individuals and businesses to determine their state income tax obligations. It provides a structured format that outlines the tax rates applicable to various income brackets. This table is essential for accurate tax calculations and helps taxpayers understand how much they owe to the state based on their earnings. The California Tax Table is updated annually to reflect any changes in tax laws or rates, ensuring that taxpayers have the most current information available.

How to use the California Tax Table

Using the California Tax Table involves a straightforward process. First, taxpayers need to identify their taxable income for the year. Once the income is determined, they can locate the appropriate income bracket in the tax table. The table will indicate the tax rate that applies to that specific income level. Taxpayers can then calculate their total tax liability by applying the rate to their income. It's important to note that this process may vary slightly depending on filing status, such as single, married, or head of household.

Steps to complete the California Tax Table

Completing the California Tax Table requires a few key steps:

- Determine your total taxable income for the year.

- Identify your filing status (single, married, etc.).

- Refer to the California Tax Table to find your income bracket.

- Locate the corresponding tax rate for your income level.

- Calculate your total tax liability by applying the tax rate to your taxable income.

Following these steps ensures that taxpayers accurately report their income tax obligations to the state.

Legal use of the California Tax Table

The California Tax Table is legally recognized as a valid tool for calculating state income taxes. It is essential for compliance with California tax laws. Taxpayers must ensure that they use the most current version of the table, as using outdated information could lead to incorrect tax filings and potential penalties. The California Franchise Tax Board provides official guidance on the legal implications of using the tax table, reinforcing its importance in the tax preparation process.

Filing Deadlines / Important Dates

Filing deadlines for the California Tax Table typically align with federal tax deadlines. Taxpayers should be aware of the following key dates:

- April 15: Standard deadline for filing individual income tax returns.

- October 15: Extended deadline for those who file for an extension.

- Various deadlines for estimated tax payments throughout the year.

Staying informed about these dates is crucial to avoid penalties and ensure timely compliance with tax obligations.

Who Issues the Form

The California Tax Table is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's income tax laws and providing taxpayers with the necessary resources to comply with state tax requirements. The tax table is made available on their official website and is included in the tax forms provided to taxpayers each year.

Quick guide on how to complete california tax table

Complete California Tax Table effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage California Tax Table on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and electronically sign California Tax Table without hassle

- Obtain California Tax Table and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and electronically sign California Tax Table and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california tax table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Tax Table and how does it apply to my business?

The California Tax Table is a comprehensive guide that outlines the various tax rates applicable to businesses operating in California. Understanding this table is crucial for accurate tax calculations and compliance. By utilizing the California Tax Table, you can ensure your business adheres to state regulations while optimizing your tax obligations.

-

How can airSlate SignNow help me manage my documents related to the California Tax Table?

airSlate SignNow provides an intuitive platform for sending and signing documents that pertain to the California Tax Table. This solution allows you to quickly prepare, send, and store essential documents securely. With airSlate SignNow, document management becomes seamless, especially when dealing with tax-related paperwork.

-

Is airSlate SignNow compliant with California tax regulations?

Yes, airSlate SignNow is designed to facilitate compliance with California tax regulations, including those related to the California Tax Table. Our eSignature solution ensures that your signed documents meet legal standards, making it easier to manage tax documentation in accordance with state laws.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you are a small business or a larger enterprise, you can choose a plan that suits your budget while maximizing your efficiency in handling tax documents associated with the California Tax Table.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow easily integrates with a variety of accounting software, enhancing your workflow for managing tax documents related to the California Tax Table. This integration streamlines processes, allowing for efficient data transfer and better organization of your tax records.

-

What features of airSlate SignNow can help with my tax documentation?

airSlate SignNow offers several features such as customizable templates, secure eSignatures, and document sharing capabilities that are invaluable for tax documentation. These features ensure that your documents are prepared accurately and efficiently according to the California Tax Table requirements.

-

How does airSlate SignNow improve document security for tax-related documents?

Security is a top priority at airSlate SignNow. Our platform utilizes encryption and authentication measures to safeguard your tax-related documents, which are essential when dealing with sensitive information dictated by the California Tax Table. You can rest assured that your documents are protected from unauthorized access.

Get more for California Tax Table

- Deponent verbs latin worksheet form

- Pdffiller huntington university physical form

- Pbgcg92f 101612 form

- Probable cause affidavit indiana form

- Individual marker survey form

- Floyd county government services form

- Fillable online srlsys bookmark contest bformbpdf satilla

- Transcript of esthetician apprentice training it is form

Find out other California Tax Table

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document