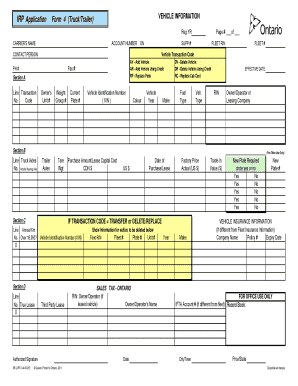

Irp Form 4

What is the IRP Form 4

The IRP Form 4 is a specific document used for reporting and documenting information related to certain tax obligations in the United States. This form is essential for individuals and businesses that need to comply with state and federal tax regulations. It typically includes details about income, deductions, and other relevant financial information that must be accurately reported to the tax authorities.

How to Use the IRP Form 4

Using the IRP Form 4 involves several steps to ensure that all required information is accurately filled out. Start by gathering all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all figures are correct and that you have included any required attachments. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to Complete the IRP Form 4

Completing the IRP Form 4 requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill in the personal information section, including your name, address, and Social Security number.

- Complete the income section, listing all sources of income accurately.

- Detail any deductions you are claiming, ensuring you have documentation to support each claim.

- Review the form for any errors or omissions before finalizing it.

- Submit the form according to the guidelines provided, whether online, by mail, or in person.

Legal Use of the IRP Form 4

The IRP Form 4 must be used in compliance with applicable tax laws and regulations. It serves as a legal declaration of your financial status for the reporting period. Failure to use the form correctly can result in penalties or legal consequences. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to audits or other legal issues.

Required Documents

When completing the IRP Form 4, certain documents are required to support the information you report. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous tax returns for reference

- Any additional documentation required by state laws

Form Submission Methods

The IRP Form 4 can be submitted through various methods, depending on the specific requirements of your state or the IRS. Common submission methods include:

- Online submission through the appropriate tax authority's website

- Mailing a physical copy to the designated address

- In-person submission at local tax offices or designated locations

Penalties for Non-Compliance

Failure to comply with the requirements associated with the IRP Form 4 can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to understand the deadlines for submission and ensure that the form is completed accurately to avoid these consequences.

Quick guide on how to complete irp form 4

Prepare Irp Form 4 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Manage Irp Form 4 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Irp Form 4 with ease

- Obtain Irp Form 4 and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Irp Form 4 and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irp form 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRP Form 4 and why is it important?

The IRP Form 4 is a crucial document used for registering vehicles in certain jurisdictions. It ensures compliance with state regulations and facilitates the legal operation of vehicles across different states. Understanding how to fill out the IRP Form 4 correctly is essential for maintaining compliance and avoiding penalties.

-

How does airSlate SignNow help with the IRP Form 4 process?

airSlate SignNow streamlines the process of completing the IRP Form 4 by providing an intuitive e-signature platform. Users can easily fill out and sign the form electronically, allowing for faster submission and approval. This enhances efficiency and saves time compared to traditional paper methods.

-

What are the pricing options for using airSlate SignNow for the IRP Form 4?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring the IRP Form 4. Prices vary based on features and the number of users, ensuring that businesses can choose a plan that fits their budget. A free trial is also available for prospective customers to explore the platform.

-

Does airSlate SignNow integrate with other applications for handling the IRP Form 4?

Yes, airSlate SignNow seamlessly integrates with various applications that can enhance your workflow when handling the IRP Form 4. Popular integrations include CRM systems and document management tools that help manage vehicle registrations efficiently. This interconnectedness maximizes productivity for your team.

-

What security features does airSlate SignNow offer for the IRP Form 4?

AirSlate SignNow prioritizes the security of documents like the IRP Form 4 with advanced encryption and authentication protocols. This ensures that sensitive information remains secure and protected against unauthorized access. Users can trust that their data is safeguarded throughout the signing process.

-

Can I track the status of my IRP Form 4 submissions in airSlate SignNow?

Absolutely! airSlate SignNow provides an easy-to-use tracking feature that allows you to monitor the status of IRP Form 4 submissions in real-time. You can receive notifications when your documents are viewed and signed, providing peace of mind and keeping your registration process on track.

-

Is it easy to customize the IRP Form 4 with airSlate SignNow?

Yes, customizing the IRP Form 4 in airSlate SignNow is straightforward. The platform offers various tools to add text fields, checkboxes, and electronic signatures, making it easy to tailor the form to your specific needs. This flexibility ensures that all required information is captured efficiently.

Get more for Irp Form 4

- Referral order form pathways hospice pathways care

- Limited liability company articles mn form

- Employees statement of nonresidence in pennsylvania form

- Bs7671 model forms

- Buyer representation agreement form 300

- Mo form 53 c 5893359

- Form cc 1682 master 10 12

- Medication administration competency checklist form

Find out other Irp Form 4

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed