Distributions from a Vanguard IRA Form

What is the distributions from a Vanguard IRA?

The distributions from a Vanguard IRA refer to the withdrawals made from an Individual Retirement Account (IRA) managed by Vanguard. These distributions can occur after reaching a certain age, typically 59 and a half, or under specific circumstances such as financial hardship. It is essential to understand the tax implications and regulations governing these distributions to avoid penalties and ensure compliance with IRS guidelines.

Steps to complete the distributions from a Vanguard IRA

Completing the distributions from a Vanguard IRA involves several key steps:

- Determine your eligibility for withdrawal based on your age or specific circumstances.

- Gather necessary documentation, including identification and any relevant account information.

- Access the Vanguard RMD form, which is required for required minimum distributions.

- Fill out the form accurately, ensuring that all required fields are completed.

- Submit the completed form online, by mail, or in person, depending on your preference.

Legal use of the distributions from a Vanguard IRA

To ensure the legal use of distributions from a Vanguard IRA, it is crucial to adhere to IRS regulations. Distributions must be taken according to the required minimum distribution (RMD) rules, which mandate that account holders begin taking withdrawals by age seventy-two. Failure to comply with these rules can result in significant penalties, including a hefty tax on the amount that should have been withdrawn.

IRS guidelines for distributions from a Vanguard IRA

The IRS outlines specific guidelines for distributions from IRAs, including tax treatment and withdrawal rules. Key points include:

- Withdrawals made before age fifty-nine and a half may incur a ten percent early withdrawal penalty.

- Required minimum distributions must begin by age seventy-two, with specific calculations to determine the amount.

- Taxation on distributions varies based on the type of IRA (traditional vs. Roth) and the account holder's tax bracket.

Eligibility criteria for distributions from a Vanguard IRA

Eligibility for distributions from a Vanguard IRA generally depends on the account holder's age and specific life circumstances. The primary criteria include:

- Account holders must be at least fifty-nine and a half years old to take penalty-free withdrawals.

- Individuals may withdraw funds in cases of financial hardship, disability, or other qualifying events.

- Required minimum distributions apply to traditional IRAs starting at age seventy-two, regardless of whether the account holder is still working.

Who issues the Vanguard RMD form?

The Vanguard RMD form is issued by Vanguard, the financial services company that manages the IRA accounts. This form is specifically designed to facilitate the process of taking required minimum distributions and ensures that account holders comply with IRS regulations. It is crucial to use the correct form to avoid delays or complications in processing withdrawals.

Quick guide on how to complete distributions from a vanguard ira

Effortlessly Prepare Distributions From A Vanguard IRA on Any Device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any lag. Handle Distributions From A Vanguard IRA on any system with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Distributions From A Vanguard IRA with Ease

- Locate Distributions From A Vanguard IRA and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Distributions From A Vanguard IRA while ensuring seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the distributions from a vanguard ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

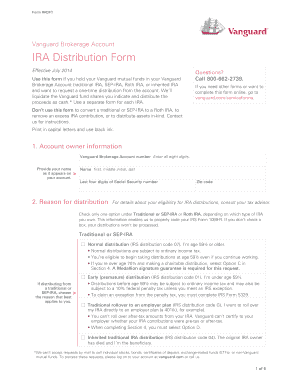

What is a Vanguard IRA distribution form?

A Vanguard IRA distribution form is a document required to withdraw funds from a Vanguard Individual Retirement Account (IRA). This form ensures that the distribution is processed correctly and complies with IRS regulations. By filling out the Vanguard IRA distribution form, you can specify how much you want to withdraw and choose your preferred method of payment.

-

How do I complete the Vanguard IRA distribution form?

To complete the Vanguard IRA distribution form, you will need your personal information, account details, and the amount you wish to withdraw. The form can be filled out online or downloaded from the Vanguard website. After completion, submit the form online or via mail to process your distribution accurately.

-

Are there any fees associated with the Vanguard IRA distribution form?

Generally, there are no fees directly associated with submitting the Vanguard IRA distribution form; however, taxes may apply to the withdrawal. It’s important to consult with a tax advisor to understand any potential tax implications. Additionally, ensure that you are aware of your investment account’s terms regarding withdrawals.

-

What are the benefits of using the Vanguard IRA distribution form with airSlate SignNow?

Using the Vanguard IRA distribution form with airSlate SignNow allows for seamless and secure electronic signatures and document management. This integration streamlines the process of submitting forms, saving time and reducing paperwork. Furthermore, you’ll have access to features such as tracking and reminders, making your experience more efficient.

-

Can I send the Vanguard IRA distribution form electronically?

Yes, you can send the Vanguard IRA distribution form electronically when using airSlate SignNow. The platform enables you to upload the completed form and send it for eSignature. This option not only speeds up the submission process but also ensures that your documents are securely stored and easily accessible.

-

What information is needed on the Vanguard IRA distribution form?

The Vanguard IRA distribution form requires personal details such as your name, address, and Social Security number, as well as information about your brokerage account. You will also need to specify the type of distribution you want and identify the amount to be withdrawn. Ensuring accurate information helps expedite the processing of your request.

-

How long does it take to process the Vanguard IRA distribution form?

Processing times for the Vanguard IRA distribution form can vary, typically ranging from 5 to 10 business days after submission. The speed of processing may depend on the method of submission and the accuracy of the information provided. To avoid delays, ensure all information is correctly filled out and consult with Vanguard’s customer service for updates.

Get more for Distributions From A Vanguard IRA

Find out other Distributions From A Vanguard IRA

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo