Hawaii Gewtarv5 General Excise Use State Legal Forms

What is the Hawaii Gewtarv5 General Excise Use State Legal Forms

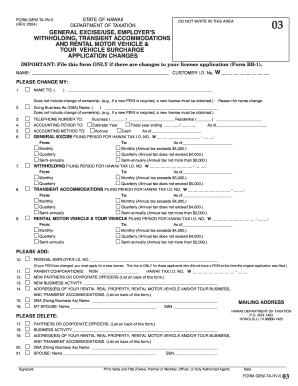

The Hawaii Gewtarv5 General Excise Use State Legal Forms are essential documents used by businesses operating in Hawaii to report and pay general excise taxes. These forms are required by the state to ensure compliance with tax regulations. The general excise tax is a tax on the gross income of businesses, and it applies to various types of transactions, including sales of goods and services. Understanding these forms is crucial for businesses to maintain legal compliance and avoid penalties.

How to use the Hawaii Gewtarv5 General Excise Use State Legal Forms

Using the Hawaii Gewtarv5 General Excise Use State Legal Forms involves several steps. First, businesses must determine the appropriate form based on their specific activities and income. After selecting the correct form, businesses should accurately fill it out, ensuring all required information is provided. This includes details about gross income, deductions, and any applicable exemptions. Once completed, the form must be submitted to the appropriate state agency, either electronically or by mail, depending on the submission options available.

Steps to complete the Hawaii Gewtarv5 General Excise Use State Legal Forms

Completing the Hawaii Gewtarv5 General Excise Use State Legal Forms requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including sales records and expense reports.

- Select the correct form based on your business structure and activities.

- Fill out the form, providing accurate figures for gross income and applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form to the state by the designated deadline, ensuring you choose the preferred submission method.

Legal use of the Hawaii Gewtarv5 General Excise Use State Legal Forms

The legal use of the Hawaii Gewtarv5 General Excise Use State Legal Forms is governed by state tax laws. These forms must be completed accurately to be considered valid. Electronic submissions are legally recognized, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Ensuring the forms are submitted on time is crucial to avoid penalties and maintain compliance with state tax obligations.

Key elements of the Hawaii Gewtarv5 General Excise Use State Legal Forms

Key elements of the Hawaii Gewtarv5 General Excise Use State Legal Forms include:

- Gross Income Reporting: Businesses must report total income generated during the reporting period.

- Deductions: Certain deductions may apply, such as those for sales returns or allowances.

- Signature: A valid signature is required to certify the accuracy of the information provided.

- Filing Period: Forms must be filed according to the established filing schedule, which may vary based on the business type.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Gewtarv5 General Excise Use State Legal Forms are critical for compliance. Typically, these forms are due quarterly or annually, depending on the business's gross income. Businesses should be aware of specific due dates to avoid late fees and penalties. Keeping a calendar of these deadlines can help ensure timely submissions and maintain good standing with state tax authorities.

Quick guide on how to complete hawaii gewtarv5 general excise use state legal forms

Complete Hawaii Gewtarv5 General Excise Use State Legal Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without issues. Handle Hawaii Gewtarv5 General Excise Use State Legal Forms on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Hawaii Gewtarv5 General Excise Use State Legal Forms with minimal effort

- Locate Hawaii Gewtarv5 General Excise Use State Legal Forms and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Hawaii Gewtarv5 General Excise Use State Legal Forms and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii gewtarv5 general excise use state legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Hawaii Gewtarv5 General Excise Use State Legal Forms?

Hawaii Gewtarv5 General Excise Use State Legal Forms are specific documents required for compliance with Hawaii’s general excise tax laws. These forms help businesses report their income accurately and fulfill their legal obligations. By using airSlate SignNow, you can easily access and eSign these forms, ensuring you remain compliant with state regulations.

-

How can I access Hawaii Gewtarv5 General Excise Use State Legal Forms through airSlate SignNow?

You can quickly access Hawaii Gewtarv5 General Excise Use State Legal Forms by signing up for airSlate SignNow. Our platform offers a comprehensive library of legal forms tailored to Hawaii’s regulations. Once you’re registered, you can easily search for and fill out the required forms online.

-

Are there any costs associated with using airSlate SignNow for Hawaii Gewtarv5 General Excise Use State Legal Forms?

Yes, there are subscription plans available for airSlate SignNow that cater to various business needs. These plans are cost-effective and include access to a variety of features, including the ability to manage Hawaii Gewtarv5 General Excise Use State Legal Forms efficiently. You can choose a plan that best aligns with your document management needs.

-

What features does airSlate SignNow offer for eSigning Hawaii Gewtarv5 General Excise Use State Legal Forms?

airSlate SignNow offers a robust set of features for eSigning Hawaii Gewtarv5 General Excise Use State Legal Forms, including an intuitive user interface, mobile access, and secure document storage. You can track signatures in real-time and send reminders to recipients, making the process efficient and hassle-free.

-

Can I integrate airSlate SignNow with other tools for managing legal forms?

Absolutely! airSlate SignNow integrates seamlessly with various tools and systems, allowing you to manage Hawaii Gewtarv5 General Excise Use State Legal Forms alongside your existing software. This integration ensures a smooth workflow where you can synchronize data and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for Hawaii Gewtarv5 General Excise Use State Legal Forms?

Using airSlate SignNow for your Hawaii Gewtarv5 General Excise Use State Legal Forms offers numerous benefits, including streamlined document management, enhanced collaboration, and quicker turnaround times for signing. This helps your business remain compliant while saving time and reducing the risk of errors.

-

Is airSlate SignNow secure for handling sensitive legal forms?

Yes, airSlate SignNow prioritizes security, employing robust encryption and compliance with industry standards to protect your Hawaii Gewtarv5 General Excise Use State Legal Forms. Your documents are stored securely, ensuring that only authorized users have access, thus safeguarding your sensitive information.

Get more for Hawaii Gewtarv5 General Excise Use State Legal Forms

- W 2t and 1099t transmittal for paper w 2 and 1099 forms otr cfo dc

- Bahria town form

- Texas occupational license form

- Mls sales agreement form

- Arabic research consent formdoc multicare

- Finishing strong protecting the recovery form

- 2 jan bn irs issues additional guidance on form w 2 reporting doc irs revises guidance on health insurance coverage information

- Marital agreement template form

Find out other Hawaii Gewtarv5 General Excise Use State Legal Forms

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free