Nys 100a Fillable Form

What is the NYS 100A Fillable Form

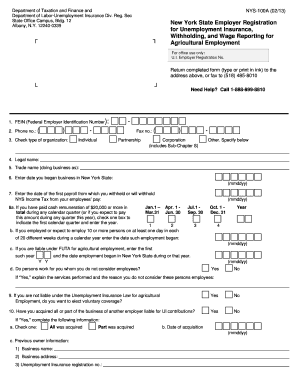

The NYS 100A fillable form is a tax document used by individuals in New York State to report their income and calculate their tax liability. This form is specifically designed for those who are not required to file a full tax return but still need to report certain income. It is essential for ensuring compliance with state tax regulations and for accurately determining any tax owed or refund due.

How to Use the NYS 100A Fillable Form

Using the NYS 100A fillable form involves several steps. First, gather all necessary information, including income details, deductions, and any credits you may be eligible for. Next, access the fillable form online, ensuring you have a compatible PDF reader. Enter your information carefully, following the prompts provided on the form. Once completed, review your entries for accuracy before submitting.

Steps to Complete the NYS 100A Fillable Form

Completing the NYS 100A fillable form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your income sources, such as wages or self-employment earnings. After entering your income, apply any deductions you qualify for, such as standard deductions or credits. Finally, calculate your total tax liability and determine whether you owe money or are due a refund. Double-check all entries before saving or submitting the form.

Legal Use of the NYS 100A Fillable Form

The NYS 100A fillable form is legally recognized for tax reporting in New York State. To ensure its legal validity, it must be completed accurately and submitted within the designated filing deadlines. Using a secure platform for electronic submission can enhance the form's legal standing, as it helps maintain compliance with electronic signature laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the NYS 100A fillable form typically align with the federal tax filing schedule. Generally, taxpayers must submit their forms by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to avoid penalties.

Form Submission Methods

The NYS 100A fillable form can be submitted through various methods. Taxpayers have the option to file online using approved e-filing services, which are often faster and more secure. Alternatively, the form can be printed and mailed to the appropriate tax authority. In-person submissions may also be possible at designated tax offices, providing another avenue for ensuring timely filing.

Quick guide on how to complete nys 100a fillable form

Complete Nys 100a Fillable Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a superior environmentally friendly substitute to traditional printed and signed documents, enabling you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents rapidly without any holdups. Manage Nys 100a Fillable Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to modify and electronically sign Nys 100a Fillable Form with ease

- Obtain Nys 100a Fillable Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact confidential information using tools specially provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and is legally equivalent to a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Nys 100a Fillable Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys 100a fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys 100a fillable form and why do I need it?

The nys 100a fillable form is a tax form used in New York State for personal income tax filings. It simplifies the process of reporting income and calculating your taxes owed. By using the nys 100a fillable form, you can ensure accurate submissions, potentially avoiding penalties or delays.

-

How can airSlate SignNow help me with my nys 100a fillable form?

airSlate SignNow allows you to easily upload, complete, and eSign your nys 100a fillable form online. With its user-friendly interface, you can fill out the form efficiently, ensuring all necessary fields are completed correctly. This streamlines the process, making tax season less stressful.

-

Is airSlate SignNow cost-effective for filing the nys 100a fillable form?

Yes, airSlate SignNow provides a cost-effective solution for managing your nys 100a fillable form. Our competitive pricing plans cater to both individuals and businesses, ensuring you have access to essential features without breaking the bank. You get great value with digital forms and e-signature capabilities.

-

What features does airSlate SignNow offer for the nys 100a fillable form?

airSlate SignNow offers several features for the nys 100a fillable form, including easy document uploads, customizable templates, and secure e-signatures. Our platform also includes tracking options to monitor the status of your form submissions. These features help you manage your tax documentation more efficiently.

-

Can I integrate airSlate SignNow with other software for the nys 100a fillable form?

Yes, airSlate SignNow supports integrations with various software solutions, making it easy to incorporate the nys 100a fillable form into your existing workflows. You can connect with popular accounting and tax software to streamline your filing process further. This flexibility enhances productivity and organization.

-

Is it secure to use airSlate SignNow for the nys 100a fillable form?

Absolutely! airSlate SignNow prioritizes security to ensure your nys 100a fillable form is protected. We utilize advanced encryption methods and comply with industry standards to safeguard your information. You can file your taxes confidently, knowing your data is secure.

-

Can I access the nys 100a fillable form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and complete your nys 100a fillable form on smartphones and tablets. Whether you're at home or on the go, you can fill out your form and add your signature easily. This flexibility means you can manage your tax filings anytime, anywhere.

Get more for Nys 100a Fillable Form

- Neodent guarantee questionnaire tracking number instradent form

- Partial bwaiverb and affidavit servicemaster dcs form

- Pesticide application record ornamental and turf agency form

- Lic 447 42a form

- Nh brokerage disclosure form

- Food handler certification application form thehealthline ca

- Form 6700

- Music producer contract template form

Find out other Nys 100a Fillable Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors