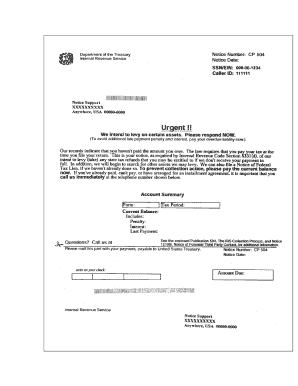

Notice Cp504 Form

What is the Notice Cp504

The Notice Cp504 is an official communication from the Internal Revenue Service (IRS) that informs taxpayers about a tax balance due. It serves as a reminder that the IRS has not received payment for taxes owed and outlines the potential consequences of failing to address the outstanding balance. This notice is typically sent after previous attempts to collect the debt have been made, making it crucial for taxpayers to understand its implications.

How to use the Notice Cp504

To effectively use the Notice Cp504, taxpayers should first review the details provided in the notice, including the amount owed and any deadlines for payment. It is important to determine whether the balance is accurate. If there are discrepancies, taxpayers should gather supporting documentation and contact the IRS for clarification. If the amount is correct, taxpayers can either pay the balance in full or explore payment plan options available through the IRS.

Steps to complete the Notice Cp504

Completing the Notice Cp504 involves several key steps:

- Review the notice for accuracy, including the amount owed and the due date.

- Gather any necessary financial documents that support your case or payment capability.

- Decide whether to pay the balance in full or set up a payment plan.

- If opting for a payment plan, complete the required IRS forms and submit them according to the instructions provided.

- Keep a copy of the notice and any correspondence with the IRS for your records.

Legal use of the Notice Cp504

The Notice Cp504 is legally binding and signifies the IRS's intent to collect the owed taxes. Taxpayers must take this notice seriously, as failure to respond can result in further action, including liens or levies on personal property. It is essential to understand the legal implications of the notice and to comply with IRS regulations to avoid additional penalties.

Key elements of the Notice Cp504

Key elements of the Notice Cp504 include:

- The taxpayer's name and address.

- The tax period for which the balance is owed.

- The total amount due, including any penalties or interest.

- Payment options and deadlines.

- Contact information for the IRS if the taxpayer has questions or disputes the amount owed.

Examples of using the Notice Cp504

Examples of using the Notice Cp504 can vary based on individual circumstances. For instance, a self-employed individual receiving this notice may need to assess their estimated tax payments and determine if they have underpaid. A retired taxpayer might need to review their income sources and decide how to allocate funds for payment. Each scenario requires careful consideration of financial resources and potential payment arrangements with the IRS.

Quick guide on how to complete notice cp504

Effortlessly Prepare Notice Cp504 on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to obtain the correct document and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Notice Cp504 on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to modify and electronically sign Notice Cp504 seamlessly

- Obtain Notice Cp504 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all information thoroughly and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, or link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form retrieval, or mistakes that necessitate reprinting document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you select. Edit and electronically sign Notice Cp504 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice cp504

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CP504 notice and why is it important?

A CP504 notice is a document issued by the IRS to notify taxpayers about an unpaid tax balance. Receiving a CP504 notice is crucial as it signifies the potential for aggressive collection actions, including liens or levies. Understanding its implications can help you take timely action to prevent more severe consequences.

-

How can airSlate SignNow help with handling CP504 notices?

airSlate SignNow allows you to manage your CP504 notices electronically by providing an easy way to sign and send responses or required documents. This streamlined process saves time and ensures that your documents signNow the IRS promptly, helping you address any issues related to your notice efficiently.

-

Are there costs associated with using airSlate SignNow for CP504 notice management?

Yes, while airSlate SignNow offers competitive pricing, there is a nominal fee for its services based on your selected plan. However, the cost can be offset by the savings you achieve through the efficient handling of your CP504 notice, preventing potential penalties and interest.

-

What features does airSlate SignNow offer for managing tax documents like the CP504 notice?

airSlate SignNow provides features such as secure e-signatures, document templates, and real-time tracking. These tools make it easier to create, send, and sign tax-related documents, including responses to your CP504 notice, ensuring compliance and clarity.

-

Can I integrate airSlate SignNow with other platforms for CP504 notice management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as CRM systems, cloud storage, and email platforms. This integration capability allows you to manage your CP504 notice and related documents within your existing workflows for enhanced productivity.

-

How does airSlate SignNow ensure the security of documents related to my CP504 notice?

airSlate SignNow takes security seriously, employing end-to-end encryption and compliance with data protection standards. This means that your documents, including those in response to a CP504 notice, are safeguarded, ensuring confidentiality and integrity throughout the signing process.

-

What benefits can I expect from using airSlate SignNow for my CP504 notice?

Using airSlate SignNow for your CP504 notice offers various benefits, such as improved efficiency through digital document management and e-signatures. Additionally, it reduces the risk of lost mail, speeding up response times to the IRS, and minimizing potential penalties.

Get more for Notice Cp504

Find out other Notice Cp504

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage