DR 0137B Claim for Refund of Tax Paid to Vendors Colorado Gov Colorado Form

What is the DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado?

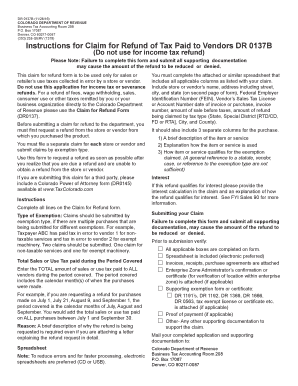

The DR 0137B is a specific form used in Colorado for claiming a refund of tax paid to vendors. This form is particularly relevant for businesses that have overpaid sales tax or have made purchases that qualify for a refund under Colorado state tax laws. The form allows taxpayers to formally request the return of excess tax payments, ensuring compliance with state regulations while facilitating the recovery of funds.

Steps to Complete the DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado

Completing the DR 0137B form involves several key steps:

- Gather necessary documentation, including receipts and proof of tax payments.

- Fill out the form with accurate information regarding your business and the tax overpayment.

- Attach any supporting documents that substantiate your claim.

- Review the completed form for accuracy to avoid delays in processing.

- Submit the form either electronically or via mail to the appropriate Colorado tax authority.

How to Obtain the DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado

The DR 0137B form can be obtained directly from the Colorado Department of Revenue's website. It is available for download in PDF format, allowing users to print and fill it out. Additionally, businesses may also request a physical copy by contacting the department if they prefer to complete the form manually.

Legal Use of the DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado

The DR 0137B form is legally recognized for claiming refunds due to overpaid sales tax in Colorado. To ensure its legal validity, the form must be completed accurately and submitted in accordance with state guidelines. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted form, as it provides a digital certificate and ensures compliance with relevant eSignature laws.

Key Elements of the DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado

Several key elements must be included in the DR 0137B form for it to be processed effectively:

- Taxpayer identification details, including name and address.

- Specific information about the tax overpayment, including dates and amounts.

- Clear documentation supporting the claim, such as invoices and receipts.

- Signature of the authorized representative of the business, confirming the accuracy of the information provided.

State-Specific Rules for the DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado

Colorado has specific regulations governing the use of the DR 0137B form. Taxpayers must adhere to the state's deadlines for submitting refund claims, which typically require that claims be filed within a certain period following the overpayment. Additionally, understanding the eligibility criteria for refunds, such as the types of purchases that qualify, is essential for a successful claim.

Quick guide on how to complete dr 0137b claim for refund of tax paid to vendors colorado gov colorado

Complete DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Manage DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado without any hassle

- Obtain DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tedious searching for forms, or errors that warrant printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0137b claim for refund of tax paid to vendors colorado gov colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0137b in the context of airSlate SignNow?

dr 0137b refers to a specific identifier for a document or process within the airSlate SignNow platform. It ensures that users can easily reference and access particular documents for efficient management. Understanding dr 0137b is crucial for streamlining your eSigning processes.

-

How does pricing work for airSlate SignNow with dr 0137b features?

airSlate SignNow offers flexible pricing plans that include dr 0137b related features. Depending on your organization's needs, you can choose between different tiers that provide varying levels of access to document management and eSignature capabilities. This ensures you only pay for what you actually use.

-

What are the key features of airSlate SignNow related to dr 0137b?

airSlate SignNow provides numerous features centered around dr 0137b, including document templates, automated workflows, and powerful eSignature tools. These features help optimize your document processes, making it easier to manage and track your electronic signatures efficiently.

-

How can dr 0137b enhance my business processes?

Implementing dr 0137b in your workflows can signNowly enhance efficiency by reducing the time spent on managing documents. With airSlate SignNow's user-friendly interface, you can automate repetitive tasks and track document progress, leading to increased productivity and improved compliance.

-

Does airSlate SignNow integrate with other tools while using dr 0137b?

Yes, airSlate SignNow supports various integrations that work seamlessly with dr 0137b. You can connect it with popular applications such as Salesforce, Google Workspace, and Microsoft Office. This integration capability allows for a smoother workflow and ensures that your document management processes are streamlined across platforms.

-

What industries can benefit from dr 0137b using airSlate SignNow?

Industries such as real estate, legal, and finance can signNowly benefit from dr 0137b in airSlate SignNow. By leveraging the platform, these sectors can process documents more efficiently, ensure compliance, and improve client communication through secure electronic signatures.

-

Is airSlate SignNow secure for handling documents linked to dr 0137b?

Absolutely, airSlate SignNow prioritizes security and compliance, especially for documents associated with dr 0137b. The platform uses advanced encryption and authentication measures to safeguard your sensitive information, ensuring that all eSignatures and document exchanges remain secure.

Get more for DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado

- Certificate of immunization clayton state university clayton form

- Narrative writing rubric kindergarten form

- Lease to own homes agreement form

- Po box 1430 sdfcu deposit form

- Montague rodeo form

- Act exceptions statement form

- Wholesalers salesperson permit application form

- Fertilizers canadian food inspection agency form

Find out other DR 0137B Claim For Refund Of Tax Paid To Vendors Colorado gov Colorado

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF