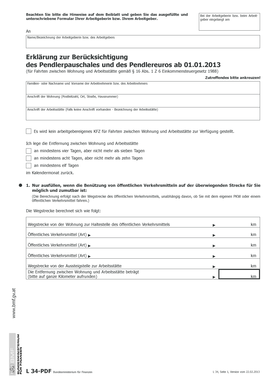

L34 Formular

What is the L34 Formular

The L34 Formular is a specific document used primarily for tax purposes in the United States. It serves as a declaration for individuals who are self-employed or have income from multiple sources. This form helps taxpayers report their earnings accurately and ensures compliance with federal tax regulations. Understanding the L34 Formular is essential for anyone who needs to file taxes correctly, as it outlines the necessary information required by the IRS.

How to use the L34 Formular

Using the L34 Formular involves several steps to ensure accurate completion. First, gather all relevant financial documents, including income statements and expense receipts. Next, fill out the form with your personal information, including your Social Security number and income details. Be sure to include any deductions or credits you may qualify for. Finally, review the completed form for accuracy before submitting it to the IRS. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the L34 Formular

Completing the L34 Formular requires a systematic approach:

- Gather all necessary documentation, such as W-2s, 1099s, and expense records.

- Fill out your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any additional income streams.

- Calculate any deductions or credits applicable to your situation.

- Review the form for errors or omissions before finalizing it.

- Submit the completed form electronically or via mail, following the IRS guidelines.

Legal use of the L34 Formular

The L34 Formular is legally binding when filled out and submitted according to IRS regulations. It is crucial to ensure that all information provided is accurate, as discrepancies can lead to penalties or audits. The form must be signed, either electronically or physically, to confirm its authenticity. Utilizing a trusted eSignature platform can enhance the legal standing of your submission, ensuring compliance with eSignature laws such as ESIGN and UETA.

Required Documents

To complete the L34 Formular, several documents are essential:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses related to your income.

- Previous year's tax return for reference.

- Any additional documentation that supports your income claims.

Form Submission Methods

The L34 Formular can be submitted through various methods, providing flexibility for taxpayers:

- Online: Submit electronically through the IRS e-file system or trusted eSignature platforms.

- Mail: Send the completed form to the appropriate IRS address based on your location.

- In-Person: Visit a local IRS office for assistance and submission.

Quick guide on how to complete l34 formular

Effortlessly Assemble L34 Formular on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage L34 Formular on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Revise and eSign L34 Formular with Ease

- Locate L34 Formular and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from a device of your choice. Revise and eSign L34 Formular and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the l34 formular

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the l34 formular 2024 and how can it benefit my business?

The l34 formular 2024 is an essential document for businesses looking to streamline their compliance processes. By using airSlate SignNow, you can easily fill out, eSign, and manage the l34 formular 2024, which saves time and reduces errors. This tool not only simplifies your workflows but also enhances overall productivity.

-

How much does it cost to use airSlate SignNow for the l34 formular 2024?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Whether you're a small business or a large corporation, you can choose a plan that best suits your needs while easily handling the l34 formular 2024. Sign up today to explore free trials and special discounts.

-

Can I integrate airSlate SignNow with other applications for managing the l34 formular 2024?

Yes, airSlate SignNow integrates seamlessly with various applications, enabling you to manage the l34 formular 2024 alongside your other business tools. This integration ensures a smooth workflow by connecting your CRM, cloud storage, and other essential software. Streamlining operations has never been easier.

-

What features does airSlate SignNow offer for the l34 formular 2024?

airSlate SignNow comes loaded with features that enhance the management of the l34 formular 2024. Key features include templates, eSigning, automated reminders, and tracking capabilities. These tools ensure that your documents are always up to date and legally binding.

-

Is there any support available for users handling the l34 formular 2024?

Absolutely! airSlate SignNow offers comprehensive support for users dealing with the l34 formular 2024. Our dedicated customer support team is available through chat, email, and phone, ensuring you have the assistance you need at every step of your eSigning journey.

-

How secure is my information when using airSlate SignNow for the l34 formular 2024?

Security is a top priority for airSlate SignNow. When managing the l34 formular 2024, your data is protected using industry-leading encryption and secure servers. We ensure that all your documents remain confidential and accessible only to authorized users.

-

Can airSlate SignNow help me keep track of the l34 formular 2024 approval process?

Yes, airSlate SignNow provides tracking tools that enable you to monitor the approval process of the l34 formular 2024 in real-time. This feature allows you to see who has signed, who still needs to sign, and even sends automated reminders. Stay informed and organized with our comprehensive tracking solutions.

Get more for L34 Formular

- Pdb user access form 20080229 doc

- Affidavit of non ownership of property form

- Cf10 11 hmrc form

- So 72 271 california department of food and agriculture cdfa ca form

- Beft applicationb form for individual shahjalal islami bank

- Energy service agreement template form

- Engagement agreement template form

- Engineering consultancy agreement template form

Find out other L34 Formular

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document