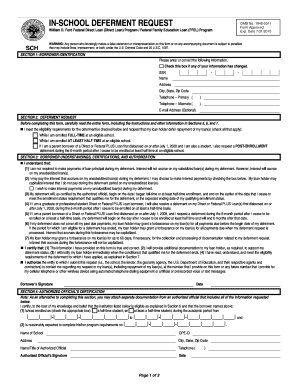

SECTION 1 BORROWER IDENTIFICATION Please Enter or Correct the Following Information

Understanding the SECTION 1 BORROWER IDENTIFICATION

The SECTION 1 BORROWER IDENTIFICATION is a crucial component of various financial documents, particularly in loan applications. This section requires borrowers to provide specific personal information, including their full name, address, Social Security number, and other identifying details. Ensuring accuracy in this section is vital, as it helps lenders verify the identity of the borrower and assess their creditworthiness. The information collected is also used to comply with federal regulations aimed at preventing fraud and ensuring responsible lending practices.

Steps to Complete the SECTION 1 BORROWER IDENTIFICATION

Completing the SECTION 1 BORROWER IDENTIFICATION involves several straightforward steps. Begin by gathering all necessary personal information, including your legal name as it appears on official documents, current residential address, and Social Security number. It is important to double-check this information for accuracy before entering it into the form. Once you have verified the details, enter them into the designated fields. After completing the section, review all entries to ensure there are no typos or omissions, as these can lead to delays in processing your application.

Legal Use of the SECTION 1 BORROWER IDENTIFICATION

The SECTION 1 BORROWER IDENTIFICATION is legally binding when completed correctly. It serves as a formal declaration of the borrower's identity and is often required by lenders to comply with regulations such as the USA PATRIOT Act. This act mandates that financial institutions verify the identity of individuals seeking loans to prevent money laundering and terrorist financing. Therefore, providing accurate information in this section is not only important for the approval process but also for legal compliance.

Key Elements of the SECTION 1 BORROWER IDENTIFICATION

Key elements of the SECTION 1 BORROWER IDENTIFICATION include the borrower's full name, residential address, Social Security number, and date of birth. Each of these components plays a significant role in verifying the identity of the borrower. Additionally, some forms may require information regarding employment status and income, which further assists lenders in assessing the borrower's financial situation. Ensuring that all information is current and accurate is essential for a smooth application process.

Who Issues the SECTION 1 BORROWER IDENTIFICATION

The SECTION 1 BORROWER IDENTIFICATION is typically included in forms issued by financial institutions, including banks and credit unions, as part of their loan application processes. These forms may vary depending on the type of loan being applied for, such as mortgages, personal loans, or auto loans. Each institution may have its own specific requirements for the information collected, but the fundamental purpose remains the same: to identify and verify the borrower.

Examples of Using the SECTION 1 BORROWER IDENTIFICATION

Examples of using the SECTION 1 BORROWER IDENTIFICATION can be seen in various loan applications. For instance, when applying for a mortgage, the borrower must complete this section to provide the lender with essential information for credit checks and risk assessments. Similarly, when seeking a personal loan, this section helps lenders ascertain the borrower's identity and financial stability. In each case, accurate completion of this section is crucial for the approval process.

Quick guide on how to complete section 1 borrower identification please enter or correct the following information

Complete SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed papers, as you can acquire the correct format and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information with ease

- Locate SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section 1 borrower identification please enter or correct the following information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SECTION 1 BORROWER IDENTIFICATION and why is it important?

SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information is a crucial step in our eSigning process. It ensures that all necessary borrower details are accurately captured, which helps in streamlining document verification and approval. Accurate information can prevent delays in transaction completion.

-

How does airSlate SignNow handle SECTION 1 BORROWER IDENTIFICATION?

With airSlate SignNow, the SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information section is user-friendly, allowing borrowers to input or correct their details easily. Our platform is designed to guide users through this step, ensuring all relevant information is accurately collected for each transaction.

-

Is there a cost associated with using the SECTION 1 BORROWER IDENTIFICATION feature?

Yes, while airSlate SignNow offers a cost-effective solution, pricing may vary based on the features you choose, including the SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information capability. We recommend exploring our pricing plans to find the best option for your needs.

-

Are there any special features related to SECTION 1 BORROWER IDENTIFICATION?

Absolutely! Our platform includes features specifically for SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information, such as customizable fields and automated validation checks. This helps ensure that all the information submitted adheres to necessary guidelines, enhancing accuracy and efficiency.

-

Can SECTION 1 BORROWER IDENTIFICATION data be integrated with other systems?

Yes, airSlate SignNow allows for seamless integration with a variety of third-party applications. The data collected during SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information can be integrated into your existing CRM systems or other business applications to create a unified data flow.

-

What benefits does SECTION 1 BORROWER IDENTIFICATION provide to businesses?

SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information enables businesses to gather essential data accurately from the start of a transaction. This prevents errors later in the process and enhances overall efficiency, helping to close deals faster and improve customer satisfaction.

-

What if I make a mistake in SECTION 1 BORROWER IDENTIFICATION?

If you notice an error in the SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information, you can easily correct it directly within the airSlate SignNow interface. Our platform allows for quick edits to ensure that all information is accurate before final submission.

Get more for SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information

- Optimist international foundation dime a day form pdf

- Doh 4287 06 08 form

- Michigan department of licensing and regulatory affairs corporations form

- Optional products and services disclosure form

- Bank form 125554

- Navajo nation rural addressing form

- You are being asked to provide upward feedback on your immediate supervisors job performance during the period indicated

- Encroachment permit application pdf clark county nevada clarkcountynv form

Find out other SECTION 1 BORROWER IDENTIFICATION Please Enter Or Correct The Following Information

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer