CAT CS Rev 1123 Commercial Activity Tax Credit S 2025-2026

Understanding the CAT CS Rev 1123 Commercial Activity Tax Credit S

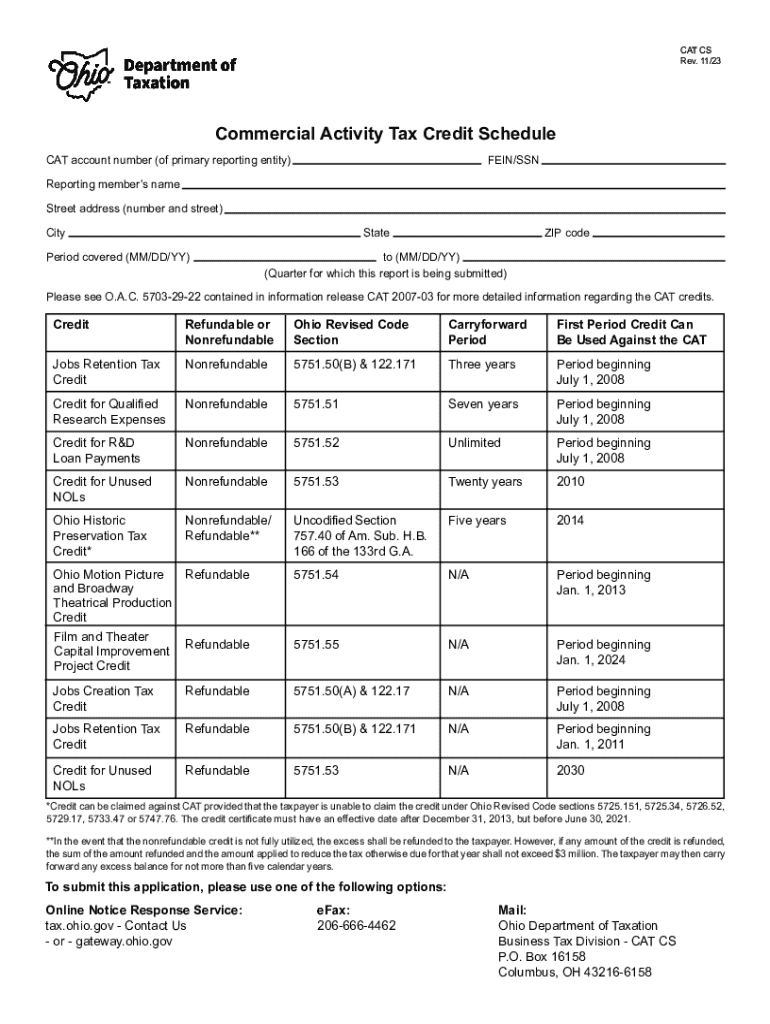

The CAT CS Rev 1123 Commercial Activity Tax Credit S is a tax credit designed to support businesses engaged in commercial activities. This credit is applicable to entities operating within the state and is intended to reduce the tax burden associated with commercial transactions. By encouraging economic growth, this credit helps businesses reinvest in their operations and contribute to local economies.

Steps to Complete the CAT CS Rev 1123 Commercial Activity Tax Credit S

Completing the CAT CS Rev 1123 form involves several key steps:

- Gather necessary financial documentation, including income statements and expense records.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total eligible credit based on your commercial activities.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated filing deadline.

Eligibility Criteria for the CAT CS Rev 1123 Commercial Activity Tax Credit S

To qualify for the CAT CS Rev 1123 Commercial Activity Tax Credit S, businesses must meet specific eligibility criteria:

- Must be a registered business entity within the state.

- Engaged in qualifying commercial activities as defined by state regulations.

- Must maintain accurate financial records to substantiate claims for the credit.

Required Documents for the CAT CS Rev 1123 Commercial Activity Tax Credit S

When applying for the CAT CS Rev 1123, businesses need to provide certain documents to support their application:

- Completed CAT CS Rev 1123 form.

- Financial statements, including profit and loss statements.

- Documentation of commercial activities that qualify for the credit.

- Any additional forms or schedules as required by state tax authorities.

How to Obtain the CAT CS Rev 1123 Commercial Activity Tax Credit S

The CAT CS Rev 1123 form can typically be obtained through state tax authority websites or offices. Businesses may also contact their tax advisor for assistance in acquiring the form and understanding the application process. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Filing Deadlines for the CAT CS Rev 1123 Commercial Activity Tax Credit S

Filing deadlines for the CAT CS Rev 1123 form are crucial to ensure compliance and avoid penalties. Businesses should be aware of the following key dates:

- The annual filing deadline, which typically aligns with the state tax return due date.

- Extensions, if applicable, and any associated deadlines for submitting the form.

Legal Use of the CAT CS Rev 1123 Commercial Activity Tax Credit S

The CAT CS Rev 1123 Commercial Activity Tax Credit S must be used in accordance with state tax laws and regulations. Misuse of the credit can lead to penalties and interest charges. It is essential for businesses to understand the legal framework surrounding the credit to ensure proper compliance and maximize benefits.

Create this form in 5 minutes or less

Find and fill out the correct cat cs rev 1123 commercial activity tax credit s

Create this form in 5 minutes!

How to create an eSignature for the cat cs rev 1123 commercial activity tax credit s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CAT CS Rev 1123 Commercial Activity Tax Credit S?

The CAT CS Rev 1123 Commercial Activity Tax Credit S is a tax credit designed to support businesses by reducing their commercial activity tax liabilities. This credit can signNowly lower the overall tax burden for eligible companies, making it an essential consideration for financial planning.

-

How can airSlate SignNow help with the CAT CS Rev 1123 Commercial Activity Tax Credit S?

airSlate SignNow streamlines the documentation process required for claiming the CAT CS Rev 1123 Commercial Activity Tax Credit S. Our platform allows businesses to easily prepare, send, and eSign necessary documents, ensuring compliance and efficiency in tax credit applications.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. By investing in our solution, companies can enhance their operations while ensuring they maximize benefits like the CAT CS Rev 1123 Commercial Activity Tax Credit S.

-

What features does airSlate SignNow provide for managing tax credits?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools simplify the management of documents related to the CAT CS Rev 1123 Commercial Activity Tax Credit S, making the process more efficient.

-

Are there any benefits to using airSlate SignNow for tax-related documents?

Yes, using airSlate SignNow for tax-related documents offers numerous benefits, including increased accuracy, reduced processing time, and enhanced security. This is particularly important when dealing with sensitive information related to the CAT CS Rev 1123 Commercial Activity Tax Credit S.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax management software. This integration allows businesses to efficiently manage their documentation for the CAT CS Rev 1123 Commercial Activity Tax Credit S alongside their existing systems.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. This ensures that all documents related to the CAT CS Rev 1123 Commercial Activity Tax Credit S are protected throughout the signing process.

Get more for CAT CS Rev 1123 Commercial Activity Tax Credit S

- Cmp 1190 form

- Appendix c ce forms florida building code energy conservation chapter c4commercial energy efficiency form c4022014 alterations

- Form sc 134pdffillercom 2017 2019

- Form 12 905a 2015 2019

- Institutional new account application cor clearing form

- Fr 800sf close of business final report form

- Proof of service template 2016 2019 form

- Sc 100 2017 2019 form

Find out other CAT CS Rev 1123 Commercial Activity Tax Credit S

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF