Ifta Form 85a 2012

What is the Ifta Form 85a

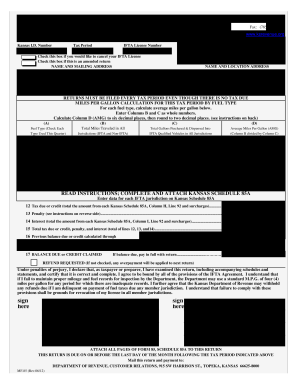

The Ifta Form 85a is a crucial document used by motor carriers to report and pay fuel taxes across multiple jurisdictions. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting process for fuel taxes for carriers operating in more than one state or province. The form serves as a means for carriers to report their fuel consumption and miles traveled in each jurisdiction, ensuring compliance with tax obligations while facilitating smoother interstate commerce.

How to use the Ifta Form 85a

To effectively use the Ifta Form 85a, carriers must first gather all necessary data regarding their fuel purchases and mileage. This includes tracking fuel consumption in each state and the corresponding miles driven. Once the data is compiled, the form can be filled out accurately, detailing the fuel usage and miles for each jurisdiction. After completing the form, it should be submitted to the appropriate state agency for processing. This ensures that the carrier meets its tax obligations and remains compliant with IFTA regulations.

Steps to complete the Ifta Form 85a

Completing the Ifta Form 85a involves several key steps:

- Gather all relevant information, including fuel purchase receipts and mileage logs for each jurisdiction.

- Fill out the form by entering the total miles traveled and fuel consumed in each state.

- Calculate the total fuel tax owed based on the rates applicable in each jurisdiction.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the form to the appropriate state agency by the specified deadline.

Legal use of the Ifta Form 85a

The Ifta Form 85a is legally binding when completed and submitted according to the regulations set forth by IFTA. To ensure its legal standing, the form must be filled out accurately, reflecting true and complete information regarding fuel usage and mileage. Electronic submissions are permissible, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that digital signatures are recognized as legally valid.

Filing Deadlines / Important Dates

Filing deadlines for the Ifta Form 85a are typically quarterly. Carriers must submit their completed forms by the last day of the month following the end of each quarter. Important dates to remember include:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31

Penalties for Non-Compliance

Non-compliance with IFTA regulations, including failure to file the Ifta Form 85a on time, can result in significant penalties. These may include fines, interest on unpaid taxes, and potential suspension of operating authority in certain jurisdictions. It is essential for carriers to adhere to filing deadlines and ensure the accuracy of the information reported to avoid these consequences.

Quick guide on how to complete ifta form 85a

Complete Ifta Form 85a effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Ifta Form 85a on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered tasks today.

How to adjust and eSign Ifta Form 85a with ease

- Locate Ifta Form 85a and click Get Form to begin.

- Utilize the tools we supply to complete your document.

- Highlight important sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors necessitating the printing of new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Ifta Form 85a while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta form 85a

Create this form in 5 minutes!

How to create an eSignature for the ifta form 85a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ifta Form 85a and why is it important?

The Ifta Form 85a is a crucial document used by transportation companies for reporting fuel use across multiple jurisdictions. It helps ensure compliance with the International Fuel Tax Agreement (IFTA). By accurately submitting this form, businesses can avoid penalties and streamline their tax obligations.

-

How can airSlate SignNow assist with the Ifta Form 85a?

airSlate SignNow simplifies the process of filling out and eSigning the Ifta Form 85a. With our user-friendly platform, you can quickly upload, edit, and send the form for signature, ensuring that your submissions are handled efficiently and securely.

-

What features does airSlate SignNow offer for managing the Ifta Form 85a?

Our platform offers several features for managing the Ifta Form 85a, including templates, cloud storage, and real-time tracking of document status. Additionally, electronic signatures provide a legally binding way to finalize your forms without the hassle of printing and scanning.

-

Is airSlate SignNow cost-effective for managing the Ifta Form 85a?

Yes, airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. By using our platform to manage the Ifta Form 85a, you can save time and resources while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for managing the Ifta Form 85a?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage documents related to the Ifta Form 85a. Our integrations help streamline your workflow and enhance your overall productivity for tax reporting.

-

What are the benefits of using airSlate SignNow for the Ifta Form 85a?

Using airSlate SignNow for the Ifta Form 85a enhances efficiency by allowing digital document management and eSigning. This helps businesses maintain compliance, reduces processing time, and minimizes the risk of errors associated with manual submissions.

-

How secure is airSlate SignNow when handling the Ifta Form 85a?

airSlate SignNow prioritizes the security of your documents, including the Ifta Form 85a. Our platform uses advanced encryption protocols and secure servers to protect sensitive information, ensuring that your tax documents remain confidential and safe.

Get more for Ifta Form 85a

Find out other Ifta Form 85a

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation