N 15 Rev NonResident and Part Year Resident Income Tax Return Forms CD Fillable

What is the N-15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable

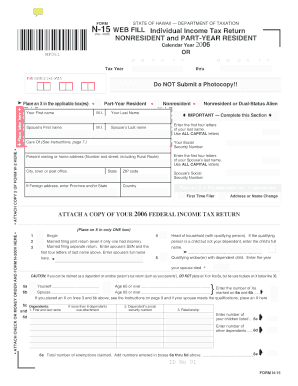

The N-15 Rev NonResident and Part Year Resident Income Tax Return Forms CD Fillable is a tax document used by individuals who are non-residents or part-year residents of the state. This form allows taxpayers to report their income earned within the state during the tax year. It is specifically designed for those who do not meet the criteria for full residency and need to accurately report their income to comply with state tax regulations.

How to use the N-15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable

Using the N-15 Rev form requires careful attention to detail. Taxpayers should start by downloading the fillable form from a reliable source. Once downloaded, users can fill in their personal information, including name, address, and Social Security number. It is essential to report all income earned in the state accurately. After completing the form, taxpayers can eSign it using a trusted electronic signature solution, ensuring the document is legally binding.

Steps to complete the N-15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable

Completing the N-15 Rev form involves several straightforward steps:

- Download the N-15 Rev form from an official source.

- Open the fillable PDF and enter your personal information.

- List all sources of income earned in the state during the tax year.

- Calculate any deductions or credits applicable to your situation.

- Review the completed form for accuracy.

- eSign the document using a secure electronic signature platform.

- Submit the form as per the filing instructions provided.

Legal use of the N-15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable

The N-15 Rev form is legally recognized when filled out correctly and submitted in accordance with state tax laws. To ensure its legal validity, taxpayers must adhere to the requirements set forth by the state’s tax authority, including proper signatures and submission methods. Using a reliable eSigning solution can enhance the legal standing of the document by providing an electronic certificate and ensuring compliance with relevant eSignature laws.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the N-15 Rev form to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check the state’s tax authority website for specific dates and any extensions that may apply.

Required Documents

To complete the N-15 Rev form, certain documents are necessary. Taxpayers should gather:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions or credits claimed.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete n 15 rev nonresident and part year resident income tax return forms cd fillable

Easily Prepare N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable Effortlessly

- Find N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in a few clicks from any device you prefer. Modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 15 rev nonresident and part year resident income tax return forms cd fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable?

N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable are specialized tax forms designed for individuals who are non-residents or part-year residents. These forms enable users to report income and claim appropriate deductions efficiently. With our service, you can easily fill them out, ensuring compliance and accuracy.

-

How can I access the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable?

You can access the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable through the airSlate SignNow platform. Our easy-to-use interface allows you to download and complete the forms seamlessly. You can start the process right from our landing page.

-

What features do the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable offer?

The N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable come with numerous features including electronic signature capabilities and the ability to save your progress. These features streamline your tax preparation process and enhance your experience. Moreover, our platform ensures your data is securely stored and easily accessible.

-

Are there any costs associated with using the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable?

Using the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable on airSlate SignNow is cost-effective. We offer various pricing plans to suit individual needs, and you can choose a package that best fits your requirements. Check our pricing page for details on available options.

-

What are the benefits of using airSlate SignNow for my N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable?

Using airSlate SignNow for your N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable allows for faster processing and increased accuracy. Our platform simplifies the entire signing and submission process, reducing the chances of errors. Additionally, our user-friendly interface makes it accessible for everyone.

-

Can I integrate the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable with other software?

Yes, airSlate SignNow offers integration capabilities with various software applications. You can seamlessly connect the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable with your preferred tools to enhance your workflow. This ensures that you can manage all your document processes in one place.

-

Is it easy to fill out the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable?

Filling out the N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable is straightforward with airSlate SignNow. Our platform provides step-by-step guidance to help you complete each section with ease. There's no need to worry about missing information, as our system prompts you for necessary details.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable

- Organ donor registry enrollment form

- Ic9 form

- Bupa skin form

- Grammar dictation past simple statements form

- Personalized ampamp specialty platessouth dakota department of form

- Penndot form mv 552a cloudfront net

- Employment applicationpart 1 preinterviewform s1

- Www taxformfinder orgarizonaform az 140varizona form az 140v arizona individual income tax payment

Find out other N 15 Rev NonResident And Part Year Resident Income Tax Return Forms CD Fillable

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy