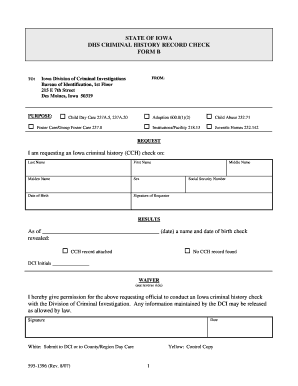

Form 595 1396

What is the Form

The Form is a specific document used primarily for tax-related purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the relevant authorities. Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and avoiding potential penalties. The form is designed to collect essential data that may affect tax liabilities or eligibility for various tax benefits.

How to use the Form

Using the Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents and information required to fill out the form. This may include income statements, expense reports, and identification details. Next, carefully complete each section of the form, ensuring that all information is correct and up to date. Once completed, review the form for any errors before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the document securely.

Steps to complete the Form

Completing the Form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather required documents, including income statements and identification.

- Access the form through the official source or a trusted digital platform.

- Fill out personal information, including name, address, and Social Security number.

- Provide detailed financial information as requested on the form.

- Review all entries for accuracy and completeness.

- Sign the form electronically or manually, depending on the submission method.

- Submit the completed form to the appropriate tax authority by the designated deadline.

Legal use of the Form

The legal validity of the Form hinges on compliance with applicable regulations. For the form to be considered legally binding, it must be filled out accurately and submitted within the required timeframe. Additionally, utilizing a reliable eSignature solution ensures that the form meets the necessary legal standards, such as those outlined in the ESIGN Act and UETA. This compliance is essential for the acceptance of the form by tax authorities and for protecting the rights of the filer.

Key elements of the Form

Understanding the key elements of the Form is vital for accurate completion. The form typically includes:

- Personal identification information, such as name and address.

- Financial data relevant to the reporting period.

- Signature section to validate the information provided.

- Instructions for submission and deadlines.

Each of these elements plays a crucial role in ensuring that the form serves its intended purpose effectively.

Form Submission Methods

The Form can be submitted through various methods, depending on the requirements set by the tax authority. Common submission methods include:

- Online submission via a secure digital platform, which allows for immediate processing.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can impact the processing time and confirmation of receipt.

Quick guide on how to complete form 595 1396

Complete Form 595 1396 seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 595 1396 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Form 595 1396 effortlessly

- Obtain Form 595 1396 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 595 1396 and ensure excellent communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 595 1396

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 595 1396 and how does it work?

Form 595 1396 is a crucial document used in various business transactions. airSlate SignNow simplifies the process of filling out and signing this form electronically, ensuring a seamless experience. With our platform, you can easily manage, send, and eSign Form 595 1396 without any hassle.

-

Is airSlate SignNow a cost-effective solution for managing Form 595 1396?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage Form 595 1396. Our competitive pricing plans cater to various business sizes, ensuring you have access to powerful eSigning features without overspending. Save time and money by digitizing your document workflow with Form 595 1396.

-

What features does airSlate SignNow provide for Form 595 1396?

airSlate SignNow provides several features to enhance the management of Form 595 1396. These include customizable templates, automated workflows, real-time tracking, and secure storage. Users can tailor the document to their specific needs while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other applications for Form 595 1396?

Yes, airSlate SignNow offers integrations with various applications to streamline the process of handling Form 595 1396. This allows you to connect your existing tools, such as CRM software and cloud storage solutions, enhancing productivity. Easily sync your documents and minimize manual entry errors.

-

What are the benefits of using airSlate SignNow for Form 595 1396?

Using airSlate SignNow for Form 595 1396 offers numerous benefits, including increased efficiency and reduced turnaround time. Our platform allows for real-time collaboration, enabling multiple stakeholders to interact with the document seamlessly. Additionally, the electronic signature feature provides added legality and security over paper-based methods.

-

Is it easy to learn how to use airSlate SignNow for Form 595 1396?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to learn how to manage Form 595 1396. Our intuitive interface and helpful resources, including tutorials and customer support, ensure that you'll be able to navigate the platform effortlessly.

-

What security measures does airSlate SignNow implement for Form 595 1396?

airSlate SignNow takes security seriously, especially when it comes to sensitive documents like Form 595 1396. We implement industry-standard encryption, two-factor authentication, and secure cloud storage to protect your data. Rest assured that your information is safe from unauthorized access.

Get more for Form 595 1396

Find out other Form 595 1396

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement