G7 Schb Quarterly Return Form

What is the G7 Schb Quarterly Return

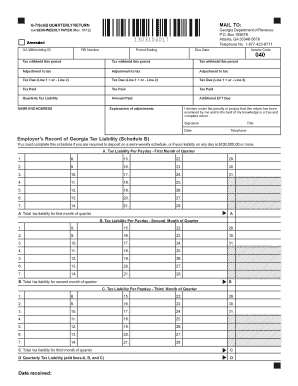

The G7 Schb Quarterly Return is a tax form used by businesses in Georgia to report and remit sales and use tax on a quarterly basis. This form is specifically designed for entities that are required to file their sales tax returns on a quarterly schedule, ensuring compliance with state tax regulations. The G7 Schb form captures essential information about the business's taxable sales, exemptions, and the total amount of tax due for the reporting period.

Steps to complete the G7 Schb Quarterly Return

Completing the G7 Schb Quarterly Return involves several key steps to ensure accurate reporting. First, gather all necessary financial records, including sales invoices and receipts for the reporting period. Next, calculate the total taxable sales and any exemptions that apply. Fill out the form with your business details, including your Georgia Department of Revenue identification number. Ensure that you accurately report the total sales tax collected and calculate the amount due. Finally, review the completed form for accuracy before submitting it.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the G7 Schb Quarterly Return to avoid penalties. Generally, the return is due on the 20th day of the month following the end of each quarter. For example, the deadlines for the first quarter (January to March) would be April 20, the second quarter (April to June) would be July 20, the third quarter (July to September) would be October 20, and the fourth quarter (October to December) would be January 20 of the following year. Timely filing is essential to maintain compliance with state tax laws.

Legal use of the G7 Schb Quarterly Return

The G7 Schb Quarterly Return is legally binding when completed accurately and submitted on time. It is important to ensure that all information provided is truthful and reflects the actual sales and tax collected. Failure to comply with the legal requirements can result in penalties or audits by the Georgia Department of Revenue. Using a reliable digital platform to complete and submit the form can enhance the security and validity of the submission, ensuring compliance with electronic filing regulations.

Form Submission Methods (Online / Mail / In-Person)

The G7 Schb Quarterly Return can be submitted through various methods. Businesses can file the form online through the Georgia Department of Revenue's e-filing system, which is often the most efficient way to ensure timely submission. Alternatively, the form can be mailed to the appropriate address provided by the department, or it can be submitted in person at local tax offices. Each method has its own advantages, and businesses should choose the one that best fits their operational needs.

Penalties for Non-Compliance

Failure to file the G7 Schb Quarterly Return on time or inaccurately reporting sales tax can result in significant penalties. The Georgia Department of Revenue may impose fines based on the amount of tax due, and interest may accrue on any unpaid tax. Additionally, repeated non-compliance can lead to more severe consequences, including audits or further legal action. It is essential for businesses to adhere to all filing requirements to avoid these penalties.

Quick guide on how to complete g7 schb quarterly return

Handle G7 Schb Quarterly Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly solution to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage G7 Schb Quarterly Return on any device with airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest way to edit and eSign G7 Schb Quarterly Return without difficulty

- Find G7 Schb Quarterly Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors requiring new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign G7 Schb Quarterly Return and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g7 schb quarterly return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GA Department of Revenue G 7 SCHB quarterly return?

The GA Department of Revenue G 7 SCHB quarterly return is a crucial tax document that businesses must file to report sales and use tax collected during the quarter. This return is essential for ensuring compliance with state tax laws and avoiding penalties.

-

How can airSlate SignNow help with the GA Department of Revenue G 7 SCHB quarterly return?

AirSlate SignNow streamlines the process of preparing and submitting the GA Department of Revenue G 7 SCHB quarterly return by allowing businesses to eSign documents quickly and securely. Our platform simplifies document management, ensuring that you stay compliant with all filing requirements.

-

What features does airSlate SignNow offer for handling G 7 SCHB quarterly returns?

AirSlate SignNow offers robust features such as document templates, electronic signatures, and secure cloud storage, all of which facilitate the efficient processing of the GA Department of Revenue G 7 SCHB quarterly return. These features help in reducing errors and saving time during tax season.

-

Is airSlate SignNow affordable for small businesses managing their G 7 SCHB quarterly return?

Yes, airSlate SignNow is a cost-effective solution designed to meet the needs of small businesses managing the GA Department of Revenue G 7 SCHB quarterly return. Our tiered pricing plans ensure that businesses can choose an option that fits their budget while gaining access to essential features.

-

Can airSlate SignNow integrate with my accounting software for G 7 SCHB quarterly return?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software, making it easier for businesses to prepare and file the GA Department of Revenue G 7 SCHB quarterly return. This integration enhances workflow efficiency and minimizes data entry errors.

-

What are the benefits of using airSlate SignNow for my G 7 SCHB quarterly return?

Using airSlate SignNow for your GA Department of Revenue G 7 SCHB quarterly return offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that all documents are stored safely, while electronic signatures speed up the approval process.

-

How secure is airSlate SignNow for filing the GA Department of Revenue G 7 SCHB quarterly return?

AirSlate SignNow prioritizes security with features such as advanced encryption and secure cloud storage. When filing the GA Department of Revenue G 7 SCHB quarterly return, you can trust that your sensitive financial information is protected at all times.

Get more for G7 Schb Quarterly Return

Find out other G7 Schb Quarterly Return

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online