Instructions for Transportation Mileage Log Form

What is a transportation log template?

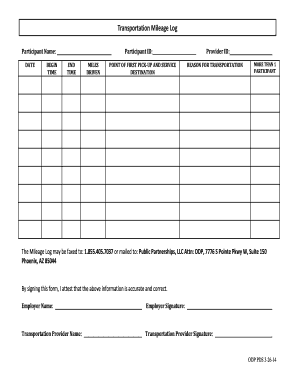

A transportation log template is a structured document used to record details about the transportation of goods or services. This template typically includes fields for the date, destination, purpose of travel, mileage, and any expenses incurred. It serves as an essential tool for businesses and individuals to track their transportation activities for various purposes, including tax deductions and compliance with legal requirements. By utilizing a transportation log template, users can ensure they maintain accurate records that can be easily referenced when needed.

Key elements of a transportation log template

When creating a transportation log template, several key elements should be included to ensure it meets legal and practical requirements:

- Date: The date of each trip should be clearly recorded.

- Destination: Specify where the trip began and ended.

- Purpose of travel: Describe the reason for the trip, such as business meetings or deliveries.

- Mileage: Record the total miles driven for each trip.

- Expenses: Include any related costs, such as fuel or tolls.

- Driver's name: Document who was responsible for the trip.

Steps to complete a transportation log template

Completing a transportation log template involves several straightforward steps:

- Gather information: Collect details about each trip, including dates, destinations, and purposes.

- Fill in the template: Enter the gathered information into the appropriate fields of the transportation log template.

- Calculate mileage: Determine the total mileage for each trip and record it accurately.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Save and store: Keep the completed log in a secure location for future reference and compliance.

Legal use of a transportation log template

Using a transportation log template is crucial for legal compliance, especially for individuals and businesses claiming mileage deductions on their taxes. The IRS requires accurate records to substantiate any claims made for business-related travel. A well-maintained transportation log can serve as evidence in case of audits or disputes. It is important to ensure that all entries are truthful and supported by receipts or other documentation when applicable.

IRS guidelines for transportation logs

The IRS has specific guidelines regarding the use of transportation logs for tax purposes. To qualify for deductions, taxpayers must keep detailed records of their business mileage. This includes:

- Documenting the date, mileage, and purpose of each trip.

- Maintaining receipts for any expenses related to the travel.

- Ensuring that the log is updated regularly and accurately reflects all travel activities.

Following these guidelines helps ensure compliance and maximizes potential tax benefits.

Examples of using a transportation log template

Transportation log templates can be utilized in various scenarios, including:

- Self-employed individuals: Tracking business-related travel for tax deductions.

- Companies: Documenting employee travel for reimbursement purposes.

- Freight carriers: Keeping records of deliveries and routes taken.

These examples illustrate the versatility and importance of maintaining a comprehensive transportation log.

Quick guide on how to complete instructions for transportation mileage log

Easily Prepare Instructions For Transportation Mileage Log on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without complications. Manage Instructions For Transportation Mileage Log on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Instructions For Transportation Mileage Log Effortlessly

- Obtain Instructions For Transportation Mileage Log and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Instructions For Transportation Mileage Log and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for transportation mileage log

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a transportation log template?

A transportation log template is a structured document that allows businesses to track details about the transportation of goods. It typically includes information such as the date, time, vehicle details, and driver information. Using a transportation log template helps streamline logistics and ensures compliance with regulations.

-

How can the airSlate SignNow transportation log template benefit my business?

The airSlate SignNow transportation log template can signNowly enhance your business operations by simplifying the documentation process. It allows for easy editing and sharing, ensuring all stakeholders have access to real-time data. This increases accuracy and efficiency, ultimately leading to improved logistics management.

-

Is the transportation log template customizable?

Yes, the transportation log template offered by airSlate SignNow is fully customizable to meet your specific business needs. You can easily modify fields, add branding elements, and adjust formats to align with your company’s protocols. Customization ensures that the template serves your unique requirements effectively.

-

What are the pricing options for the transportation log template?

The pricing options for the transportation log template are competitive and tailored to fit various business sizes. You can choose from different subscription plans based on the features and support you need. Sign up for a free trial to explore the benefits of the transportation log template before committing to a plan.

-

Can I integrate the transportation log template with other software?

Absolutely! The airSlate SignNow transportation log template can be integrated with various software systems, including CRM and ERP platforms. This integration facilitates seamless data transfer and enhances overall business efficiency. You can manage your transportation logs alongside your other business processes effortlessly.

-

How does eSigning work with the transportation log template?

eSigning with the transportation log template is straightforward using airSlate SignNow. You simply fill out the template, and then you can send it for electronic signatures to relevant parties. This feature speeds up the approval process and eliminates paper-based logistics, making operations more efficient.

-

Is the transportation log template suitable for small businesses?

Yes, the transportation log template is designed to be user-friendly and is suitable for businesses of all sizes, including small businesses. It offers essential features that help smaller companies manage their logistics effectively without overwhelming complexity. Utilize the template to boost your operational efficiency without incurring high costs.

Get more for Instructions For Transportation Mileage Log

- 1120s s corporation tax return checklist mini form

- And regulatory services form

- Unreasonable to live at home form

- Client history questionnaire dermatologyallergy university of uwveterinarycare wisc form

- 90 day chronological bible reading plan form

- Tff application santa barbara form

- Church nursery child information sheet

- Instructions for current owners nebraska brand committee nbc nol form

Find out other Instructions For Transportation Mileage Log

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later