Form 2302

What is the Form 2302

The Form 2302 is a specific document used primarily for tax purposes in the United States. It is often required by businesses and individuals to report certain financial information accurately. Understanding the nature of this form is crucial for compliance with IRS regulations. The form serves as a declaration of income, deductions, or other tax-related information, making it an essential tool for both taxpayers and the IRS.

How to use the Form 2302

Using the Form 2302 effectively involves several steps. First, gather all necessary financial documents that pertain to the information you need to report. This may include income statements, receipts for deductions, and any other relevant financial records. Once you have the required documents, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, it can be submitted electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to complete the Form 2302

Completing the Form 2302 involves a systematic approach to ensure accuracy. Here are the key steps:

- Gather all necessary documents, such as income statements and receipts.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring that all information is accurate and up to date.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate IRS address.

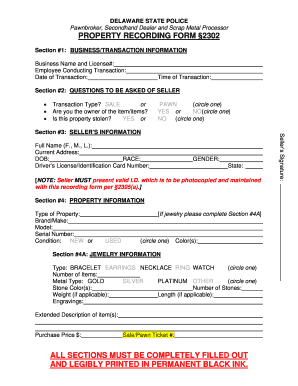

Key elements of the Form 2302

The Form 2302 contains several key elements that are essential for its validity. These include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Accurate reporting of all income sources is crucial.

- Deductions: Any applicable deductions must be clearly stated to reduce taxable income.

- Signature: The form must be signed to certify that the information provided is true and correct.

Legal use of the Form 2302

The legal use of the Form 2302 is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the required timeframe. Compliance with all IRS guidelines is essential to avoid penalties or legal issues. Additionally, using a reliable electronic signature solution can enhance the legal standing of the submitted form, providing an added layer of security and verification.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2302 can vary based on individual circumstances, such as the type of income reported or the taxpayer's filing status. Generally, it is advisable to submit the form by the standard tax filing deadline, which is typically April fifteenth. However, extensions may be available under certain conditions. Keeping track of important dates is crucial to ensure compliance and avoid late filing penalties.

Quick guide on how to complete form 2302

Effortlessly Prepare Form 2302 on Any Device

Digital document administration has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 2302 on any platform with airSlate SignNow's Android or iOS applications and improve any document-centric procedure today.

The easiest way to modify and eSign Form 2302 with ease

- Locate Form 2302 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and click the Done button to save your amendments.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs within a few clicks from your device of choice. Modify and eSign Form 2302 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2302

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BIR 2302 sample?

A BIR 2302 sample is a tax form used in the Philippines for reporting employee compensation and withholding tax. This form is essential for both employers and employees to ensure compliance with tax obligations. Understanding how to fill out a BIR 2302 sample can streamline your tax reporting process.

-

How does airSlate SignNow help with BIR 2302 samples?

airSlate SignNow simplifies the process of managing and signing BIR 2302 samples electronically. Our platform ensures that you can easily send, sign, and store these documents securely. With features tailored for tax forms, you can handle BIR 2302 samples efficiently.

-

Is there a cost associated with using airSlate SignNow for BIR 2302 samples?

Yes, there is a subscription cost to use airSlate SignNow; however, it's a cost-effective solution compared to traditional methods. We offer various pricing plans to accommodate different business needs while providing the features necessary for handling documents like the BIR 2302 sample. You can choose a plan that best suits your budget and volume of transactions.

-

What features does airSlate SignNow offer for managing BIR 2302 samples?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure storage for managing BIR 2302 samples. You can also track the status of documents in real-time, ensuring you know when your BIR 2302 sample is signed and filed. These features enhance productivity and compliance.

-

Can airSlate SignNow integrate with other software for BIR 2302 samples?

Absolutely! airSlate SignNow offers integrations with various popular software programs, enhancing your workflow when dealing with BIR 2302 samples. Whether you're using accounting software or customer relationship management tools, our platform can seamlessly integrate to streamline your processes.

-

What are the benefits of using airSlate SignNow for BIR 2302 samples?

Using airSlate SignNow for your BIR 2302 samples offers numerous benefits including improved efficiency, reduced paperwork, and enhanced security. Our platform allows for immediate document turnaround, minimizing delays associated with traditional paper processes. This ensures timely submission of your BIR 2302 samples and helps maintain compliance.

-

How secure is airSlate SignNow for handling BIR 2302 samples?

AirSlate SignNow prioritizes security when it comes to handling sensitive documents like BIR 2302 samples. We utilize industry-standard encryption and secure cloud storage to protect your documents. Additionally, access controls ensure that only authorized personnel can view or edit your BIR 2302 samples.

Get more for Form 2302

- Idaho loaner plate or registration orderrenewal itd idaho form

- Promedica student attestation form toledo hospital promedica

- Hoja de ayuda para el pago en ventanilla bancaria form

- Famu application form

- Www templateroller comtemplate2276897new hampshire fitness reimbursement form for anthem members

- Wisconsin department of health services division of health form

- Forms librarywisconsin department of health servicesmedicaiddhcf washington d cforms librarywisconsin department of health

- Medicaid for the elderly blind or disabled application form

Find out other Form 2302

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template