Pastor Compensation Worksheet Form

What is the Pastor Compensation Worksheet

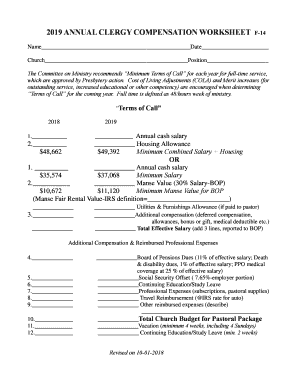

The Pastor Compensation Worksheet is a vital document designed to help churches and religious organizations outline and calculate the compensation packages for their pastors. This worksheet typically includes various components such as salary, housing allowances, benefits, and other forms of compensation. It serves as a comprehensive tool to ensure that all aspects of a pastor's remuneration are considered and documented. By using this worksheet, organizations can maintain transparency and fairness in their compensation practices, aligning them with IRS guidelines and ensuring compliance with tax regulations.

How to use the Pastor Compensation Worksheet

Using the Pastor Compensation Worksheet involves several straightforward steps. First, gather all relevant financial information regarding the pastor's compensation, including salary, benefits, and any additional allowances. Next, input this data into the worksheet, ensuring that each section is filled out accurately. It's essential to review the worksheet for completeness and correctness before finalizing it. Once completed, the worksheet can serve as a reference for both the organization and the pastor, providing clarity on the compensation structure and helping to prevent misunderstandings.

Steps to complete the Pastor Compensation Worksheet

Completing the Pastor Compensation Worksheet requires a methodical approach. Begin by collecting necessary documentation, such as previous compensation agreements, tax guidelines, and church budgets. Follow these steps:

- Enter the pastor's base salary in the designated section.

- Include any housing allowances or benefits, such as health insurance or retirement contributions.

- Calculate total compensation by summing all components, ensuring accuracy.

- Review the completed worksheet for compliance with IRS regulations.

- Obtain necessary signatures for approval and record-keeping.

Legal use of the Pastor Compensation Worksheet

The Pastor Compensation Worksheet must be utilized in accordance with applicable laws and IRS guidelines. It is crucial to ensure that all compensation elements are reported correctly to avoid potential legal issues. The worksheet serves as a formal record that can be referenced during audits or tax filings. By adhering to legal requirements, churches can protect themselves from penalties associated with misreporting or non-compliance with tax regulations.

Key elements of the Pastor Compensation Worksheet

Several key elements should be included in the Pastor Compensation Worksheet to ensure comprehensive documentation. These elements typically encompass:

- Base Salary: The foundational salary agreed upon for the pastor's services.

- Housing Allowance: Any funds designated for housing expenses, which may have specific tax implications.

- Benefits: Health insurance, retirement contributions, and other perks that form part of the overall compensation.

- Additional Allowances: Any other financial support provided, such as travel or education reimbursements.

IRS Guidelines

Understanding IRS guidelines is essential when preparing the Pastor Compensation Worksheet. The IRS has specific rules regarding the taxation of clergy compensation, including housing allowances and self-employment taxes. It is important to familiarize yourself with these regulations to ensure compliance and avoid potential penalties. The IRS provides resources and publications that detail how different components of pastor compensation should be treated for tax purposes, making it easier for organizations to navigate their obligations.

Quick guide on how to complete pastor compensation worksheet

Complete Pastor Compensation Worksheet effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Pastor Compensation Worksheet on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Pastor Compensation Worksheet effortlessly

- Obtain Pastor Compensation Worksheet and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for those purposes.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to preserve your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Pastor Compensation Worksheet and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pastor compensation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pastor compensation worksheet?

A pastor compensation worksheet is a valuable tool designed to help churches and religious organizations determine fair and competitive salaries for their pastors. By utilizing a pastor compensation worksheet, you can easily assess various compensation components such as salary, benefits, and housing allowances to ensure you are meeting IRS guidelines and providing adequate support.

-

How can the pastor compensation worksheet benefit my church?

Using a pastor compensation worksheet can signNowly benefit your church by providing a clear structure for determining compensation. It helps ensure transparency and fairness in salary discussions, aligns compensation with the industry standards, and aids in budget planning and resource allocation.

-

Is the pastor compensation worksheet customizable?

Yes, the pastor compensation worksheet is highly customizable to fit the specific needs of your church. You can modify various parameters such as salary ranges, benefits options, and additional compensation factors based on your church's unique requirements and budget constraints.

-

What features does airSlate SignNow provide for using the pastor compensation worksheet?

airSlate SignNow offers excellent features that enhance the usability of the pastor compensation worksheet, such as eSigning capabilities, secure document storage, and easy editing options. These features streamline the process from drafting to finalizing the worksheet, making it efficient and user-friendly.

-

Can I integrate the pastor compensation worksheet with other software?

Absolutely! airSlate SignNow allows for seamless integration with various tools and software commonly used by churches. This means you can incorporate data from your accounting software or HR systems directly into your pastor compensation worksheet, enhancing accuracy and saving time.

-

What types of compensation can I analyze with the pastor compensation worksheet?

The pastor compensation worksheet allows you to analyze various types of compensation, including base salary, housing allowances, retirement benefits, and health insurance coverage. This comprehensive approach ensures that all aspects of compensation are considered, leading to informed decision-making.

-

Is the pastor compensation worksheet suitable for small churches?

Yes, the pastor compensation worksheet is perfectly suitable for small churches. It is designed to be flexible and user-friendly, accommodating varying church sizes and budgets, ensuring that every congregation can effectively manage and evaluate their pastor's compensation fairly.

Get more for Pastor Compensation Worksheet

Find out other Pastor Compensation Worksheet

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure