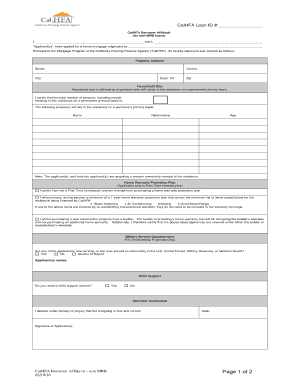

CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca Form

What is the CalHFA Borrower Affidavit?

The CalHFA Borrower Affidavit is a crucial document issued by the California Housing Finance Agency (CalHFA) that verifies the borrower's identity and financial status when applying for housing assistance or loans. This affidavit serves as a legal declaration, ensuring that the information provided by the borrower is accurate and truthful. It is typically required for various financial programs aimed at assisting low- to moderate-income individuals and families in California.

How to Use the CalHFA Borrower Affidavit

To effectively use the CalHFA Borrower Affidavit, borrowers must first complete the form with accurate personal and financial information. This includes details such as income, assets, and liabilities. Once filled out, the affidavit must be signed and dated by the borrower. It can then be submitted as part of the application process for CalHFA programs. Ensuring that all information is correct is essential, as discrepancies can delay processing or lead to disqualification.

Steps to Complete the CalHFA Borrower Affidavit

Completing the CalHFA Borrower Affidavit involves several key steps:

- Gather necessary personal and financial documents, such as pay stubs, tax returns, and bank statements.

- Fill out the affidavit form accurately, ensuring all sections are completed.

- Review the information provided for any errors or omissions.

- Sign and date the affidavit in the designated areas.

- Submit the completed affidavit along with your application to the appropriate CalHFA program.

Key Elements of the CalHFA Borrower Affidavit

The CalHFA Borrower Affidavit includes several key elements that are essential for its validity:

- Borrower Information: Personal details such as name, address, and contact information.

- Financial Disclosure: A comprehensive overview of income, assets, and debts.

- Signature: The borrower's signature, which verifies the truthfulness of the information provided.

- Date: The date on which the affidavit is signed, marking its official execution.

Legal Use of the CalHFA Borrower Affidavit

The legal use of the CalHFA Borrower Affidavit is significant, as it acts as a sworn statement under penalty of perjury. This means that any false information provided can lead to legal consequences, including potential criminal charges. The affidavit must be completed carefully to ensure compliance with all applicable laws and regulations. It is advisable for borrowers to consult with a legal professional if they have questions about the affidavit's implications.

Eligibility Criteria for the CalHFA Borrower Affidavit

Eligibility for using the CalHFA Borrower Affidavit typically includes specific criteria that applicants must meet. These may involve income limits, creditworthiness, and residency requirements within California. Borrowers should review the specific guidelines provided by CalHFA to ensure they qualify for the programs associated with the affidavit. Understanding these criteria is essential for a successful application process.

Quick guide on how to complete calhfa borrower affidavit california housing finance agency calhfa ca

Effortlessly prepare CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to retrieve the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Easily modify and electronically sign CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca

- Locate CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca and ensure seamless communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the calhfa borrower affidavit california housing finance agency calhfa ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CalHFA Borrower Affidavit and how is it used?

The CalHFA Borrower Affidavit is a crucial document used in conjunction with loan applications managed by the California Housing Finance Agency (CalHFA). This affidavit outlines the borrower's financial situation and eligibility for various housing programs, ensuring that all necessary information is accurately represented to facilitate the loan approval process.

-

How does airSlate SignNow simplify the signing process for the CalHFA Borrower Affidavit?

airSlate SignNow streamlines the signing process for the CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca by providing an intuitive platform that allows users to electronically sign documents securely. This saves time and resources, eliminating the need for physical paperwork while ensuring compliance with all legal requirements.

-

What are the pricing options for using airSlate SignNow with CalHFA Borrower Affidavit?

airSlate SignNow offers flexible pricing plans that cater to organizations of all sizes looking to efficiently handle the CalHFA Borrower Affidavit. Whether you are a small business or a large institution, you can choose a plan tailored to your specific needs, ensuring you get the most cost-effective solution for eSigning documents.

-

Can airSlate SignNow integrate with other tools for handling CalHFA documents?

Yes, airSlate SignNow offers integrations with a range of tools that can enhance your workflow for managing the CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca. Seamless connections with CRM systems, cloud storage, and document management solutions enable a cohesive process that boosts efficiency.

-

What benefits do users experience when using airSlate SignNow for the CalHFA Borrower Affidavit?

Users experience numerous benefits when using airSlate SignNow for the CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca, including reduced processing time, improved accuracy, and enhanced compliance. The ability to sign and manage documents digitally fosters a more organized and efficient approach to loan qualification.

-

Is airSlate SignNow secure for signing the CalHFA Borrower Affidavit?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that any document, including the CalHFA Borrower Affidavit, is signed and managed with the utmost protection. The platform uses advanced encryption and authentication methods to safeguard sensitive information throughout the signing process.

-

How long does it take to complete the CalHFA Borrower Affidavit using airSlate SignNow?

The time it takes to complete the CalHFA Borrower Affidavit using airSlate SignNow is signNowly reduced to just a few minutes. With the platform's user-friendly interface, users can easily fill out, review, and sign documents online without the delays commonly associated with traditional methods.

Get more for CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca

Find out other CalHFA Borrower Affidavit California Housing Finance Agency Calhfa Ca

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT