Amended 540x Form

What is the Amended 540x Form

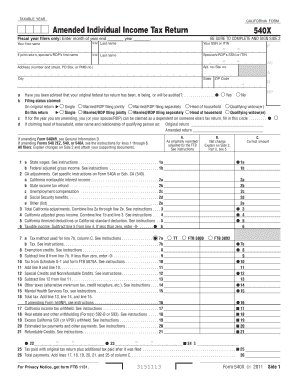

The Amended 540x Form is a tax document used by individuals in the United States to amend their California state income tax returns. It allows taxpayers to correct errors or make changes to their previously filed tax returns, such as adjusting income, deductions, or credits. This form is essential for ensuring that taxpayers accurately report their financial information and comply with state tax regulations.

How to use the Amended 540x Form

Using the Amended 540x Form involves several steps to ensure that all necessary information is accurately reported. First, obtain the form from the California Franchise Tax Board's website or through authorized tax preparation services. Next, clearly indicate the changes being made by filling out the relevant sections of the form. It is important to provide detailed explanations for each amendment to avoid confusion or delays in processing. After completing the form, review it thoroughly for accuracy before submission.

Steps to complete the Amended 540x Form

Completing the Amended 540x Form requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including your original tax return and any supporting documents for the changes.

- Fill out your personal information at the top of the form, ensuring it matches your original return.

- Indicate the tax year you are amending and provide a clear explanation of the changes in the designated section.

- Adjust the figures in the appropriate sections, ensuring that the new amounts are accurately calculated.

- Sign and date the form to validate your submission.

Legal use of the Amended 540x Form

The Amended 540x Form is legally recognized for making corrections to previously filed tax returns. To ensure its legal validity, it must be filled out completely and submitted within the specified time frame set by the California Franchise Tax Board. Compliance with state laws regarding amendments is crucial, as failure to do so may result in penalties or further scrutiny of your tax filings.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Amended 540x Form. Generally, taxpayers have up to four years from the original filing date to submit an amendment. For specific tax years, check the California Franchise Tax Board’s guidelines to ensure timely submission. Missing the deadline may result in the inability to claim refunds or make necessary corrections.

Required Documents

When completing the Amended 540x Form, certain documents are necessary to support your amendments. These may include:

- Your original tax return for the year being amended.

- Any additional forms or schedules that were part of your original submission.

- Documentation supporting the changes, such as W-2s, 1099s, or receipts for deductions.

Form Submission Methods (Online / Mail / In-Person)

The Amended 540x Form can be submitted through various methods. Taxpayers can file the form online through the California Franchise Tax Board's e-file system, which provides a convenient and efficient option. Alternatively, the form can be mailed to the appropriate address listed on the form instructions. In-person submissions are also possible at designated tax offices, although this option may vary by location.

Quick guide on how to complete amended 540x form

Effortlessly prepare Amended 540x Form on any device

Digital document management has become popular among organizations and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Amended 540x Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Amended 540x Form with ease

- Obtain Amended 540x Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Amended 540x Form to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended 540x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Amended 540x Form?

The Amended 540x Form is used to correct or change information on a previously filed California personal income tax return. It's essential for taxpayers who need to ensure their returns are accurate and compliant. By utilizing this form, individuals can achieve the correct financial reporting and potentially adjust their tax obligations.

-

How can airSlate SignNow help with the Amended 540x Form?

airSlate SignNow streamlines the process of filling out and eSigning the Amended 540x Form. Our platform provides an intuitive interface that allows users to complete necessary tax documents efficiently. With legal eSignatures, you can ensure that your amended forms are processed quickly and securely.

-

Are there any costs associated with using the Amended 540x Form through airSlate SignNow?

The pricing for using airSlate SignNow is designed to be cost-effective, making it accessible for all types of businesses. You can choose from various subscription plans that can accommodate your needs. Each plan includes features that facilitate the seamless processing of your Amended 540x Form.

-

What features does airSlate SignNow offer for managing the Amended 540x Form?

airSlate SignNow offers a range of features tailored for the Amended 540x Form, including eSigning, templates, and document tracking. Our platform enables easy collaboration between signers and provides notifications when documents are viewed or signed. This ensures a smooth workflow for handling your tax amendments.

-

Is airSlate SignNow secure for handling sensitive documents like the Amended 540x Form?

Yes, security is a top priority for airSlate SignNow. We utilize advanced encryption technologies and compliant data handling practices to protect sensitive information associated with the Amended 540x Form. You can trust that your confidential documents remain secure throughout the entire signing process.

-

Can I integrate airSlate SignNow with other software for my Amended 540x Form needs?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and document management software. This allows you to easily import and export your Amended 540x Form data, making your workflow more efficient and organized.

-

How does airSlate SignNow enhance the experience of submitting the Amended 540x Form?

By leveraging airSlate SignNow, users can enhance their experience with the Amended 540x Form through a user-friendly interface and expedited signature processes. This results in quicker submissions and reduced frustration. Our easy-to-use platform ensures that your forms are submitted properly the first time.

Get more for Amended 540x Form

- Verbal employment reference check form kansas adjutant kansastag

- Hw052 22520270 form

- Getting paid math answer key form

- Mississippi quitclaim deed forms

- California gun permit application pdf form

- Town of tusten building department form

- Bond and or permit fee waiver form state of indiana state in

- Application for mechanical permit bondurant iowa form

Find out other Amended 540x Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors