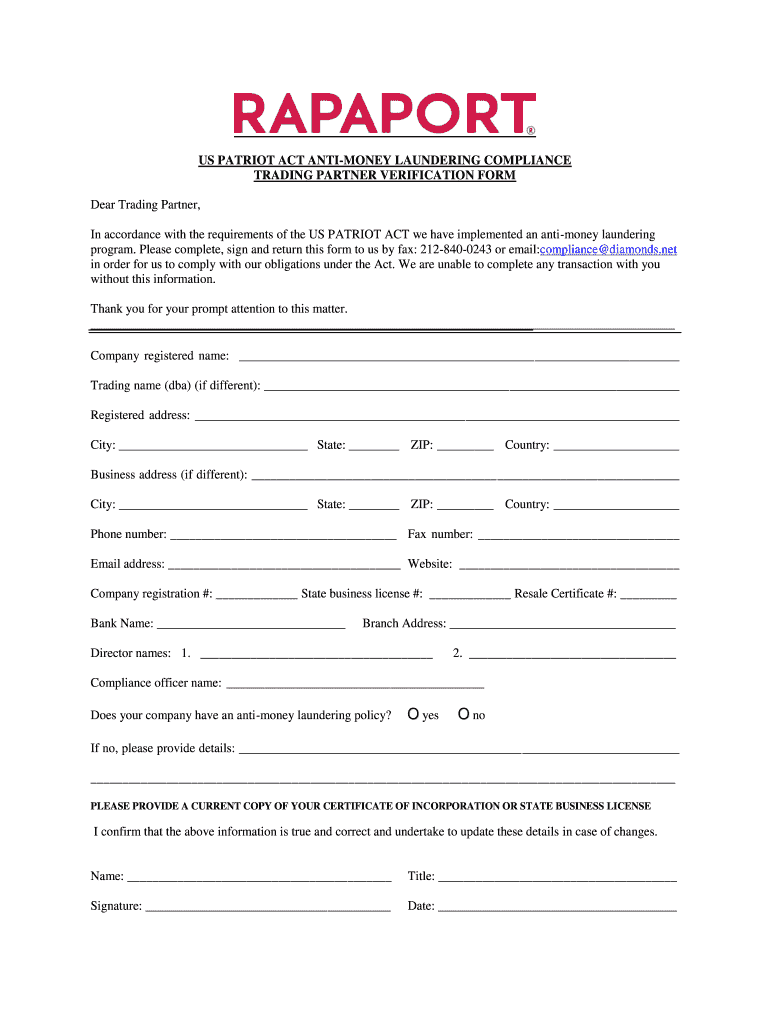

US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE Form

What is the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

The US PATRIOT Act Anti Money Laundering Compliance refers to a set of regulations designed to prevent and combat money laundering and terrorist financing activities. Enacted in response to the events of September 11, 2001, the Act mandates that financial institutions and certain businesses implement robust compliance programs. These programs must include customer identification procedures, ongoing monitoring of transactions, and reporting of suspicious activities to the authorities.

Compliance with the US PATRIOT Act is essential for maintaining the integrity of the financial system and ensuring that businesses do not inadvertently facilitate illegal activities. Organizations must regularly review and update their compliance measures to align with evolving regulations and best practices.

Key elements of the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

Several key elements form the foundation of the US PATRIOT Act Anti Money Laundering Compliance framework. These include:

- Customer Due Diligence: Businesses must verify the identity of their customers and understand the nature of their activities.

- Monitoring and Reporting: Continuous monitoring of transactions is required to detect and report suspicious activities to the appropriate authorities.

- Risk Assessment: Organizations must assess the risks associated with their customers and transactions, adapting their compliance programs accordingly.

- Training Programs: Employees must receive training on recognizing and responding to potential money laundering activities.

These elements work together to create a comprehensive compliance strategy that helps organizations mitigate risks related to money laundering and terrorist financing.

Steps to complete the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

Completing the US PATRIOT Act Anti Money Laundering Compliance involves several essential steps that businesses must follow:

- Develop a Compliance Program: Create a written compliance program tailored to the specific needs of the organization.

- Implement Customer Identification Procedures: Establish processes for verifying the identity of customers and assessing their risk profiles.

- Conduct Ongoing Monitoring: Regularly review transactions to identify any suspicious activities that may require reporting.

- Provide Employee Training: Ensure that all employees understand their roles in the compliance process and are trained to recognize red flags.

- Maintain Records: Keep detailed records of compliance efforts, customer identification, and any reports filed with authorities.

Following these steps helps organizations maintain compliance and reduce the risk of facilitating money laundering or terrorist financing.

Penalties for Non-Compliance

Failure to comply with the US PATRIOT Act Anti Money Laundering requirements can result in significant penalties for businesses. These penalties may include:

- Fines: Organizations may face substantial financial penalties, which can vary based on the severity of the violation.

- Criminal Charges: Individuals within the organization may be subject to criminal prosecution if found complicit in money laundering activities.

- Reputational Damage: Non-compliance can lead to a loss of trust from customers and partners, potentially harming the business's reputation.

It is crucial for businesses to prioritize compliance efforts to avoid these serious consequences.

Legal use of the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

The legal use of the US PATRIOT Act Anti Money Laundering Compliance is grounded in the requirement for financial institutions and other businesses to adhere to federal regulations aimed at preventing illegal activities. Compliance is not only a legal obligation but also a best practice for safeguarding the organization against potential risks associated with money laundering.

Organizations must ensure that their compliance programs are regularly updated to reflect changes in legislation and regulatory guidance. Legal counsel can provide valuable insights into the specific obligations and risks associated with compliance, helping businesses navigate the complex regulatory landscape effectively.

Examples of using the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

Practical examples of how businesses implement the US PATRIOT Act Anti Money Laundering Compliance can provide valuable insights. For instance:

- A bank may implement a system that flags large cash deposits for further review, ensuring that any suspicious transactions are reported.

- A real estate firm could conduct background checks on clients to verify their identities and assess potential risks before proceeding with transactions.

- A money service business might require customers to provide identification and proof of address before processing transactions, thereby adhering to compliance requirements.

These examples illustrate the diverse approaches organizations can take to ensure compliance while mitigating risks associated with money laundering and terrorist financing.

Quick guide on how to complete us patriot act anti money laundering compliance

Effortlessly Prepare US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without delays. Handle US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

The Easiest Way to Edit and eSign US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE with Ease

- Locate US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE and click Get Form to begin.

- Make use of the available tools to complete your document.

- Mark pertinent sections of your documents or conceal sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or sharing an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you select. Edit and eSign US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the us patriot act anti money laundering compliance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE?

The US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE refers to regulations designed to prevent money laundering and terrorist financing. Businesses must adhere to these regulations to ensure they are not inadvertently facilitating illegal activities. Compliance involves implementing specific procedures and controls to monitor and report suspicious activities.

-

How does airSlate SignNow support US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE?

airSlate SignNow provides features that help businesses maintain compliance with the US PATRIOT ACT ANTI MONEY LAUNDERING regulations. Our platform allows for secure document management and eSigning, ensuring that sensitive information is protected. Additionally, we offer audit trails and reporting features that assist in compliance monitoring.

-

What are the pricing options for airSlate SignNow in relation to compliance needs?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and compliance needs, including those related to the US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE. Our plans are designed to be cost-effective while providing essential features for secure document handling. You can choose a plan that best fits your compliance requirements and budget.

-

What features does airSlate SignNow offer for compliance with the US PATRIOT ACT?

Our platform includes features such as secure eSigning, document encryption, and customizable workflows that align with US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE. These features help ensure that your documents are handled securely and that you can easily track and manage compliance-related activities. Additionally, our user-friendly interface simplifies the compliance process.

-

Can airSlate SignNow integrate with other compliance tools?

Yes, airSlate SignNow can integrate with various compliance tools and software to enhance your US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE efforts. Our platform supports integrations with popular CRM and document management systems, allowing for seamless data flow and improved compliance tracking. This flexibility helps businesses streamline their compliance processes.

-

What are the benefits of using airSlate SignNow for compliance?

Using airSlate SignNow for US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE offers numerous benefits, including enhanced security, improved efficiency, and reduced risk of non-compliance. Our solution simplifies the document signing process while ensuring that all compliance requirements are met. This allows businesses to focus on their core operations without worrying about compliance issues.

-

Is airSlate SignNow suitable for all business types regarding compliance?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes and types, ensuring compliance with the US PATRIOT ACT ANTI MONEY LAUNDERING regulations. Whether you are a small startup or a large enterprise, our platform can be tailored to meet your specific compliance needs. This versatility makes it an ideal choice for any organization.

Get more for US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

- 5113 1 396 in the district court of county kansas in kansasjudicialcouncil form

- Suggestion record form

- 5113 352 in the district court of county kansas in the matter of name juvenile year of birth a male female case no form

- Kansasjudicialcouncil 6969234 form

- Criminal information sheet kansas judicial council kansasjudicialcouncil

- 9113 340 in the district court of county kansas in the matter of name juvenile year of birth a male female case no form

- Cdocuments and settingsnataliemy documentsksjc websitewebsite files 2008statutory formswpksa194738complaintwpd

- Je of adjudication and sentencing kansas judicial council kansasjudicialcouncil 6969294 form

Find out other US PATRIOT ACT ANTI MONEY LAUNDERING COMPLIANCE

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF