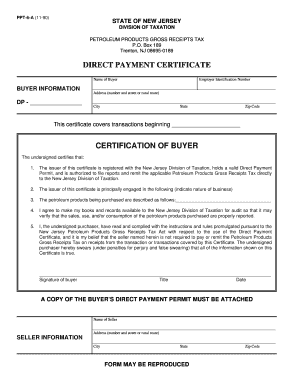

New Jersey PPT Direct Payment Certificate Form

What is the New Jersey PPT Direct Payment Certificate?

The New Jersey PPT Direct Payment Certificate is a crucial document that allows businesses to make direct payments for certain transactions without incurring sales tax at the point of purchase. This certificate is particularly relevant for businesses that frequently purchase taxable goods or services for resale or for use in their operations. By utilizing this certificate, businesses can streamline their purchasing processes and ensure compliance with state tax regulations.

How to Use the New Jersey PPT Direct Payment Certificate

To effectively use the New Jersey PPT Direct Payment Certificate, businesses must present the certificate to their suppliers at the time of purchase. This document certifies that the buyer intends to resell the items or use them in a manner that is exempt from sales tax. It is essential for the buyer to complete the certificate accurately, including all required information, to avoid any potential issues with tax compliance.

Steps to Complete the New Jersey PPT Direct Payment Certificate

Completing the New Jersey PPT Direct Payment Certificate involves several straightforward steps:

- Obtain the certificate form from the New Jersey Division of Taxation website or through authorized channels.

- Fill in the business name, address, and tax identification number accurately.

- Specify the type of property being purchased and the reason for the tax exemption.

- Sign and date the certificate to validate it.

- Present the completed certificate to the vendor at the time of purchase.

Legal Use of the New Jersey PPT Direct Payment Certificate

The legal use of the New Jersey PPT Direct Payment Certificate is governed by state tax laws. It is essential for businesses to understand that misuse of the certificate, such as using it for non-qualifying purchases, can lead to penalties and interest charges. Therefore, businesses should maintain accurate records of all transactions involving the certificate to ensure compliance and protect against audits.

Key Elements of the New Jersey PPT Direct Payment Certificate

Key elements of the New Jersey PPT Direct Payment Certificate include:

- Business Information: Name, address, and tax identification number of the purchaser.

- Vendor Information: Name and address of the vendor receiving the certificate.

- Description of Property: Clear description of the items being purchased.

- Reason for Exemption: Explanation of why the purchase is exempt from sales tax.

- Signature: Signature of an authorized representative of the business.

Eligibility Criteria for the New Jersey PPT Direct Payment Certificate

To be eligible for the New Jersey PPT Direct Payment Certificate, businesses must meet specific criteria, including:

- Being a registered business entity in New Jersey with a valid tax identification number.

- Intending to purchase items for resale or for use in exempt activities.

- Maintaining proper documentation to support the use of the certificate in case of an audit.

Quick guide on how to complete new jersey ppt direct payment certificate

Accomplish New Jersey Ppt Direct Payment Certificate effortlessly on any device

Digital document management has gained immense traction among companies and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without any hold-ups. Oversee New Jersey Ppt Direct Payment Certificate on any device utilizing airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to modify and eSign New Jersey Ppt Direct Payment Certificate with ease

- Find New Jersey Ppt Direct Payment Certificate and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for such purposes.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Alter and eSign New Jersey Ppt Direct Payment Certificate to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new jersey ppt direct payment certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a direct pay certificate?

A direct pay certificate is a document that allows businesses to make direct purchases without the need for sales tax. This certificate can streamline the purchasing process, saving both time and money on tax exemptions. With airSlate SignNow, obtaining and managing a direct pay certificate becomes a seamless experience.

-

How can airSlate SignNow help in managing direct pay certificates?

airSlate SignNow provides an efficient platform for creating, sending, and signing direct pay certificates digitally. By using our solution, businesses can ensure all relevant stakeholders have quick access to important documents, thereby speeding up the process. Our user-friendly interface also simplifies the management of multiple direct pay certificates.

-

What are the pricing options for using airSlate SignNow to manage direct pay certificates?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses, regardless of size. Our pricing is competitive and designed to provide value, especially for those needing to handle direct pay certificates regularly. You can select a plan that includes features specifically for managing documents and eSignatures effectively.

-

What features does airSlate SignNow offer for direct pay certificate management?

With airSlate SignNow, you can create templates for direct pay certificates, automate workflows, and ensure secure eSignatures for approvals. Our robust features allow for easy tracking of document status and comprehensive audit trails. This ensures that your direct pay certificates are properly managed and compliant with regulations.

-

What are the benefits of using airSlate SignNow for direct pay certificates?

Using airSlate SignNow for direct pay certificates enhances efficiency by reducing the time spent on document processing. The platform also ensures accuracy and legal compliance, minimizing errors in tax management. Additionally, airSlate SignNow's cloud-based solution allows access from anywhere, facilitating remote work and collaboration.

-

Can airSlate SignNow integrate with other financial or accounting tools for direct pay certificates?

Yes, airSlate SignNow offers integrations with various financial and accounting software to streamline the management of direct pay certificates. This allows businesses to maintain a cohesive workflow, linking document management with financial processes. Integrating these tools ensures smoother operations and better tracking of expenditures and tax compliance.

-

Is it easy to export direct pay certificates from airSlate SignNow?

Absolutely! Exporting direct pay certificates from airSlate SignNow is straightforward and user-friendly. Users can easily save documents in multiple formats, ensuring that all your direct pay certificates can be utilized and shared as needed for audits or financial records.

Get more for New Jersey Ppt Direct Payment Certificate

- Putno zdravstveno osiguranje form

- Nevada workplace safety form bcn bcn nshe

- Ps form 5980 printable

- Aris timesheet form

- Reg 227 application for duplicate title form

- Requisitions of 10000 249999 must be supported by documentation of 3 quotes and the completion of form

- 26 measure o senior citizen exemption form

- Voetstoots sale agreement template form

Find out other New Jersey Ppt Direct Payment Certificate

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast