Form Ct 592

What is the Form CT 592

The Form CT 592 is a tax document used in the state of Connecticut. It is primarily designed for withholding tax purposes, specifically for non-resident individuals and entities that receive income from Connecticut sources. This form helps ensure that the appropriate amount of state tax is withheld from payments made to non-residents, which may include wages, rents, or other types of income. Understanding the purpose of this form is crucial for compliance with state tax regulations.

How to Obtain the Form CT 592

To obtain the Form CT 592, individuals and businesses can visit the official Connecticut Department of Revenue Services website. The form is available for download in a fillable format, making it easy to complete electronically. Additionally, physical copies may be available at local tax offices or through tax professionals who assist with Connecticut tax filings. Ensuring you have the correct and most current version of the form is essential for accurate reporting.

Steps to Complete the Form CT 592

Completing the Form CT 592 involves several key steps:

- Gather necessary information, including details about the payer and payee.

- Fill in the required fields, such as the amounts paid and the corresponding withholding tax.

- Review the form for accuracy to prevent errors that could lead to penalties.

- Sign and date the form to validate it.

Taking the time to carefully complete each section will help ensure compliance with Connecticut tax requirements.

Legal Use of the Form CT 592

The Form CT 592 is legally binding when filled out correctly and submitted as required by Connecticut law. It serves as a formal declaration of the income paid to non-residents and the taxes withheld. For the form to be accepted, it must comply with the state's tax regulations, including accurate reporting of income and withholding amounts. Failure to properly use this form can result in legal repercussions, including fines or audits.

Form Submission Methods

The Form CT 592 can be submitted through multiple methods to accommodate different preferences:

- Online Submission: The form can be electronically filed through the Connecticut Department of Revenue Services e-filing system.

- Mail: Completed forms can be printed and mailed to the appropriate address specified by the Connecticut Department of Revenue Services.

- In-Person: Taxpayers may also submit the form in person at designated tax offices for immediate processing.

Choosing the right submission method can help ensure timely processing and compliance with state deadlines.

Key Elements of the Form CT 592

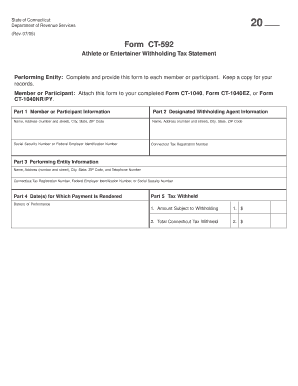

Several key elements must be included on the Form CT 592 to ensure it is complete and accurate:

- Payer Information: Name, address, and identification number of the entity making the payment.

- Payee Information: Name, address, and identification number of the non-resident receiving the payment.

- Income Amount: Total amount paid to the non-resident.

- Withholding Tax Amount: Total tax withheld from the payment.

Including all these elements helps facilitate proper tax reporting and compliance with state regulations.

Quick guide on how to complete form ct 592 100002044

Effortlessly Prepare Form Ct 592 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without holdups. Manage Form Ct 592 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Form Ct 592 with Ease

- Locate Form Ct 592 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive details using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Revise and electronically sign Form Ct 592 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 592 100002044

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ct 592 and why is it important?

Form ct 592 is a critical document used by businesses for withholding tax purposes in Connecticut. Understanding its requirements is essential for compliance, as it helps ensure accurate reporting and payment of taxes. Using airSlate SignNow simplifies the process of completing and submitting form ct 592, making it reliable and efficient.

-

How does airSlate SignNow help with form ct 592?

airSlate SignNow streamlines the eSigning and document management process for form ct 592. With user-friendly features, you can quickly prepare, send, and receive signed documents, ensuring that your form ct 592 is completed accurately and submitted on time. This saves you both time and effort in handling tax paperwork.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you're a small business or a large enterprise, you'll find a plan that allows for easy management of documents like form ct 592. Evaluating your options can help you choose the best fit for your organization.

-

Can I integrate airSlate SignNow with other applications for managing form ct 592?

Yes, airSlate SignNow supports integration with a variety of applications, enhancing your ability to manage documents such as form ct 592 seamlessly. By connecting with software like CRMs and other tools, you can automate workflows and improve productivity, making handling tax forms more efficient.

-

Is it secure to use airSlate SignNow for sensitive documents like form ct 592?

Absolutely, airSlate SignNow prioritizes security and confidentiality when handling sensitive documents such as form ct 592. With advanced encryption and compliance with global privacy regulations, you can trust that your information is protected throughout the entire signing process.

-

What features does airSlate SignNow offer for enhancing the eSigning experience of form ct 592?

airSlate SignNow provides a range of features designed to enhance the eSigning experience for form ct 592. This includes customizable templates, bulk sending options, and reminders to ensure timely signing. These functionalities simplify the workflow, enabling efficient completion of documents.

-

How quickly can I send and receive signed form ct 592 with airSlate SignNow?

With airSlate SignNow, you can send and receive signed form ct 592 within minutes. The platform's intuitive design minimizes delays, allowing you to expedite the review and signing process. This means businesses can stay compliant with tax requirements without unnecessary hold-ups.

Get more for Form Ct 592

Find out other Form Ct 592

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple