117 Form

What is the 117 Form

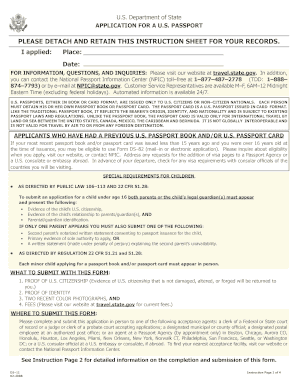

The 117 form, officially known as USCIS Form DS-117, is a document used by individuals who are applying for a U.S. visa or seeking to adjust their immigration status. This form is essential for those who need to provide information about their eligibility and intent to travel to the United States. The 117 form collects personal details, including the applicant's name, date of birth, nationality, and specific information regarding their immigration history. It serves as a vital tool for U.S. Citizenship and Immigration Services (USCIS) to assess an applicant's qualifications and background.

How to obtain the 117 Form

To obtain the 117 form, individuals can visit the official USCIS website where the form is available for download. It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted. Applicants can also request a physical copy by contacting USCIS directly. It is advisable to check the website for any updates or changes to the form or the application process before proceeding.

Steps to complete the 117 Form

Completing the 117 form involves several key steps to ensure accuracy and compliance with USCIS requirements:

- Download the form: Access the USCIS website to download the latest version of the 117 form.

- Read the instructions: Carefully review the instructions provided with the form to understand the information required.

- Fill out the form: Provide all necessary personal information, ensuring accuracy and completeness.

- Review your entries: Double-check all responses for any errors or omissions before finalizing the form.

- Sign and date: Ensure that you sign and date the form where indicated, as an unsigned form may be rejected.

Legal use of the 117 Form

The 117 form is legally binding when completed and submitted according to USCIS guidelines. To ensure its legal validity, applicants must provide truthful and accurate information. Misrepresentation or failure to disclose relevant details can lead to penalties, including denial of the application or future immigration benefits. Additionally, the form must be submitted within the specified time frames to maintain compliance with U.S. immigration laws.

Key elements of the 117 Form

Several key elements are essential when completing the 117 form:

- Personal Information: This includes the applicant's full name, date of birth, and nationality.

- Immigration History: Applicants must disclose their immigration status and any previous applications or petitions.

- Purpose of Travel: Clearly state the intent for traveling to the United States, whether for work, study, or other reasons.

- Signature: A valid signature is required to affirm that the information provided is accurate and complete.

Form Submission Methods

The 117 form can be submitted through various methods, depending on the specific instructions provided by USCIS. Common submission methods include:

- Online Submission: Some applicants may have the option to submit the form electronically through the USCIS online portal.

- Mail: The completed form can be mailed to the designated USCIS address, as specified in the form instructions.

- In-Person: Certain applicants may be required to submit the form in person at a USCIS office during their appointment.

Quick guide on how to complete 117 form

Effortlessly complete 117 Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage 117 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign 117 Form with ease

- Locate 117 Form and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and carries the same legal standing as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 117 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 117 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 117 form and how can airSlate SignNow help?

The 117 form is a widely used document that often requires signatures for approval or verification. airSlate SignNow streamlines the process by allowing businesses to create, send, and eSign 117 forms effortlessly. Our platform ensures that all signatures are legally binding and securely stored for future reference.

-

Is airSlate SignNow suitable for small businesses needing to manage 117 forms?

Yes, airSlate SignNow is an excellent choice for small businesses looking to manage 117 forms efficiently. Our user-friendly interface and cost-effective pricing make it accessible for all companies. SignNow's features ensure that small businesses can handle their documentation needs without extensive resources.

-

What are the key features of airSlate SignNow related to 117 forms?

airSlate SignNow offers several key features for managing 117 forms, including customizable templates, real-time tracking, and automatic reminders. Users can easily create, send, and sign 117 forms from any device. Secure storage and easy retrieval of signed documents ensure compliance and accessibility.

-

How does airSlate SignNow ensure the security of 117 forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 117 form. We utilize advanced encryption methods to protect your data both in transit and at rest. Additionally, our platform complies with various industry regulations to ensure your information remains confidential.

-

What integrations does airSlate SignNow offer for managing 117 forms?

airSlate SignNow seamlessly integrates with several popular business applications, enhancing your workflow for managing 117 forms. This includes integrations with CRM systems, project management tools, and cloud storage solutions. By integrating with your existing software, SignNow optimizes your document management processes.

-

Can I track the status of my 117 forms in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking capabilities for your 117 forms. You will receive notifications when the document is viewed, signed, or completed, allowing you to manage your workflows more effectively and ensure timely approvals.

-

What is the pricing structure for using airSlate SignNow for 117 forms?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs. You can choose from monthly or annual subscription options, which provide access to features specifically beneficial for managing 117 forms. Our cost-effective solutions ensure you get the best value for your investment.

Get more for 117 Form

- Petsmart w2 form

- Cat ref form

- Marriage certificate request form cook county find laws

- Form 100w california corporation franchise or income tax return waters edge filers form 100w california corporation franchise

- Cat cs rev 1123 commercial activity tax credit s form

- Bcbs prior authorization form pdf 24449260

- Sign on bonus repayment agreement template form

- Signature page agreement template form

Find out other 117 Form

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement