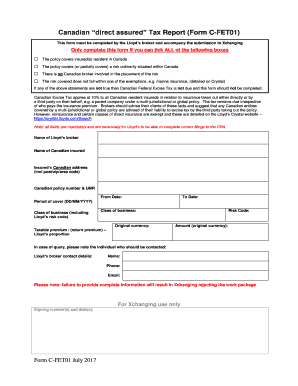

Canadian Direct Assured Tax Report Form C FET01

What is the Canadian Direct Assured Tax Report Form C FET01

The Canadian Direct Assured Tax Report Form C FET01 is a specific tax document used for reporting various financial activities related to Canadian taxation. This form is essential for individuals and businesses that have financial ties to Canada and need to comply with tax regulations. It serves as an official record that outlines income, deductions, and other financial details necessary for accurate tax reporting. Understanding this form is crucial for ensuring compliance with tax laws and avoiding potential penalties.

How to use the Canadian Direct Assured Tax Report Form C FET01

Using the Canadian Direct Assured Tax Report Form C FET01 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form with accurate information, ensuring that all sections are completed as required. Review the form for any errors or omissions before submission. Once finalized, the form can be submitted electronically or via traditional mail, depending on the specific requirements set by tax authorities.

Steps to complete the Canadian Direct Assured Tax Report Form C FET01

Completing the Canadian Direct Assured Tax Report Form C FET01 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including income statements and expense receipts.

- Fill in personal identification information accurately at the top of the form.

- Detail your income sources in the appropriate sections, ensuring accuracy.

- List any deductions or credits you are eligible for, providing necessary documentation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Canadian Direct Assured Tax Report Form C FET01

The legal use of the Canadian Direct Assured Tax Report Form C FET01 is governed by tax regulations that require accurate reporting of income and deductions. This form must be completed truthfully and submitted within the designated time frame to avoid legal repercussions. Failure to comply with the legal requirements associated with this form can lead to penalties, including fines or audits. It is essential to understand the legal implications of submitting this form to ensure compliance with tax laws.

Required Documents

To successfully complete the Canadian Direct Assured Tax Report Form C FET01, certain documents are required. These typically include:

- Income statements from employers or clients.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant tax documents from financial institutions.

Having these documents ready will facilitate a smoother completion process and ensure that all information reported is accurate.

Form Submission Methods

The Canadian Direct Assured Tax Report Form C FET01 can be submitted through various methods. Common submission options include:

- Online submission via authorized tax platforms.

- Mailing a printed version of the form to the appropriate tax office.

- In-person delivery at designated tax offices, if applicable.

Choosing the right submission method can depend on personal preferences and the specific requirements of the tax authorities.

Quick guide on how to complete canadian direct assured tax report form c fet01

Effortlessly prepare Canadian Direct Assured Tax Report Form C FET01 on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without holdups. Manage Canadian Direct Assured Tax Report Form C FET01 on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

The easiest method to modify and eSign Canadian Direct Assured Tax Report Form C FET01 effortlessly

- Locate Canadian Direct Assured Tax Report Form C FET01 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Canadian Direct Assured Tax Report Form C FET01 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canadian direct assured tax report form c fet01

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canadian Direct Assured Tax Report Form C FET01?

The Canadian Direct Assured Tax Report Form C FET01 is a tax reporting document required for certain businesses in Canada. This form helps ensure compliance with tax regulations and facilitates accurate reporting of financial data. By utilizing the Canadian Direct Assured Tax Report Form C FET01, businesses can streamline their tax processes while maintaining transparency with tax authorities.

-

How can airSlate SignNow assist with the Canadian Direct Assured Tax Report Form C FET01?

airSlate SignNow provides a user-friendly platform for businesses to easily send, manage, and eSign the Canadian Direct Assured Tax Report Form C FET01. With our solution, you can reduce the time spent on paperwork and minimize errors in your submissions. Additionally, our tracking features enable you to stay organized and ensure timely submission of your forms.

-

What are the pricing options for using airSlate SignNow for the Canadian Direct Assured Tax Report Form C FET01?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from a monthly or annual subscription based on your usage requirements for managing the Canadian Direct Assured Tax Report Form C FET01. Our pricing is competitive, providing excellent value for a comprehensive eSigning solution.

-

What features does airSlate SignNow offer for the Canadian Direct Assured Tax Report Form C FET01?

With airSlate SignNow, you can benefit from features like secure eSigning, document templates, and real-time tracking for your Canadian Direct Assured Tax Report Form C FET01. Our platform also offers cloud storage, making it easy to access and manage your documents anytime. These features streamline the process and enhance the overall user experience.

-

Can I integrate airSlate SignNow with other tools while using the Canadian Direct Assured Tax Report Form C FET01?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications to enhance the efficiency of your workflow. Whether you use accounting software or project management tools, you can easily configure connections to effectively manage the Canadian Direct Assured Tax Report Form C FET01. This integration simplifies data transfer and minimizes manual entries.

-

What benefits does airSlate SignNow provide for the Canadian Direct Assured Tax Report Form C FET01?

The main benefits of using airSlate SignNow for the Canadian Direct Assured Tax Report Form C FET01 include faster turnaround times, reduced paperwork, and enhanced compliance. By digitizing your document management process, you can ensure that your reports are accurate and timely. Additionally, our solution offers robust security features to protect sensitive information.

-

Is it easy to get started with airSlate SignNow for the Canadian Direct Assured Tax Report Form C FET01?

Absolutely! Getting started with airSlate SignNow for the Canadian Direct Assured Tax Report Form C FET01 is quick and straightforward. Simply sign up for an account, customize your document templates, and begin sending and signing forms with ease. Our user-friendly interface ensures that you can navigate the platform without any prior experience.

Get more for Canadian Direct Assured Tax Report Form C FET01

Find out other Canadian Direct Assured Tax Report Form C FET01

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile