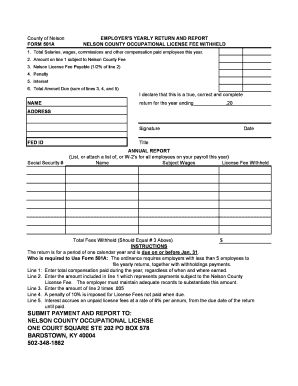

Nelson County Occupational Tax Form

What is the Nelson County Occupational Tax

The Nelson County Occupational Tax is a local tax imposed on individuals and businesses operating within Nelson County, Kentucky. This tax is typically assessed based on the income earned from employment or business activities within the county. The primary purpose of this tax is to generate revenue for local government services, such as public safety, infrastructure, and community development. Understanding the specifics of this tax is essential for residents and business owners to ensure compliance and proper financial planning.

Steps to complete the Nelson County Occupational Tax

Completing the Nelson County Occupational Tax form involves several key steps to ensure accurate submission. Here’s a straightforward guide:

- Gather necessary documentation, including proof of income and any relevant business records.

- Obtain the Nelson County Occupational Tax form, typically available from the county's tax office or website.

- Fill out the form with accurate information, including personal details, income sources, and any deductions applicable.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the form by the designated deadline, either online, via mail, or in person, as per the county's submission guidelines.

Required Documents

When completing the Nelson County Occupational Tax form, certain documents are essential for accurate reporting. These may include:

- W-2 forms from employers for wage earners.

- 1099 forms for independent contractors or self-employed individuals.

- Business income statements for those operating a business.

- Proof of any deductions or credits claimed.

Having these documents ready can streamline the filing process and ensure compliance with local tax regulations.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for avoiding penalties associated with the Nelson County Occupational Tax. Typically, the tax year aligns with the calendar year, and forms are due by April fifteenth of the following year. It is advisable to check for any updates or changes to these deadlines annually, as local regulations may vary.

Penalties for Non-Compliance

Failing to comply with the Nelson County Occupational Tax regulations can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action for severe non-compliance, including liens on property.

Understanding these penalties emphasizes the importance of timely and accurate tax filings.

Legal use of the Nelson County Occupational Tax

The Nelson County Occupational Tax is legally binding and must be adhered to by all individuals and businesses operating within the county. Compliance with local tax laws ensures that residents contribute to community services and infrastructure. It is important to stay informed about any changes in tax legislation that may affect obligations, as well as to utilize reliable tools for electronic filing and documentation.

Quick guide on how to complete nelson county occupational tax 38822869

Finish Nelson County Occupational Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides all the resources you require to create, adjust, and eSign your files swiftly without interruptions. Manage Nelson County Occupational Tax across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The most efficient way to edit and eSign Nelson County Occupational Tax effortlessly

- Obtain Nelson County Occupational Tax and then click Get Form to commence.

- Utilize our tools to submit your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Nelson County Occupational Tax and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nelson county occupational tax 38822869

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nelson county ky occupational tax and how does it affect businesses?

The nelson county ky occupational tax is a tax levied on individuals and businesses operating within Nelson County, Kentucky. This tax directly affects your business by requiring proper filing and payment to avoid penalties. Understanding its implications can help you maintain compliance and optimize your financial strategy.

-

How can airSlate SignNow assist with managing nelson county ky occupational tax documentation?

airSlate SignNow streamlines the process of managing nelson county ky occupational tax documents by providing a user-friendly platform for eSigning and document management. Our solution allows for efficient tracking and organization of your tax-related paperwork, ensuring you meet all compliance deadlines promptly.

-

What are the pricing options for using airSlate SignNow for nelson county ky occupational tax filings?

airSlate SignNow offers competitive pricing plans tailored to varying business needs, ensuring that handling your nelson county ky occupational tax filings is cost-effective. By choosing our service, you can enhance productivity without overextending your budget, all while ensuring accurate and timely tax submissions.

-

Can airSlate SignNow integrate with accounting software for tracking nelson county ky occupational tax?

Yes, airSlate SignNow can seamlessly integrate with popular accounting software, making it easier to track the nelson county ky occupational tax. This integration allows you to manage tax filings within your existing workflow, ensuring all financial records are accurate and readily accessible for audits or reviews.

-

How does airSlate SignNow ensure compliance with the nelson county ky occupational tax regulations?

airSlate SignNow ensures compliance with nelson county ky occupational tax regulations by offering automated reminders and template documents designed to meet local requirements. Our platform helps you avoid common pitfalls associated with tax filings, allowing you to focus on running your business with peace of mind.

-

What benefits does eSigning provide for nelson county ky occupational tax documents?

eSigning provides signNow benefits for nelson county ky occupational tax documents, including faster processing times and reduced paperwork. With airSlate SignNow, you can complete tax documents electronically, minimizing delays and enhancing overall efficiency in your tax compliance process.

-

Is it easy to onboard and use airSlate SignNow for nelson county ky occupational tax needs?

Absolutely! airSlate SignNow is designed for ease of use, and onboarding is quick and intuitive for managing nelson county ky occupational tax needs. Our user-friendly interface helps you get started without a steep learning curve, allowing you to focus on your business operations right away.

Get more for Nelson County Occupational Tax

- Dmap 3119 enrollment attachment for chemical dependency providers apps state or form

- Muscular system tour lab skeletal muscle wasd form

- Leanne mcdougall sales director 923 n scenic dr yakima form

- Csep recertification application international special events society form

- Common interest community resale disclosure steve lehmeyer form

- Mvr27ppa 1115 application for a new special license plate category name of organization name of contact person address of form

- Volunteer background check form frenship isd

- Ftb pub 2016 form

Find out other Nelson County Occupational Tax

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure