Ar 1100ct Instructions Form

What is the AR1100CT Instructions

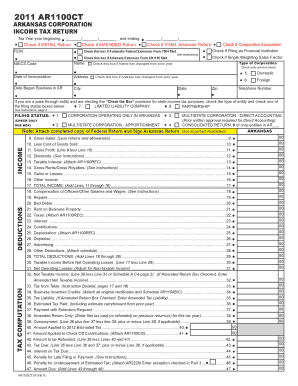

The AR1100CT instructions provide essential guidance for completing the Arkansas Form AR1100CT, which is used for corporate income tax purposes. This form is crucial for corporations operating in Arkansas and outlines the necessary steps for reporting income, deductions, and tax liabilities. Understanding these instructions ensures compliance with state tax regulations and helps businesses accurately file their taxes.

Steps to Complete the AR1100CT Instructions

Completing the AR1100CT instructions involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Review the AR1100CT form to understand each section and its requirements.

- Fill out the form accurately, ensuring all figures are correct and supported by documentation.

- Double-check for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal Use of the AR1100CT Instructions

The legal use of the AR1100CT instructions is vital for ensuring that corporate tax filings meet state requirements. The instructions outline the legal obligations of corporations in Arkansas, including compliance with tax laws and regulations. Proper adherence to these guidelines helps prevent legal issues and ensures that the corporation remains in good standing with the state.

Filing Deadlines / Important Dates

Filing deadlines for the AR1100CT are critical for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the end of the corporation's fiscal year. Corporations should be aware of these dates to avoid late fees and penalties. It is advisable to check for any changes to deadlines or additional requirements each tax year.

Required Documents

When completing the AR1100CT instructions, corporations must have several documents ready:

- Financial statements, including balance sheets and income statements.

- Records of all income and deductions claimed.

- Previous year's tax returns, if applicable.

- Any supporting documentation for credits or deductions.

Form Submission Methods

The AR1100CT can be submitted through various methods, ensuring convenience for corporations. Options typically include:

- Online submission through the Arkansas Department of Finance and Administration website.

- Mailing a paper copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Who Issues the Form

The Arkansas Department of Finance and Administration is responsible for issuing the AR1100CT form. This department oversees tax administration in the state and provides resources and guidance for corporations to ensure compliance with tax laws. Corporations can reach out to this department for assistance with completing the form or understanding specific requirements.

Quick guide on how to complete ar 1100ct instructions

Complete Ar 1100ct Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents promptly without delays. Manage Ar 1100ct Instructions on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ar 1100ct Instructions effortlessly

- Obtain Ar 1100ct Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Ar 1100ct Instructions to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar 1100ct instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ar1100ct instructions for setting up my device?

To get started with your ar1100ct device, follow the provided ar1100ct instructions that detail the setup process including connecting to Wi-Fi, registering your account, and configuring your settings. Make sure to have all necessary accessories on hand for a seamless setup experience. If you encounter any issues, refer to the troubleshooting section in the instructions.

-

How can I access the latest ar1100ct instructions?

The latest ar1100ct instructions can typically be found on the manufacturer's official website or through the product's customer support page. Additionally, many online forums and user communities may provide valuable insights and user-generated content regarding the instructions. Always ensure you are referring to the most up-to-date version.

-

What features do the ar1100ct instructions highlight?

The ar1100ct instructions highlight various features such as document compatibility, user interface design, and eSigning capabilities. They also cover advanced features like integration with third-party applications and secure document storage. This ensures users can maximize the benefits of their device.

-

Are there any costs associated with using the ar1100ct instructions?

Accessing the ar1100ct instructions is generally free, but if you require additional support or services, there may be associated costs. For instance, premium features or extended support plans may incur fees. Review the pricing structure and service options provided in the instructions for clarity.

-

What are the benefits of following the ar1100ct instructions accurately?

Following the ar1100ct instructions accurately ensures optimal performance and functionality of your device. It helps in understanding all features and reduces the likelihood of errors during setup. Moreover, it enhances your overall user experience by making sure you are fully equipped to utilize all capabilities.

-

How do I troubleshoot using the ar1100ct instructions?

The ar1100ct instructions include a troubleshooting section that addresses common issues. It guides you through step-by-step solutions for problems like connectivity issues or eSigning errors. Following these instructions will help minimize downtime and ensure a smooth operation.

-

Can the ar1100ct instructions assist in integrating with other software?

Yes, the ar1100ct instructions provide guidance on integrating your device with popular software applications, enhancing your workflow. This integration allows you to streamline processes, making document management more efficient. Refer to the integration section in the instructions for detailed steps and supported services.

Get more for Ar 1100ct Instructions

- Upmc nomnc form

- Trustline kyc form

- Parts of a newspaper worksheet form

- Empanelment of valuer form

- Gov notice voter registration records are considered you may use this form to register to vote in utah preregister to vote if

- Film work for hire agreement template form

- Film writer agreement template form

- Filming agreement template form

Find out other Ar 1100ct Instructions

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer