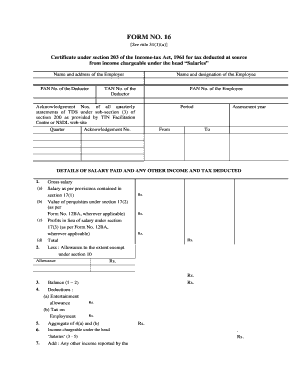

16 See Rule 311a Certificate under Section 203 of the Incometax Act, 1961 for Tax Deducted at Source from Income Chargeable Unde Form

Understanding the certificate of source of income

The certificate of source of income is a crucial document for individuals and businesses in the United States. It serves as proof of income for various purposes, including tax filings, loan applications, and financial transactions. This certificate outlines the source of income, ensuring transparency and compliance with financial regulations. It is essential for those who need to verify their income for official processes, such as applying for credit or government assistance.

Steps to complete the certificate of source of income

Completing the certificate of source of income involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as pay stubs, tax returns, and bank statements. Next, fill out the certificate with accurate information regarding your income sources, including employer details and income amounts. It is important to review the completed document for any errors before submission. Finally, sign and date the certificate to validate it.

Who issues the certificate of source of income

The certificate of source of income is typically issued by employers or financial institutions. Employers provide this certificate to their employees to confirm their earnings for tax purposes. Financial institutions may issue it for clients who need to verify income for loans or mortgages. It is important to request this certificate from the appropriate entity to ensure it meets all necessary legal requirements.

Legal use of the certificate of source of income

The certificate of source of income is legally binding when properly executed. It can be used in various legal contexts, including tax assessments and loan approvals. It is important to ensure that the certificate is filled out accurately to avoid any legal complications. Additionally, the certificate must comply with relevant regulations, such as those set forth by the Internal Revenue Service (IRS) and state tax authorities.

Required documents for the certificate of source of income

To obtain a certificate of source of income, several documents may be required. Commonly needed documents include:

- Recent pay stubs or salary statements

- Tax returns from the previous year

- Bank statements showing income deposits

- Any additional documentation that verifies income sources

Having these documents ready will streamline the process of completing and submitting the certificate.

IRS guidelines for the certificate of source of income

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the certificate of source of income. It is essential to follow these guidelines to ensure compliance with federal tax laws. The certificate should accurately reflect all sources of income, including wages, bonuses, and any other earnings. Failure to provide accurate information may result in penalties or further scrutiny from tax authorities.

Quick guide on how to complete 16 see rule 311a certificate under section 203 of the incometax act 1961 for tax deducted at source from income chargeable

Effortlessly Prepare 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde on Any Device

Managing documents online has gained popularity among both organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related operation today.

The Easiest Way to Edit and eSign 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde with Ease

- Locate 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing fresh document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde and ensure top-notch communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 16 see rule 311a certificate under section 203 of the incometax act 1961 for tax deducted at source from income chargeable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of source of income?

A certificate of source of income is an official document that verifies an individual's income origin. It is often required for loan applications, tax purposes, or when applying for financial services. Using airSlate SignNow, you can easily create and send this document for eSigning.

-

How can airSlate SignNow help with creating a certificate of source of income?

airSlate SignNow provides templates and an intuitive interface to create a certificate of source of income effortlessly. You can customize fields, add signatures, and ensure compliance with legal standards. This streamlines the process, making it faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for a certificate of source of income?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget. The investment in airSlate SignNow will save you time and improve document management for certificates of source of income.

-

What features does airSlate SignNow offer for handling certificates of source of income?

airSlate SignNow includes features such as customizable templates, automated workflows, real-time tracking, and secure eSigning. These tools make the creation and distribution of your certificate of source of income more efficient and reliable. You can manage everything from one platform.

-

Are there integrations available for airSlate SignNow related to certificates of source of income?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. These integrations allow you to link the workflow for your certificate of source of income directly with other business tools, enhancing productivity and coordination.

-

What benefits does airSlate SignNow provide when issuing a certificate of source of income?

By using airSlate SignNow, you can accelerate the issuance process of your certificate of source of income, reducing turnaround time signNowly. The platform also offers enhanced security features, ensuring that sensitive information is protected during transmission. This ultimately increases trust with your clients or partners.

-

How secure is the certificate of source of income created with airSlate SignNow?

Security is a top priority at airSlate SignNow. All documents, including certificates of source of income, are encrypted during transfer, and access controls are in place. You can trust that your information is safe when using our platform for electronic signatures.

Get more for 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde

- Print shop work order special billing form

- Form ds 1 fidelity national title

- Pisq 12 questionnaire pdf form

- Mary kay inventory spreadsheet form

- Air quality permit checklist south coast air quality form

- Do you make the best garden salsa in huntley village of huntley form

- Reset form print form rooming accommodation agreem

- Settlement payment between two parties agreement template form

Find out other 16 See Rule 311a Certificate Under Section 203 Of The Incometax Act, 1961 For Tax Deducted At Source From Income Chargeable Unde

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU